TDI Point of View: Insurance Blockchain & Web3

Ten reasons why the time for boards to get involved is NOW

In this TDI Point of View, Simon Phipps considers the accelerating pace of blockchain & Web3 development around the world, proposing ten compelling reasons why now is the time for insurance board members to get their heads around these exciting new technological developments and, as part of their oversight responsibilities, ensure that executive teams are proactively exploring the technology’s potential now.

Blockchain – Coming of Age

Bitcoin itself has come a long way since then. 2021 alone saw a raft of new firsts for the darling child and ‘digital gold’ of the wider, burgeoning crypto asset class:

- the theoretical total market value of Bitcoin topped US$1Tn for the first time

- the first country (El Salvador) adopted bitcoin as legal currency

- the first US-based Bitcoin futures ETF was launched

- the price of bitcoin hit a new all time high of US$69,044 in November

- the first mainstream companies started openly putting bitcoin on their balance sheets

- private Banks including Morgan Stanley started offering HNW clients access to bitcoin funds

- the first major Bitcoin blockchain upgrade in over four years (‘Taproot’) was implemented

- Bitcoin’s hash rate (a proxy not only for expended energy but also level of security) hit an all-time high

While the jury remains out on what Bitcoin’s final use case may be, it is becoming increasingly hard to argue against the staying power and growing importance of both Bitcoin, and the wider cryptocurrency market and asset class it has spawned (Bitcoin is currently positioned firmly as a digital store of value, regarded by many as a 21st Century replacement for gold, in contrast to its original design intent by Satoshi of a decentralised digital alternative to fiat currencies like the US dollar).

Not only is this because the stories of illegal use associated with the early days are becoming increasingly rare, marginalised through wider legitimate use and improved security protocols and legislation, but also because the integrity of the underlying technological design has proved to be, well, pretty much bomb-proof. There have been no significant data integrity breaches on the Bitcoin blockchain since its inception 13 years ago.

But more importantly, it is because Bitcoin is just the tip of the crypto iceberg – just one, relatively narrow use case in a puddle that became a pond, which grew into a sea, and will soon become an ocean of potential.

How? Because not long after the concept of the Bitcoin blockchain was released on the world, others (notably Vitalik Buterin, co-founder of Ethereum) realised that the underlying technology of the Bitcoin blockchain had far, far wider potential than simply replacing fiat money with decentralised digital currencies.

Blockchains, and the wider family of distributed ledger technologies (DLTs), have the potential to enable near-instantaneous, frictionless and 100% secure transactions of value, anytime, and, anywhere; opening-up the potential for digital, value-based transactions to take place as quickly and cheaply as we have become accustomed to with the movement of information through things like Google search and email. This so called ‘internet of value’, the foundation of Web3, is closer than most of us think, with many clever and enthusiastic developers and entrepreneurs working around the clock, across the world, to turn the underlying technology into increasingly consumer and business-friendly propositions.

Which helps explain why, in 2021, the wider cryptocurrency market topped a theoretical market value of US$3Tn, with the altcoin market (everything other than Bitcoin) topping US$2Tn, representing thousands of new projects around the world. Of course much if not most of this is built on speculation and hence the asset class continues to be highly volatile [the total market cap was down to US$1.5-2Tn in January 2022!].

Web3 – The Dawn of a New Era

Turning for a moment to Web3, also known as the Decentralized Web, Web 3.0 (shortened to Web3 by most commentators) represents the latest generation of internet applications and services powered by distributed ledger technology, the most common being blockchain. It is, however, not a new concept. The inventor of the World Wide Web himself, Tim Berners-Lee, predicted that this version of the internet, which he called the Semantic Web, would be more open, smarter and more autonomous.

Fig 1: What is Web3 and Why Does it Matter? https://internationalbanker.com/technology/what-is-web-3-0-and-why-does-it-matter/

Proponents and enthusiasts cite the following advantages of Web3 that we can all look forward to:

✔ Efficiency in search results

✔ Efficiency in browsing for the user as there is better access to information

✔ Change in human interaction with a computer as the end user has complete control over their data by encrypting it

✔ Change in human interaction with a computer as the end user has complete control over their data by encrypting it

✔ Intermediaries like Apple and Google and even governments will no longer have control over data, services or sites

✔ Digital assets can be transferred and moved quickly and efficiently leading to the distribution of wealth with no barriers

✔ No interruption of services as data is stored in multiple disparate nodes to improve redundancy.

