TDI Point of View: Agency alarm bells ringing as consumer adoption of digital accelerates beyond tipping point

Insurers and their agents need to urgently transform, from ‘traditional sales’ to an ‘OMNI Advisor’ model, not only to stay relevant, but also to generate significant growth in the years ahead

In this TDI Point of View, The Digital Insurer’s Hugh Terry and Simon Phipps consider the future of the insurance advisor in Asia, and present the OMNI Advisor Model (Fig 1) as a strategic approach to reinventing face-to-face insurance advice in an increasingly digital world.

In this TDI Point of View, The Digital Insurer’s Hugh Terry and Simon Phipps consider the future of the insurance advisor in Asia, and present the OMNI Advisor Model (Fig 1) as a strategic approach to reinventing face-to-face insurance advice in an increasingly digital world.

Current face-to-face models are under severe stress

It has taken Covid-19 to illustrate what happens as consumers accelerate adoption of technology and reduce their face-to-face meetings and visits to branches. Lead generation has stalled, and this has inevitably fed into reductions in new business volumes for many. Each insurer is in a slightly different position, but most will identify with the reasons opposite.

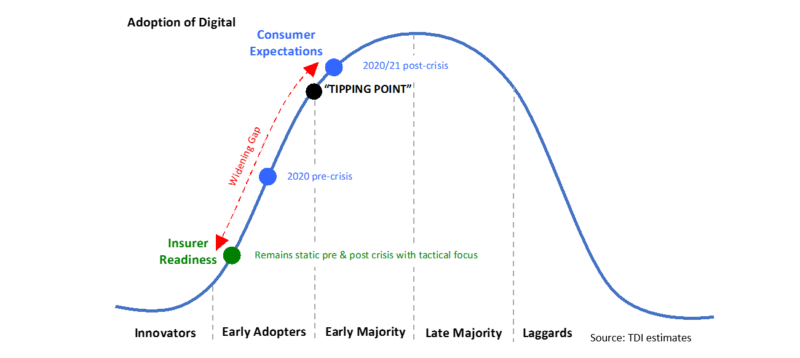

Many insurers are hoping for a return to business as usual once Covid-19 is behind us – but we believe this is misguided. What the pandemic has shown is that customers have leapt ahead in their adoption of digital, and this trend is likely to continue (albeit at a slower pace). In our recent POV whitepaper on the digital tipping point we estimated that consumer adoption of digital has already moved ahead by two years, further widening the gap between reality and consumer expectation faced by most insurers.

TDI is clear, and insurers in their hearts now know, that existing face-to-face business models urgently need to be reimagined and re-tooled for the digital world.

But all is not lost. For the first time, there is an alignment of key stakeholders – advisors are asking for tech, and risk management committees have, at long last, put digital towards the top of their agendas. Growth prospects and core fundamentals, especially in Asia, remain extremely positive.

Alarm Bells are ringing for Traditional Sales Agents, but the future is bright for the OMNI Advisor

Fig 1: TDI OMNI Advisor is the transformational model for insurance advisory

Scope of this TDI PoV

Our primary focus will be on face-to-face life insurance agency models in Asia. However, we will broaden our analysis and briefly examine the application of the TDI OMNI Advisor Model to bancassurance and platform business models.

Challenges with agency models – and the current playbook

The tied agency business model has a strong tradition in Asia and has been responsible for driving remarkable growth rates in life insurance sales over the last two decades.

With a typically part-time commissioned sales force, there are on-going challenges in attracting skilled individuals and consequent downstream problems with productivity and quality of advice, as well as customer satisfaction. Figure 2 below summarises some of the wider challenges with traditional life insurance agency models as we see them.

Of course, many insurers have recognised these challenges and have implemented, or are implementing, initiatives to address some of these issues, under a move to what we call the ‘Quality Advisor’ model.

These Quality Advisor initiatives look at methods to improve performance. Many are of course, digital in nature, and include activities such as:

- Point of Sale initiatives focused on digital issuance and straight through processing

- Enhanced recruitment and training processes to improve advisor productivity and retention

- Advisor performance dashboards to illustrate and focus on performance both at an individual and team/business unit level.

While such tactical moves to improve quality are both admirable and necessary, without explicitly factoring in changing customer behaviours in a digital world, these moves do not, and will not, address the key challenges to be faced post Covid-19. So let’s explore what ‘OMNI’ means and how insurers can use it to fundamentally enhance their agency business model, and in so doing, empower their agents to operate in our increasingly digital world.

Fig 2: Some of the challenges with face-to-face life insurance agency models in Asia

The world is going ‘OMNI’ – What does that mean?

Fig 3: Customers have accelerated beyond the digital tipping point and insurers are currently left even further behind

As customers accelerate beyond the digital tipping point (Figure 3) they are increasingly demanding and expecting to be in control, through services and support provided on an anytime/anywhere basis. Customers want to use their channel of choice for different steps in the process as illustrated in Figure 4 below.

