TDI Point of View: 21st Century Claims – Why AI still needs the human touch

TDI’s Simon Phipps, alongside Mark Breading from Strategy Meets Action, ask why, despite the potential of AI being well-recognised across the claims function, do insurer’s AI claims projects struggle to get beyond the POC phase? To help answer this question they also speak with Rupin Mago of InsurTech omni:us on its unique approach, which is achieving impressive results helping insurers improve claims with new tech, in particular AI.

Much has been written about the potential for digital claims. And for good reason. In many parts of our insurance world, claims is the key moment of truth. Yet as the role of insurers continues to evolve – from risk indemnification (paying out when an insured risk event occurs) to risk prevention (helping the insured reduce the probability of the risk occurring in the first place) – insurers still need to be there for their clients, assessing and settling claims fairly and efficiently as and when they occur.

Like many aspects of insurance, claims processes and functions have ‘grown arms and legs’ over the years, often representing large swathes of resource and expense which, despite everyone’s best efforts, often leave customers unimpressed.

Source: Why Claims Service Matters, Accenture

Unimpressed with the time it takes the insurer to assess and settle claims, unimpressed with the amount of administration and toing and froing involved between themselves and the insurer, and unimpressed with the subjectivity of many of the insurer’s claims settlement decisions.

On top of the challenges of high levels of inefficiency and low levels of customer satisfaction, the insurer also has to navigate one of the key morale hazards of our industry – claims fraud – which, depending on which market you are in, can either be a very big challenge for insurers to navigate, or just a fairly big one.

With so many opportunities to improve such a critical part of the insurance value chain, it’s no wonder that InsurTechs are getting involved. And they’re not holding back. A quick look at TDI’s InsurTech Directory (The World’s InsurTech database– https://www.the-digital-insurer.com/search-insurtech-directory/ ) shows that there are more than 180 claims-focused InsurTechs around the world, with a relatively high percentage focused on the more developed markets in the US and Europe:

So why so many firms? Where is the real potential? According to McKinsey, while claims is awash with digital-enablement opportunities, key areas along the value chain stand out:

Source: Claims in the digital age: How insurers can get started, McKinsey

And according to McKinsey’s report, improving claims through digitalisation offers benefits for all:

Source: Claims in the digital age: How insurers can get started, McKinsey

The use of Machine Learning and Artificial Intelligence is well-recognised for its potential applications across the claims function. Yet all too often, ‘AI claims projects’ are not getting beyond PoCs. Why? As a generalisation, it’s because of two common faults in the way these projects are being set-up:

1.‘Solution trying to find a problem’ – innovation teams asking “what can we do with AI” rather than business teams starting with the problems they need to solve for customers, and then exploring what solutions, including different technologies, could help to fix them. Starting with the tech is never a good idea, as Steve Jobs observed in this video from many years ago: https://www.youtube.com/watch?v=r2O5qKZlI50

2.‘Reaching too far, too fast’ – trying to transform too quickly, especially on newly emerging technologies, can often backfire, if the pace of business deployment is faster than both the staff and customers willingness to adapt and adopt, and/or if the technology is still being developed and sources of value explored.

One of the few stand-out InsurTechs that understands these problems, and is focused on deploying AI with insurers in a pragmatic, ‘fit for purpose’ way, is omni:us, which describes itself as the Home of AI. Future of Claims. TDI presented at their Machine Intelligence Summit in Berlin in 2019 https://www.the-digital-insurer.com/event/3rd-machine-intelligence-summit/ and we got to know the team pretty well over the last 12 months. They are breaking new ground in the US, already have a strong and growing client list with a proven track record in Europe and, perhaps therefore unsurprisingly, have just completed their Series A round.

The omni:us team, 2019

They are an impressive team, who “get” insurance, and the need to introduce new-generation technologies in a way which helps insurers to fast-evolve, rather than attempt to radically transform – in order to get some initial wins, and earn the right for further investment. Their value proposition is “modular AI as a service for intelligent claims automation”, aiming to “fast-evolve insurers’ claims functions from rules-based to data-driven automation and decisions”.