✔ Multiple backups will eliminate interruptions in flow of data

✔ Sharing information will be easier

✔ Harder to adopt fake identity online

✔ Easier to work on the internet since it can be personalized

Fig 2: When the Web3 bubble pops, real world assets will survive https://www.ft.com/content/ddaa6b58-1ed2-40bb-bf71-642e2b9767a9

Of course, there are always two sides to a story, and there remain plenty of sceptics and cynics on the real impact such developments may have. A good case in point was this well-considered article in the Financial Times recently

Importantly for me, the gist of this article is not that blockchain and Web3 won’t be successful – in fact, the author argues quite the contrary – but more importantly that picking the winners at this early stage is tough, with underlying infrastructure plays perhaps being the safest bet.

Yet from DeFi to NFTs, CBDCs, smart contracts, security tokenisation and the metaverse, the potential applications of this exciting new technology are coming through thick and fast. And the pace is exponential. Web3 and the internet of value are just one of many developments enabled through blockchain and DLT, which have the potential to transform our personal and professional lives forever. It’s hugely exciting. And should not be ignored.

There is not enough time here to provide an explanation of all the terminology, technological nuances, potential applications and use cases that this technology involves. It isn’t called ‘the rabbit hole’ for nothing! Instead, I have embedded various links throughout, as well as adding a few hopefully useful references at the end of this paper for those who wish to explore things further. And of course, the helping hands of Google and YouTube are only ever a click away.

For the rest of this paper, with the above context in mind, we are turning to insurance – a 300-year-old, US$5Tn global industry – and I am going to make the case as to why I consider now is the time for insurance board members to start paying (more) attention and getting involved now – directly or indirectly – in order to ensure that the executive teams of the companies they oversee are consciously and proactively exploring the potential of this transformational technology.

So below are my Top 10 reasons for boards to be getting involved in now.

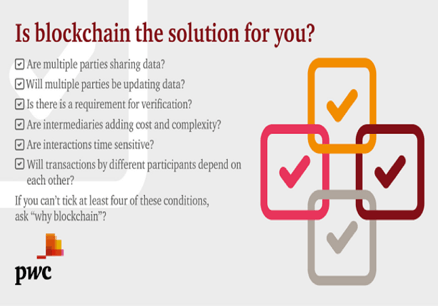

I should add as a final opening comment that blockchain is not a panacea. For investment in blockchain to make sense, the right conditions need to be in place. Not least of which is that typically three or more parties need to be able to benefit from a single version of the truth. PwC captured this summation of where blockchain may and may not make sense a couple of years ago, and I think it still holds fairly true.

Gartner’s view is that CIOs should begin to embrace blockchain to explore strategic business initiatives, but avoid falling for the hype.

But make no mistake, despite these caveats, there exists an ocean of opportunity for our industry to explore

10 reasons why the time for insurance boards to get involved in Blockchain & Web3 is NOW

- Strategy

In a Nutshell: Most likely it will be three to seven years for blockchain and Web3 to start making a real impact on our industry. This is outside most CEO/executive teams’ three-year incentivisation periods, so boards need to drive the strategic debate.

It is a sad but understandable reality of most executive teams including CEOs, that their incentive schemes typically have a short-medium time horizon, driving short-medium term behaviours. Few CEOs have a genuine interest in creating value 5-10 years from now, because their most controllable incentive horizon is three years – in most instances they probably expect to be working for another organisation in five years time.

It is for this reason that big infrastructure decisions are all-to-often kicked down the road for someone else to grapple with: why big-bet strategy re-sets are few and far between and; why many new technology & innovation projects tend to not move beyond Proof of Concept – instead utilising ear-marked R&D budgets to ‘tick the innovation box’, when in reality there is little to no interest in significant investments, that are more likely to deliver value on someone else’s watch.

Having set-up and managed the change function of a large multi-national insurer myself, I understand first-hand the critical importance of allocating budgets to cover a spectrum of change which delivers value across the short, medium and long-term. Right-sizing both the quantum of spend, and the percentage allocated to <1 year, 1-3 year and >3 year initiatives, are critical to the ongoing success of a business, and require checks and balances including board oversight in order to ensure that shareholders’ interests are being appropriately represented and actioned by the executive management team.

The harsh reality is that nine times out of ten, there is insufficient focus on reinventing ourselves as insurers – with a tendency / preference instead to milk cash cow/s and leave the challenge of reacting to innovation from others, to another team, at a later date.