Fig 4: OMNI allows customers choice in service delivery. Source: McKinsey: The multi-access (r)evolution in insurance sales

From this simple requirement there are profound changes to the way in which advisors need to engage with their customers, and critically, this needs to be increasingly in conjunction with the rest of their organisation.

Instead of setting up a fixed journey (face–to-face meetings), advisors need to be able to create personalised journeys with flexible engagement. For some customers this will mean a continuation of largely face-to-face meetings while for others they will prefer an almost 100% digital experience.

The vast majority, as evidenced In Figure 5 below, will want something in between, with the journey varying each time based on circumstances and personal preferences.

Fig 5: evidence that consumer want an OMNI experience Source: McKinsey: The multi-access (r)evolution in insurance sales

Figure 6 below captures the essence of this OMNI experience and, well-executed, it can maximise the customer experience on each individual engagement.

So how do insurers hardwire OMNI into their agency operating models?

Fig 6: Today’s customers increasingly demand anytime/anywhere service on their own terms – an OMNI experience

Introducing the TDI OMNI Advisor Model

Based on TDI research and experience we have developed the TDI OMNI Advisor Model, to help articulate the customer-centric and digitally-enabled capabilities needed to support advisors in our increasingly digital world.

The OMNI Advisor Model shown in Figure 1 previously, and further elaborated in Figure 7 below, allows the advisor to be fully empowered across all aspects of their agency business. This model has a simple customer-centric design that allows customers to be in control of their experience and create unique journeys, which reflect their own preferences at any point in time.

The customer can continue with a face-to-face/physical relationship with their advisor but, at the same time, can access all digital services via a ‘Customer Engagement Hub’. This digital hub is an advisor/insurer co-branded microsite that is maintained by the insurer for the use of the clients of each advisor. It provides each advisor with their own unique digital presence.

Through this Engagement Hub the customer is able to engage digitally in areas such as:

- Multimedia content to build awareness or understand solutions

- Connectivity with their advisor/dedicated team e.g. using live chat, call-back

- Self-maintenance and self-service for existing solutions

- Client reviews and testimonials

The advisor can push content and updates via social media that have links back to content on the Hub. This approach is very different from providing a customer with a disconnected customer portal or app via a corporate website.

With single sign-on, the OMNI Advisor can access all the tools and information needed to perform sales, marketing and servicing, as well as access learning, development and coaching support that is essential to help advisors maintain and improve their key skills and industry knowledge.

From an insurer perspective the advantages of providing a digital presence extend beyond increased productivity to include data insights on digital marketing practice not previously held and, a set of capabilities that will both attract new advisors and reduce churn of successful advisors.

Fig 7: TDI OMNI Advisor business model

Making it happen

The primary challenge for management teams in adopting the OMNI Advisor Model is the need to move on from well-established practices to new ways that are not yet fully proven. It requires clarity of intent vis-à-vis business strategy, customer proposition and target operating model, coupled with an absolute resolve to deliver in an agile way, at the top table.

The primary challenge for management teams in adopting the OMNI Advisor Model is the need to move on from well-established practices to new ways that are not yet fully proven. It requires clarity of intent vis-à-vis business strategy, customer proposition and target operating model, coupled with an absolute resolve to deliver in an agile way, at the top table.

There are several high-level case studies that provide a measure of comfort that OMNI Advisory can work but, in reality, at this early stage of adoption, executives will need to carefully manage both rollout and measurement of outcomes.

Measuring outcomes

Measuring outcomes

Figure 8 outlines some of the key metrics that will allow the OMNI Advisor Model to be measured – they are a combination of traditional quantitative measures along with the addition of new qualitative experience measures. Many executives will be uncomfortable with measuring a qualitative experience – the need, in essence, to create customer and advisor experiences that are ‘stunning’ and that customers and advisors ‘love’. But this is the key to successful outcomes and will demand both ambition, attention to detail and, forward-looking thinking that challenges a status quo designed and optimised for a pre-digital world.

Managing the rollout

The industry knows through experience how difficult adoption of technology has been in agency sales forces. The challenges with point of sale implementations have proven more difficult than many insurers anticipated. However, Covid-19 has changed this, and insurers that thoughtfully and deliberately adopt new business models will reap the rewards. There are a number of tried and tested implementation guidelines that can help maximise the chances of success:

The industry knows through experience how difficult adoption of technology has been in agency sales forces. The challenges with point of sale implementations have proven more difficult than many insurers anticipated. However, Covid-19 has changed this, and insurers that thoughtfully and deliberately adopt new business models will reap the rewards. There are a number of tried and tested implementation guidelines that can help maximise the chances of success:

- Prototype an approach that is genuinely agile

- Deploy modern tech, on the cloud, in key areas to ensure agility and future-proofing

- Move to 100% online and phase out offline-only modes that cause complexity and reduce speed of innovation

- Design new processes around the new tech

- Prioritise the critical importance of change management including phasing, testing and learning, and great communications and support for advisors

- Investment in skills training for advisors and management – and investment in new roles to support components of the new business model.

