Library: Life Code Compliance Committee – Annual Industry Data and Compliance Report 2019-20

Executive summary :

Key findings

New consumer protection laws resulted in 8.3 million fewer covers

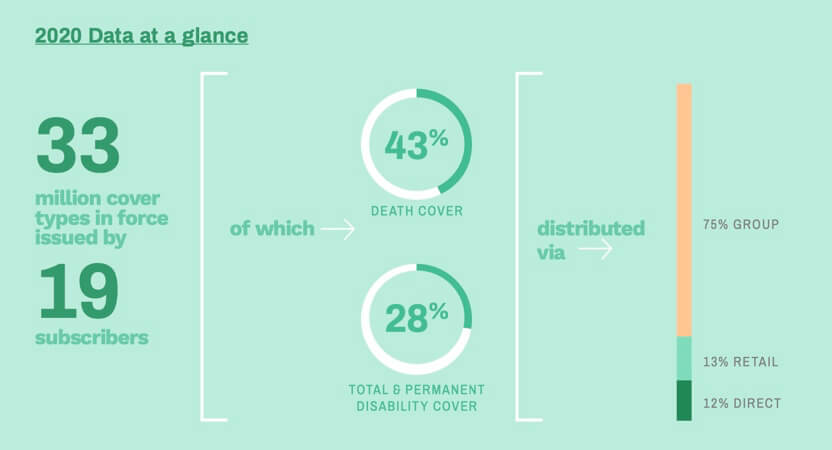

Covers in force this year reduced by 20% compared to 2018–19 (down from 40.9 million to 32.6 million).

The decline is largely attributable to the cancellation of covers as a result of the Protecting Your Super (PYS) and Putting Members’ Interests First (PMIF) laws, which were introduced in response to the Royal Commission into Banking, Superannuation and Financial Services to protect consumers’ superannuation funds from being eroded by insurance premiums.

Group cover was particularly affected by the new superannuation laws, and the industry experienced a 23% reduction in covers during the year.

Sales of consumer credit insurance (CCI) and funeral insurance also declined following a tightening of the ASIC regulations for the sale of these products.

As a result, some subscribers ceased distributing these products, either directly or as white-label products via third-party sellers, and overall 25% fewer CCI covers and 20% fewer funeral insurance covers were in force.

Most claims decisions were made within the required timeframes

The numbers of claims received and determined were similar to last year, each declining by just 3%. The number of claims in progress across all benefit types also remained stable as subscribers finalised a similar number of claims as were received.

Pleasingly, most claims decisions were made within the timeframes set out in chapter 8 of the Code, with 80% of income-related claims made within two months and 91% of non- income-related claims made within six months.

Most subscribers were able to pinpoint a reason for applying unexpected circumstances to a claim

This year, for the first time, subscribers were asked to report on the number of claims where unexpected circumstances applied as referred to in sections 8.16 and 8.17 of the Code.

They were also required to give specific reasons (as listed in chapter 15 (‘definitions’) of the Code) for applying unexpected circumstances to these claims.

The committee was encouraged to see that most subscribers were able to provide this information and clearly identify the reason for applying unexpected circumstances to a claim.

Regrettably, two subscribers confirmed that they were unable to identify and record the reasons for applying unexpected circumstances on any of the claims where unexpected circumstances applied and one of these subscribers appeared to have no framework in place for doing so.

In the committee’s view, simply recording that a claim is in unexpected circumstances is not sufficient. We expect subscribers to be able to record the specific unexpected circumstances reason so that they can understand why delays are occurring and take steps to prevent them where possible.

See the full report for more…

Link to Full Article:: click here

Link to Source:: click here