Of course this may be a deliberate over-exaggeration, and doing a dis-service to the many insurance leaders around the world who are in fact passionately driving innovation and change day-to-day. But they are sadly still the minority. Not enough Exco members are allocating sufficient time to ponder what the future could and should look like, or investing enough resources to explore the roles that new technology can and should play in getting their company to a better place.

Blockchain is still in its relative infancy. Big rewards for insurers are unlikely to come in the next 2-3 years. But over the 5-10 year horizon the potential impact for our industry is unimaginable. So can board members really afford to run the risk of allowing CEOs and their teams to tinker with business as usual, milk the cash cow and, leave the voyage of discovery to someone else?

In Action?

A good example of a company taking a longer-term view can be found in China. Well-known for their strategic approach to business, considering an extended time horizon on investments is nothing new for the Chinese. Ping An, regarding itself first and foremost as a technology company rather than insurer, and taking a leaf out of the playbooks of tech powerhouses such as Google and Facebook, targets 1% of annual revenue into IT investments the following year, and has been an early explorer of the role/s that blockchain can play. They are one of the insurance industries heaviest investors in blockchain, and have filed more blockchain patents than most other insurers combined. See the links in the further references section for more.

- Perception

In a Nutshell: Analysts, investors, staff and customers are looking for real evidence of insurance leadership teams and their boards having their finger on the pulse – anticipating future market trends, developments and needs.

As much as it pains me to call the elephant in the room, unfortunately most insurance boards (and individual members by association) are not regarded as the most dynamic or cutting-edge bunch – whether that view is held by investment analysts, investors, leadership teams, business partners, customers or staff. The more recent push for diversity is of course to be applauded, but there remains a lack of experience in tech, data & analytics, customer engagement and, platform business and ecosystem management at most of the insurers top tables.

This manifests itself in a perception of insurance boards typically being risk-averse, old school and out of touch. Whilst wisdom and experience will never go out of favour, there remains a need for boards to encourage more open-mindedness, more experimentation and more learning within their organisations. And to avoid being regarded as ‘old farts’ (no offence intended!). Board members need to be proactive in encouraging these necessary behaviours by walking the talk – rolling-up their sleeves and going to the new, often uncomfortable areas of exploration themselves.

Board members – in which category are you?

Perceptions matter. Not just at the organisational level – for example how the market is rating your stock over competitors’. But at a personal level too. I chose to leave an employer a few years back, in part because one of the leaders was dismissive of my attempt to generate senior market connectivity and engagement through a blockchain event – a topic the leader in question dismissed as “a waste of time”, “a solution trying to find a problem” and “just another piece of tech, soon to be ubiquitous like the Cloud”. I pushed ahead with the event, despite the lack of support from above; we had a huge turnout of senior movers and shakers and potential future clients and, the young, blockchain entrepreneur that was our guest at the event, is now one of the world’s youngest billionaires.

Everything speaks. Perception counts. At all levels. All the time.

In Action?

A good example of a company that has been visibly experimenting AND going beyond Proof of Concepts with blockchain technology, from the top down, is Allianz. In 2021 they announced the launch of a blockchain-powered claims solution across 23 countries. This follows previous innovation announcements exploring the potential of the technology, as well as Allianz being an early member of B3i. To our knowledge the 2021 announcement represents one of the largest multi-market insurance deployments of blockchain so far.

See the links in the further references section for more.

- Trust

In a Nutshell: Insurance is one of the least trusted industries globally, fostering vulnerability to new entrants from more trusted sectors. Blockchain enables incumbent insurers to reset the trust paradigm before others do.

One of the biggest opportunities and challenges our global industry faces today continues to be consumer trust. More mature markets around the world, such as the UK, sadly have a history of mis-selling scandals and attempts by insurers to avoid / curtail claims in order to bolster profits for shareholders, which has eroded consumer confidence and left our industry at the wrong end of the trust charts compared to other industries.

Yet, with all the opportunities that new technologies can bring, including the changing role of insurers from ‘indemnification’ to ‘prevention’, we have a multitude of opportunities queueing up on our doorstep. If only we could get consumers to trust us more.

Fig 7: The Trust Machine, The Economist 2015 https://www.economist.com/leaders/2015/10/31/the-trust-machine

Enter the world of blockchain, and smart contracts. A world that is trust-less i.e. no one party needs to trust another, because what is agreed gets done, period. Approvals by consensus across validator nodes (independent, segregated / dispersed computers) remove the need or ability for any one party to decide whether or not they want to honour what they agreed to do. In the world of smart contracts on the blockchain, agreements between parties are permanently recorded on the distributed ledger and clauses such as claims payments are auto-activated when the conditions for a claim occur.