Fig 8: Some of the potential performance metrics for the OMNI Advisor Business Model

Fig 9: TDI’s Digital Engagement Model – Digital first models will compete strongly

How does the OMNI Advisor Model apply outside of agency?

The OMNI Advisor Model is a key ‘transversal’ capability that will be a critical part of most insurer’s businesses within the next two to three years.

TDI’s Digital Engagement Model, Figure 9, illustrates the emerging digital distribution landscape. There are three components:

- Physical First – existing face-to-face advisory models including agency and bancassurance, which need to be increasingly digitally-enabled

- Digital First – typically new challengers (or in some instances separate insurer units) that are first and foremost distributing and servicing online, but supplementing with human touch where required

- Digital Micro – typically digital-only models facilitated by ecosystem players that have the ability to embed insurance into exiting propositions

Which of these business models will dominate distribution 10 years from now?

Fig 10: TDI Point of view – Digital insurance landscape in Asia by 2030

Figure 10 captures TDI’s view of the distribution landscape in Asia by 2030. While insurance and bancassurance advisory will continue to be significant they will be transformed by OMNI. Insurance advisory models will find this easier as insurers are in control of the value chain. Change at banks may take longer as it will involve integration with a bank’s IT architecture and agreement on strategy and data models. However, bancassurance may prove even more effective in the long run, especially if advisors can sell both banking and insurance products in an OMNI model.

New challengers that are digital first will be plugged into the emerging ecosystems, winning larger numbers of clients with smaller policy values. If these new challengers successfully create OMNI models, then they will become directly competitive with existing advisory models.

OMNI also has significant application in employee benefits business models.

It’s time for OMNI Advisory – integration of digital with face-to-face to transform the customer experience

- Advisory models must change – Covid-19 has accelerated customer adoption of digital and exposed flaws in ‘face-to-face only’ agency models

- OMNI is the way to go – the TDI OMNI Advisor Model provides the route to a blended advisory approach that optimises the customer experience and can deliver a step change in productivity by providing advisors with their own digital presence and empowering them to take a broader relationship management role with their clients

- TDI’s OMNI Advisor Model is highly strategic and has broad application – TDI expects to see adoption of digital first models by new challengers, as well as existing insurers with large agency and bancassurance advisory sales forces

Implementation needs to be thoughtful, clear- headed and respectful – adoption of new ways of working is never easy. Insurers need to communicate a compelling vision, create advisor and customer experiences that are ‘loved’, and execute well with technology that works. This will require financial resources but, more than that, investment in, and empowerment of, teams of people to make it happen. Effective change management is key.

If you are an insurance leader, please reflect on this paper and talk to your colleagues about what else can and should be done. If you are a member of staff or an insurance advisor and feel that your company isn’t taking digital seriously enough, whether for the business overall and/or for you personally, talk to your colleagues, and share your concerns with management to see what else can be done. Ultimately this is in everyone’s interests – not just colleagues, leaders and shareholders – but customers too. Ask yourself:

If you are an insurance leader, please reflect on this paper and talk to your colleagues about what else can and should be done. If you are a member of staff or an insurance advisor and feel that your company isn’t taking digital seriously enough, whether for the business overall and/or for you personally, talk to your colleagues, and share your concerns with management to see what else can be done. Ultimately this is in everyone’s interests – not just colleagues, leaders and shareholders – but customers too. Ask yourself:

- Is going back to business-as-usual seriously an option?

- Do you believe face-to-face insurance advisory will survive and thrive without significant digital transformation?

- If your answer to either is “no”, then don’t CEOs and their leadership teams have a responsibility to act, right now, to embrace the new challenges and opportunities of our digital-first world? The TDI OMNI Advisor Model can help you chart the path to sustainable future growth.

How TDI Can Help

- Strategy – TDI have developed a proprietary set of diagnostic tools that are available for insurers to quickly understand their current position, define their OMNI Advisor target end-state and analyse gaps with current operating models, so that you can then rapidly create a roadmap to introduce OMNI.

- Execution – Our partner network is available as needed to help you move from strategy to results with both implementation, change management and solution options available as needed.

- New skills – TDI Academy (see appendix) provides virtual learning & development programmes to address key skill gaps and achieve broader goals around digital engagement and cultural transformation.

So, please reach out to TDI to discuss how we can help. Now, more than ever, is the time for all of us to work together, to accelerate the digital transformation of insurance. And OMNI Advisory needs to be a key part of the journey.

Let’s get this transformation done

The TDI PoV series supports learning for the digital age and is part of the TDI Academy, which includes the world’s first virtual mini-MBA and professional qualification in digital insurance.