We caught-up with Rupin Mago, VP Americas, to better understand their approach to helping insurers improve claims with new tech, in particular AI:

“Knowing that machines can’t automate everything nor can we afford to have humans do everything manually, we need a hybrid approach to claims…automating simple to medium complexity cases and enabling human decision making on complex cases. The start of any automation project requires carriers to have ‘clean data’ to avoid the ‘garbage in, garbage out’ problem. Deep and broad clean data with little to no manual intervention. If you use flawed data to initiate the claims process, the resolution of the claim will be similarly flawed. This is also known as claims leakage,” he says.

“At the end of the day, when it comes to 21st century claims, AI will still need the human touch.”

Impressive rhetoric …but all talk, or is there substance to the claims (forgive the pun!) and aspirations of the omni:us team? In their pitch decks they claim to offer 20% Net Promoter Score increases whilst at the same time delivering 25-35% cost reduction. We challenged Rupin to share some examples of where they have created real value for insurers, through this considered, blended approach to the use of AI in claims. What they shared was impressive:

CASE STUDY 1 – AI-based claims indexation

For this project, the idea was to kill two birds with one stone: the birds being claims leakage and manual work rate, the well-thrown stone being automation. The insurer had an annual incoming volume of 25 million pages for all their commercial lines business.

A major concern for the client was to reduce the amount of inefficiencies and errors, which always accompanied manual document classification and data extraction. The client wanted this to be achieved by automatically indexing the incoming claims documents to the appropriate case file in their claims system.

The solution was to train and deploy AI models, which automatically classify incoming documents into 20 document classes. The information is first filed into the appropriate bucket, and then we extract over 30 attributes including the following key attributes:

- Claim number

- First name, last name

- Social Security Number

- Date of birth

- Date of loss

- Loss state

With this information, the carrier could build system logic that would find the relevant claim file and automatically assign a task to the appropriate individual for further processing.

The business impact was significant: process time was cut in half; the error rate saw a drop of 90%; FTE redeployment and savings reached 80%.

CASE STUDY 2 – Real-time interactive FNOL (First Notification of Loss)

The goal here was to improve the customer’s experience when first talking to their insurer about a claim. Customers were complaining about the difficult online process for submitting claims. The form required more than 20 fields of data and caused frustration among claimants. As a result, they avoided the online portal and soaked up customer support resources with often low-value, low-priority claims. Truly urgent claims were being caught-up in the chokepoint, and the insurer’s net promoter score and overall reputation was rapidly slipping.

The solution was to implement AI to avoid the claimant from entering data manually to initiate a claim. With the use of interactive web forms into the customer journey, using a machine learning system to “extract” and “understand” to quickly fill in the blanks on the form, requiring only some basic data from the customer to do so. For customers, this system was far more manageable and user-friendly.

Overall this project will impact the following areas.

– Online submission journey

– Automatically process incoming emails

– Shift customers from physical mail to digital submission journeys

CASE STUDY 3 – Automated coverage check

The target here was to automate verification of whether the claim is covered by the claimant’s policy. The problem for the insurer is that this step is a heavily manual and inefficient process, which is flooded with low/mid value claims. This combination results in a sluggish service time and subsequently, widespread customer dissatisfaction.

The solution implemented by omni:us created a structured data set from the policy language and terms. A machine learning system was then trained with this data set. The ML system was also able to quickly cross-reference claim information against the individual policy, quickly verifying coverage status before checking that the loss described is covered under the T&Cs. If the system is not satisfied, it will request further data to confirm.

This improved checking system resulted in a significant reduction in manual processing and increased response times.

CASE STUDY 4 – Straight-through processing

A large Dutch insurer wanted to substantially automate low to medium-complexity claims that were digitally submitted, whilst being able to resolve against approved risk business logic without human intervention. The problem was that slow processes and poor triaging were creating a high volume of customer service complaints.

omni:us automated the claims journey, enabled real-time digital interaction with the claimant through webchat and other tools, and increased automation of the triage step, which lowered the previous error rate.

As a result, the business cut its manual workload in half and reduced remaining manual claims time from five weeks to four days.

Our friends at SMA (Strategy Meets Action, US) also know the omni:us team well and, more broadly have a good handle on how digital is helping P&C carriers across the US. So we turned to them for additional insight on why AI still needs the human touch in claims.