Trust, or rather a lack of trust by consumers, is the Achilles Heel of our industry for many markets around the world.

Blockchain takes away the need for trust and, in so doing, presents an opportunity for insurers to re-define what good looks like, and reset relationships for a new era of closer connectivity in consumers’ daily lives.

In Action?

Trust works both ways, and reducing claims fraud is another excellent use case for blockchain, as demonstrated by the Hong Kong Federation of Insurers and their blockchain-powered MIDAS initiative, launched in 2018.

Note:

TDI in conjunction with iptiQ recently hosted a webinar on the topic of ‘Digital Trust – What’s the Big Deal?’.

See the links in the further references section for more.

- Equity

In a Nutshell: Shareholder-owned insurers have a perceived conflict of interest between optimising returns for policyholders and shareholders. New P2P models using blockchain will further amplify this, forcing transparency.

One of the defining characteristics of blockchains, at least for public blockchains, lies in the design ideology of decentralisation.

It is a truism that society is increasingly questioning the merits of globalisation, central authority and control and, the cost v benefit trade-off of middle-men, intermediaries and large organisations. As new technology shows consumers what more efficient, 21st Century business models, with interests more directly aligned to their own can do for product and service propositions, existing organisations are increasingly under pressure to justify their existence, and demonstrate their integrity as well as broader reason for being.

Insurers, originally borne from mutuality and arguably with fairness and equity hard-wired into their construct, have largely evolved over the years into multinational corporations, accountable to shareholders with ever-increasing expectations on return on capital employed. Inevitably, this leaves shareholder-owned insurers vulnerable to accusations of a mis-alignment of interests between serving policyholders and serving shareholders. The obvious example here being claims, and the pressure on insurers to minimise claims pay-outs in order to meet / beat the profit expectations of shareholders.

My point here, and why equity is one of the Top 10 Reasons in this PoV paper, is not that insurers aren’t by and large already working hard to meet their policyholder commitments and, navigating this conundrum pretty well. But rather that the whole question of equity and fairness is coming more into the spotlight. And with a perceived lack of alignment to consumer interests, shareholder-based insurers are vulnerable to new companies running models that exploit this weakness, in contrast to their own. So existing insurers are going to have to work harder going forward to demonstrate integrity, fairness and being equitable in all that they do, through greater transparency and most likely, tighter margins.

Blockchain enables insurers to develop and deploy propositions that are rock-solid in the eyes of consumers… where claims payments are not subject to the whim of an individual claims assessor, or the profit needs of the insurer on the day

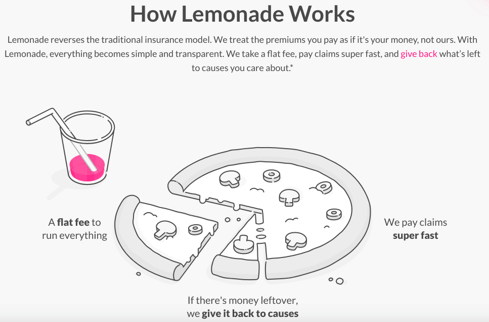

Fig 8: How Lemonade Works www.lemonade.com

In Action?

A good example of a company tackling this issue head-on is Lemonade. Lemonade uses both AI and blockchain to offer insurance at low prices to homeowners and renters. They take a fixed fee from each monthly payment made by policyholders and allocate the rest towards future claims. When a claim is made, the smart contracts on the blockchain verify the loss immediately so that customers get paid almost instantaneously. If there is money left over after claims, it goes to worthy causes that policyholders help select.

See the links in the further references section for more.

- Service

In a Nutshell: Consumer satisfaction with digital services of insurers vs other sectors is low. Blockchain enables insurers to deliver a step-change in service e.g. near instantaneous claims payments at ‘a key moment of truth’.

Blockchain also presents an opportunity for insurers to take a leap forward in the area of service. And research clearly shows that insurers have their work cut out in the eyes of consumers, relative to other industries.

Great examples of how blockchain can transform the service experience can be found in areas such as claims:

-in travel insurance vast amounts of qualifying low-level claims are never made by entitled policyholders every year because they can’t face the administrative headache i.e. they have paid for something they eventually don’t use, with insurers happily pocketing the enhanced margins, and trust / satisfaction being eroded along the way – smart contracts on the blockchain could auto-settle claims instantly with no admin for the client, turning something that is currently a purchase which is resented, into something which reinforces the insurer’s value to the client

-many death claims can sadly take years to be paid out to families in need, while technical matters related to entitlement are resolved – with all this clearly recorded at the time of policy inception on the blockchain, again auto-settlement presents insurers with the opportunity to prove their value at a key moment of truth.

See the visuals in Top 10 Reasons 7 – Innovation (below) for a broader view of other service improvement opportunities across the insurance value chain.

In Action?

Galileo Platforms has been a front-runner in exploring the potential for blockchain in insurance. Its platform “connects participants in insurance ecosystems like microinsurance, embedded insurance, and digital wallets, with straight-through and real-time client experiences, by providing a shared source of truth and eliminating the duplication of data”. Their recent partnership with SingLife and GCash in the Philippines has demonstrated the technology’s ability to deliver high levels of service at scale and low cost.

See the links in the further references section for more.

- Efficiency

In a Nutshell: Substantial inefficiencies (and costs) can be removed through the use of blockchain, delivering a win-win-win for policyholders, insurers and their shareholders e.g. motor claims 70% quicker / 80% cheaper.

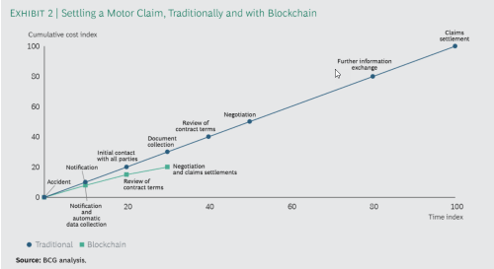

Building on trust, equity and service, comes efficiency. Insurers are always looking for ways to improve margins, ideally also improving the customer value proposition along the way. Just look at the impact blockchain can have on claims settlement times, and associated administration costs for the insurer, according to research from BCG. This is just one example of many. Time down by 70%, and costs by 80%. A win-win-win? I think so!

Interestingly blockchain could also be the key that unlocks a huge box of latent potential for insurance efficiency – as an enabler for scaled deployments of advanced analytics, artificial intelligence (AI) and automation software. Each of these have to date been hampered by concerns around data security, which can be mitigated with the additional application of blockchain technology.

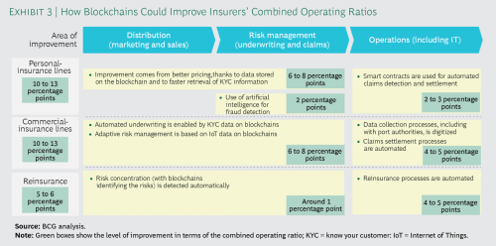

Indeed, BCG suggest blockchains could help the worldwide property and casualty (P&C) insurance industry reduce its combined operating ratio by 5 to 13 percentage points and generate upwards of $200 billion more in technical margin from its current gross written premiums.

These numbers are significant. And they were estimated by BCG in 2018… I suspect they would be much higher now.

“It is our opinion that a wait-and-see approach is short-sighted and leaves insurers vulnerable” BCG

In Action?

Fig 12: B3i’s Fluidity https://b3i.tech/

Now incorporated as its own separate legal entity, the Blockchain Insurance Industry Initiative B3i is aiming to deliver “the insurance network of the future” through its DLT-powered network ecosystem.

Their first use case built on “B3i Fluidity” focused on Catastrophe Excess of Loss and they are heavily focused on driving more efficiency through other use cases across the industry.

See the links in the further references section for more.

- Innovation

In a Nutshell: As a fledgling technology, blockchain opens-up a whole new world of potential applications, many of which have not been thought about yet. Exploration will foster and accelerate corporate innovation.

As an industry, we are not renowned for being the most innovative bunch. Yet our industry is huge. And the world needs more insurance.

So the opportunity is on our doorstep to keep innovating – reinventing what we do – in order to ensure we are fit for purpose and impossible to displace by new players.

Our industry has only scratched the surface of potential applications for blockchain. Some of these will sit at an industry level – best served and enabled through consortia. But many others will present themselves at an individual insurer level, offering opportunities to differentiate, beat the competition and / or create new market space.

|

Fig 15: TDI’s “InsurTech Wheel” https://www.the-digital-insurer.com/search-insurtech-directory/

As you may be aware TDI runs the world’s largest freely available InsurTech database, called The InsurTech Directory.

In order to facilitate categorisation of InsurTechs we developed what we call our ‘TDI InsurTech Wheel’ which, whilst not perfect, nevertheless provides a useful lens through which to consider how and where new technologies are being deployed. The lens is split, to allow for those companies more focused on working with insurers to “Improving Today” through value chain innovations and those focused on “Reinventing Tomorrow” via new digital business models. Blockchain has the potential to accelerate improvements in all categories, on both sides of the wheel.