“There is so much potential value for insurers to apply AI technologies in claims. There are vast amounts of unstructured data vital to the claims process. Today that data is processed in very inefficient ways and the potential insights from the data are largely untapped,” says Mark Breading, SMA Partner.

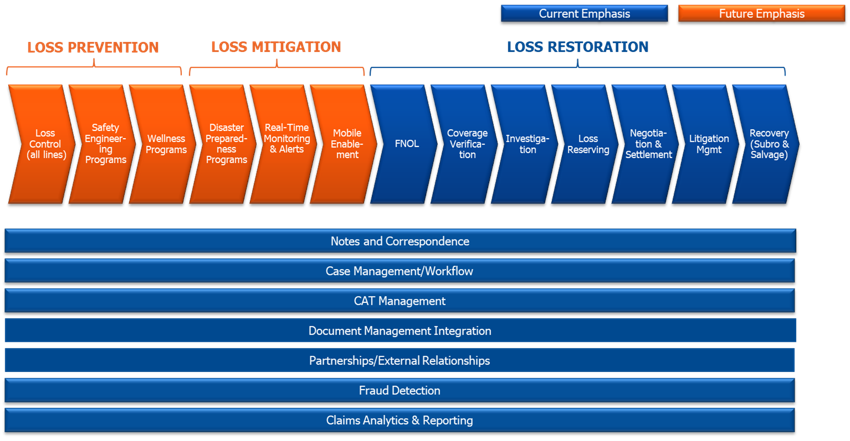

“The claims environment relies on a wide variety of data in different formats. The future claims value chain will be more tightly linked with loss prevention and loss mitigation efforts. As a result, both the future claims value chain and the related ecosystem will be even more expansive and complex than today. Figure 2 below shows how.

Figure 2: Future claims value chain

*Source: SMA Survey, 2019 Transformational Technologies for P&C, n=57

“All of these many functional areas represented by the chevrons in the primary value chain and the horizontal processes that span the value chain, have significant intake requirements. Industry standard forms, carrier specific forms, e-mails, spreadsheets, digital images, and more, are ingested and must be identified, categorised, and analyzed. The core claims administration systems handle the structured transaction data and serve as the systems of record, but a variety of other systems and technologies are required to support key functions and especially to optimise and leverage the unstructured data flowing into the enterprise from multiple sources.”

According to SMA Research*, 77% of commercial lines insurers, and 61% of personal lines insurers, expect high value from applying AI technologies for claims automation and insights. The research also confirms that applying machine learning and NLP technologies to unstructured data is where insurers see great opportunity.

Many reading this will know that there is huge potential for claims to be improved through the use of new technologies.

And while AI is likely to play an increasingly important role, it’s not the only exciting area of tech offering potential. Distributed Ledger Technology, and specifically smart contracts, present a hugely exciting opportunity for step-changes in claims efficiency and service experience. But these potential solutions are arguably still some way off, as many of the technologies are still in their infancy – presenting perfect ingredients for innovation lab PoCs but, invariably at this point, not much more.

What we like about omni:us, and their pragmatic approach to working with insurers to fast-evolve claims functions, is their problems-first approach, combined with not wanting to over-stretch insurers too soon on the use of the new technology. Insurers need helping hands to accelerate their digital transformations – now more than ever (see: https://www.the-digital-insurer.com/tdi_pov_papers/tdi-pov-industry-warning-digital-tipping-point-is-approaching-insurers-faster-than-expected/) – and InsurTech partners who understand the criticality of the change management journey, and the need to create value as you go, so you can earn the right as well as the trust, to take digital investments to the next level.

Eliminating non-value adding human activities to get more done, at higher quality, and lower cost, whilst at the same time improving staff engagement scores AND customer satisfaction, is a ‘holy grail’ outcome for most insurers’ projects. Hopefully more InsurTechs will follow in the path of omni:us over time. For now, their contact details are below.

In line with TDI’s purpose of Working Together to Accelerate the Digital Transformation of Insurance, I’ll finish this article in the same way I did my last, as the clock is ticking, faster than ever before….

Let’s get this transformation done.

The TDI PoV series supports learning for the digital age and is part of the TDI Academy, which includes the world’s first virtual mini-MBA and professional qualification in digital insurance.