In Action?

An interesting example of how the technology is enabling new digital business models can be found with FidentiaX – “the world’s first marketplace for tradable insurance policies”.

See the links in the further references section for more.

- Partnerships

In a Nutshell: Going forward, insurers will increasingly be working with non-traditional (e.g. non-FS) partners. These partners will expect and demand 21st Century technology capabilities, including blockchain and Web3.

Fig 16: The Ecosystem Paradox, BearingPoint https://www.bearingpoint.com/en-gb/our-success/insights/the-ecosystem-iq/

Ecosystem partners – such as social platforms and utility providers – are the new game in town for insurers reliant upon, or at least minded to explore, third-party distribution. Akin to bancassurance deals in the early 2000s, they are the catalyst for a new ‘gold rush’ among insurers keen to secure new routes to market, before someone else does so. And of course, as predictable as clockwork, many insurers in their haste to have something rather than nothing, are making all the same mistakes they made previously with early bancassurance deals – signing contracts before thinking through the required ingredients for success – not just operationally but also in terms of alignment of partnership interests and what levers need to be put in place to incentivise and underpin successful outcomes.

New capabilities, such as blockchain-enabled insurance smart contracts, are likely to have high appeal to these new kinds of partners. Why? Because they are already tech-savvy and expert in finding ways to engage their customers and make money out of high-volume, low-margin transactions. Blockchain enables insurers to design and deploy fit-for-purpose products and services that will seamlessly align with these new types of partnerships.

But the partnership opportunity for insurers through blockchain extends way beyond sales and distribution.

Blockchain comes into its own when three or more entities are reliant on a single version of the truth.

Take medical information through wearable devices, and the opportunity for insurers to help clients take preventative action through behavioural change to minimise / eliminate health and mortality risk.

Multi-party dependency on the same data can, if established in an efficient way, unlock exciting new products, services and propositions which, with partners, insurers can use to further enhance customer engagement, retention, referrals and sales.

In Action?

One of my favourite examples in this area is the PoC developed by the team at bIOTAsphere, who put a blockchain-enabled dynamic pricing engine in a Tesla, to show how, through collaboration with ecosystem partners, the technology can be used to help insurers accurately price risk for their customers in real time. For me, this example was always less about motor insurance, and more about how exciting this blockchain-powered, ecosystem partnership model could be for all types of user-based insurance – and the potential it offers say health and life insurers – to demonstrate trust, transparency, fairness and, better alignment with consumer needs along the way.

See the links in the further references section for more.

- Competition

In a Nutshell: An insurer’s competition is no longer other insurers, but those who have the most frequent and trusted relationships with shared consumers. Insurers need to look to other industries for what good looks like.

The old adage “keep your friends close, and your enemies closer” works well here too. It may be that blockchain doesn’t have an immediate or significant role to play in your organisation. But, interest and adoption is picking-up, as I will demonstrate in my final Top 10 Reason below.

So, bearing in mind the likely magnitude of change that will be enabled across the world by blockchain & Web3 in the years ahead, can your organisation afford to unconsciously discover its potential only once competitors (new as well as old) have shown the way?

Many of our industry pain points and problems to solve are already clear to see – at the end of the day all of us, including members of insurance boards, are consumers of insurance. So we know what frustrates us and what would make us more inclined to trust our insurers more, and become their advocates. Don’t we have a moral as well as fiduciary duty not just to our shareholders, but also to our customers and staff, to keep pushing the envelope on what we offer, rather than simply playing ‘me too’?

And on that note, the goalposts that define ‘me too’ are moving for insurers, faster than we realise. As the charts above showed, consumers both trust other industries more than insurers and, in many cases are far more impressed with services offered by other industries too. So, don’t expect customers to sit around and put up with mediocre service levels and out of date products for too long – other industries are already seeing the potential to bring non-core products and services such as insurance to their more loyal and engaged customers. If not ecosystem partners, these are the businesses that have the potential to become the real competitors of tomorrow. So insurers that benchmark innovation and technology activity against traditional insurance competition in isolation are misguided at best – arguably doing shareholders and their staff a far greater dis-service along the way.

Is languishing around in the red ocean, leaving the creation of new market space in the blue ocean to others, really the best that your team can do?

Fig 17: Blue Ocean Strategy, Kim & Mauborgne https://www.blueoceanstrategy.com/what-is-blue-ocean-strategy/

In Action?

For me SingLife Philippines is a good example of thinking outside the box and being brave enough to adopt a new technology (blockchain) for their insurance administration system (delivered by Galileo Platforms) for their new mobile payments partner Gcash. New type of partner. New type of system. New market space.

See the links in the further references section for more.

- Adoption

In a Nutshell: Cross-industry adoption is accelerating. Insurance adoption has yet to really take off, but momentum is building, and outlook over the 3-7 year horizon for blockchain in insurance is extremely bullish.

Hopefully by this stage of the PoV, at a conceptual level at least, we are in agreement that taking blockchain & Web3 seriously is indeed something insurance boards, and their executive teams, need to do. This leaves us with one big and unanswered question – why now? Well, firstly of course, whilst not wishing to repeat ground already covered, the nine reasons above are all becoming increasingly real and present dangers / opportunities, which insurers need to address.

But beyond that, the reality is that global corporate adoption of blockchain has been quietly and steadily picking-up pace, behind the headlines of retail crypto adoption and fevered speculation within the asset class.

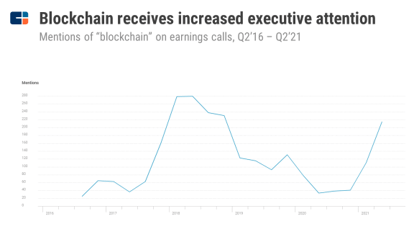

Mentions on earnings calls, for example, have been picking up again, reflecting this.

Many consumer-brand powerhouses as well a sovereign states have already announced their intent to actively engage in, deploy, or explore blockchain in various ways. Some examples that spring to mind include:

– Tesla – bitcoin is now on the corporate balance sheet, and they announced early in 2021 that they would accept bitcoin payments for new cars (subsequently quickly retracted due to “environmental concerns” according to Elon Musk)

– PayPal – now offers the ability to buy/sell crypto on its platform

– DBS – launched a crypto exchange service for its HNW clients

– McDonalds – launched NFTs in China

– Estonia – an early adopter of the technology, already has all its public health records stored on the blockchain

– China – is in advanced testing of its planned CBDC – the Digital Yuan, and many other nations are considering the merits of following their lead

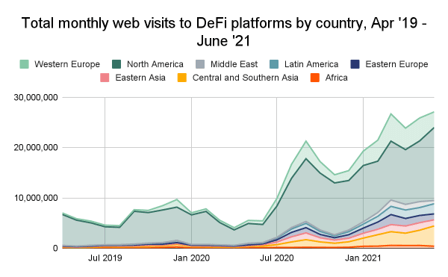

DeFi is one of the areas of blockchain application that may pose some of the biggest opportunities and threats to existing financial services entities, including insurers.

As the team at ChainAnalysis point out “DeFi’s growth has been one of the biggest stories in cryptocurrency over the last 18 months. DeFi refers to a class of decentralized cryptocurrency platforms that can run autonomously without the support of a central company, group, or person. How is this possible? DeFi platforms, also known as protocols, are built on top of smart contract-enriched blockchains — primarily the Ethereum network — and can fulfil specific financial functions determined by the smart contract’s underlying code. Popular types of DeFi protocols include decentralized exchanges and lending platforms. While concerns remain around DeFi’s safety and compliance obligations, it represents one of the fastest-growing and most innovative sectors of the cryptocurrency economy”.

The charts below show just how quickly uptake of DeFi has been over the last couple of years.

|

Fig 21: 2021 Global Crypto Adoption Index, ChainAnalysis https://blog.chainalysis.com/reports/2021-global-crypto-adoption-index

While the stage of corporate adoption of blockchain varies greatly by company, research is already starting to show just how pervasive corporate adoption is becoming, with 81 of the world’s top 100 companies already using blockchain in some way.

Unfortunately a comparable view of company activity by level of maturity isn’t yet available for the insurance industry. It is fair to say that our industry is not exactly on the leading-edge of experimentation and adoption, so likely would be more skewed to the earlier stages of research and pilot. But the forecasts suggest that this is all about to change (and my contention would be that the chart below is conservative).

There are already many interesting and sometimes exciting examples of insurers and / or InsurTechs successfully working on blockchain-powered projects across our global industry.

I’ve highlighted just a few throughout this paper and in the further references section at the end of this paper you will find various links to further reading if you’d like to understand more.

Last year we released our TDI TechMap21, which you can see below. We had blockchain as a “still early days, high to very-high impact” technology then.

Fig 24: TDITECHMAP21 – https://www.the-digital-insurer.com/tdi_pov_papers/tdi-techmap21/

Today, twelve months on, at the beginning of 2022, we see its pace of adoption accelerating and, if anything, we are even more excited about the opportunities it presents our industry going forward.

We have covered a lot of ground already in this PoV, and I’m conscious of your time. Inevitably we have only managed to scratch the surface on many important aspects of this emerging technology and its implications for insurance, but hopefully it has stoked your curiosity to explore things further.

For now, it’s time to draw things to a close with my parting thoughts on the following page…

Concluding Remarks

There is plenty of good reason for the naysayers to recommend that you proceed with caution – nascent technology, regulatory uncertainty, slow run times, environmental issues, cyber security concerns and skill gaps to name just a few.

But make no mistake – these issues will all be addressed and blockchain, wider applications of the underlying Distributed Ledger Technology and Web3, are all going to have a profound impact on our personal and professional lives, akin to the resultant impact from earlier generations of the internet.

While the pace at which these new developments occur, and the projects and sources of value that present most opportunity for insurers may both be up for debate, the fact that blockchain is here to stay is not.

And, with so much at stake, and so many opportunities to leverage the technology to drive a step-change in insurance business performance for the benefit of all, why wouldn’t every board be asking their Exco to report back on the simple question below, if not already done?

“What do we consider to be the three biggest opportunities and threats presented by blockchain and Web3 to our organisation over the short, medium and long-term and, what is our planned response?”

Another PoV brought to you by:

Working Together to Accelerate the Digital Transformation of Insurance

Further References

Examples of insurance use cases from around the world

Ping An |

China China |

Strategy https://insureblocks.com/ep-144-a-new-approach-to-blockchain-ping-ans-insights/ |

|

|

||

| Perception

https://www.ledgerinsights.com/allianz-launches-blockchain-claims-solution-in-23-countries https://www.agcs.allianz.com/news-and-insights/news/blockchain-prototype-captive-insurance.html www.allianz.com |

||

|

|

||

HKFI HKFI |

Trust | |

|

|

||

Lemonade Lemonade |

Equity

https://www.conyers.com/publications/view/insurtech-demystifying-the-hype/ www.lemonade.com |

|

|

|

||

Galileo Platforms Galileo Platforms |

Service

https://ibsintelligence.com/ibsi-news/insurtechs-galileo-platforms-and-amodo-partner-in-thailand/ https://www.youtube.com/watch?v=45LqqIByZl8 |

|

|

|

||

B3i B3i |

Efficiency

https://www.youtube.com/watch?v=Ywx0fjajgtQ&t=5s https://www.insurancejournal.com/news/international/2019/10/22/546184.htm https://www.raconteur.net/finance/insurance/blockchain-improve-insurance/ |

|

|

|

||

FidentiaX FidentiaX |

Innovation

https://www.youtube.com/watch?v=5658SIqCXd4 |

|

|

|

||

bIOTAsphere bIOTAsphere |

Partnerships | |

|

|

||

SingLife SingLife |

Competition | |

d

Deloitte, Blockchain in Insurance Why should you care? Infographic and report:

https://www2.deloitte.com/ca/en/pages/financial-services/articles/blockchain-in-insurance.html

BCG: The First All-Blockchain Insurer

https://www.bcg.com/publications/2018/first-all-blockchain-insurer

Gartner: The CIO’s Guide to Blockchain:

https://www.gartner.com/smarterwithgartner/the-cios-guide-to-blockchain

Top 7 Use Cases of Blockchain in the Insurance Industry (with Examples):

https://imaginovation.net/blog/blockchain-insurance-industry-examples/

Swiss Re, Blockchain: How insurers are building up trust by breaking down barriers:

https://www.swissre.com/institute/conferences/blockchain-insurers-are-building-up-trust.html

B3i Reinsurance Use Case Story:

https://b3i.tech/news-reader/b3i-reinsurance-use-case-story.html

Munich Re – Blockchain and its Implications for the Insurance Industry

Bankrate – How blockchain is transforming the industry:

https://www.bankrate.com/insurance/car/blockchain-disruption/

TDI China in Focus: Chinese insurers poised to embrace blockchain:

https://www.the-digital-insurer.com/china-in-focus/blockchain/

TDI InsurTech analysis video and research deck, Lemonade:

https://www.the-digital-insurer.com/dia/lemonade-insurtech-analysis-video-and-research-deck/