The reality of Big Data and Digital Transformation in Latin America

We spoke with Hilario Itriago about big data and digital transformation in Latin America. Hilario Itriago is an international executive, with experience in operations, business transformation and business digitization. He has extensive corporate experience in strategic and operational roles. He worked for 16 years in RSA, where he served in different roles such as COO and CEO for Latin America.

Nowadays, he participates actively in the Latin American entrepreneurial sector as Co-founder and CEO of Bullfrog Ventures, a company specialized in the transformation of the insurance industry through the search, investment, and implementation of digital solutions and Insurtech.

1. In your words, how do you define big data?

The term big data has several meanings and means different things to each industry. For me and especially for what is related to the insurance industry, I would define it as the promise of information that exists within the insurance ecosystem. The information that I referred to is the one that is held by insurance companies, brokers, adjusters, etc. Therefore, the data can be considered as high volume, and it is available to be “mined” by the different actors to have a better and more accurate understanding of the behavior of customers, the use of products, the accident rate, and the specific characteristics of each line of business.

This information, in theory, should help us improve the ability to design better products, with better coverage, better services and with terms and conditions more aligned to the characteristics of the user’s daily life or in this case “the Insured.” This could be a general definition of big data that applies to the insurance industry.

2. According to your experience, how has big data evolved in Latin America in the past five years? And where do you think it is going to be in the next ten years?

In the last five years, the terminology and the concepts have sophisticated, and its use has suffered an exponential growth across the industry. However, in terms of implementation, the situation is different; you don’t see the same kind of growth.

What I mean by this is that ten years ago, we talked about issues related to “Management Information” and report development for better decision making processes. Then what happened was that most of the companies that were implementing those models, only changed the vocabulary to include the new terminology of big data, but they have not taken the path of transforming their business strategy to include data analytics models and data mining.

What we have in the region today are companies that implemented or are working on systems to adequately manage information and companies that developed information cubes to manage their databases, but none of them explains if the systems are a compendium of historical data, with the present data and how they are using it for the future. I think that if there was a company in the region that had implemented big data and analytical models to its business strategy, that company would have a significant competitive advantage today in terms of interaction with the client, “the insured.” And that is not the case.

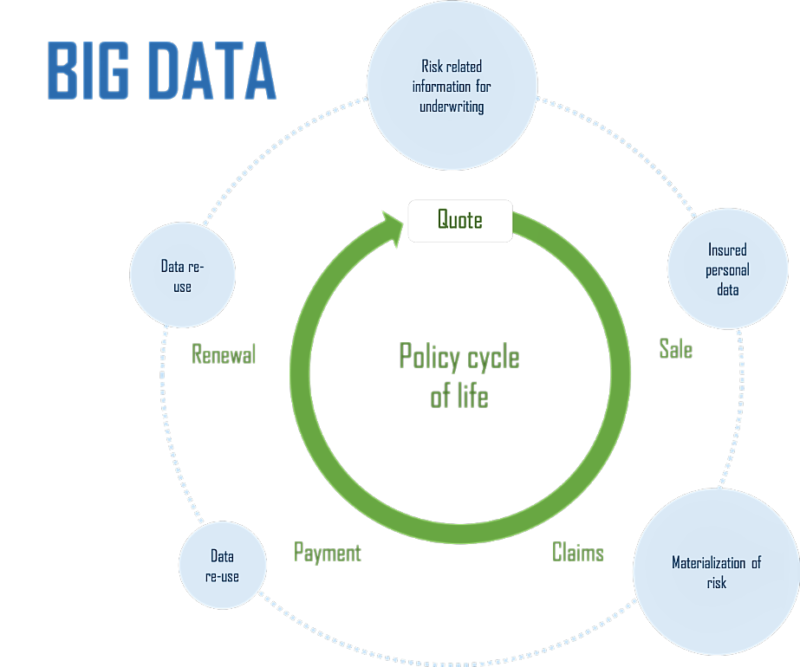

What I mean by this is that one thing is that today you have information about the life cycle of an insurance policy (Graph 1), and another is that a company can offer additional coverage through an App using the client’s geolocation.

The intention and where the big data become relevant is when we can identify how to interact better and at the right time with the customer throughout the lifecycle of the insurance policy. For example, car insurance with a value proposition of telematics, where the technology allows the company to collect information and make reports in real time to its clients. The reports may be of its driving habits, differential rates and identification of drivers for driving behavior, etc. However, I do not see this kind of capacity in the market yet.

In the region, what we see is the technological upgrade and the beginning of the implementation of analytical models, where companies are upgrading their operating systems and are implementing new technologies and starting the conversation around big data, which seeks to improve some specific service issues, but we are far from a digital transformation of the insurance industry that allows a daily interaction with the insured.

For example, in Bullfrog Ventures we have a few startups in the portfolio that are entering the insurance ecosystem with innovative products, such as Boxx Insurance with its product Cyberboxx and Likk Technologies with its IOT service, that are seeking this kind of interaction with customers to become preventive and predictive.

3. What are the main barriers when you want to implement big data models in the insurance sector in Latin American?

In practice and being fair with the capabilities of the organizations in Latin America, I think that the main problem that companies face when they want to implement this type of solution is the lack of resources. When I talk about resources, I refer mainly to time, knowledge and internal talent to develop this type of projects. That is one of the reasons why there is a company like Bullfrog; we help companies in the insurance industry to plan that future and build the road map of their products and processes.

At this point, it is important to recall a term that we have mentioned above, digital transformation. As with big data, the term digital transformation often is wrongly used to describe processes that do not cover all the key aspects and the necessary variables that are important for its definition. That kind of incomplete definitions create complications at the time of implementation and problems to produce sustainable results. The digital transformation and big data models should be projects that embrace the entire corporate strategy. This implies a cultural shift that involves all the employees, a different thinking process and a new way of doing things. For example, insurance products should not only be designed by underwriters and actuaries but should also include the concept of Design Thinking that takes into account interactions in the life of the insured, sociologists and social networks experts should be consulted, among others.

Other barriers that exist to these new models and new technologies are the regulatory bodies of each country. It is essential that governments and regulatory authorities have the talent and resources to collaborate with the development of the insurance industry in an agile manner. Also, they need to facilitate and promote the new technologies but always considering that the products and services must fulfil their promise of value to the users.

4. Regarding the applicability in insurance, what do you consider to be the areas with the most significant impact and applicability for big data?

In terms of commercial lines, companies need to start creating products that allow them to become more preventive and predictive. These products will have a significant effect on the financial statements of the companies since the amounts insured, and the claims have a higher value.

Concerning business models, much depends on the attitude of companies and local brokers towards the implementation of this type of new technologies. I think that if brokers succeed in the application of this type of tools to enhance their relevance and added value, they will be able to generate a significant impact. The same will happen if companies produce a more personalized value proposition using all the information available. However, if they do not it, the reinsurers will. As an example, you see how some reinsurers are investing in emerging technologies, which will allow them to have higher bargaining power in the future.

5. You have an example of a company in the sector that is making a successful implementation of big data models.

An excellent example of a successful implementation is the pay as you go auto insurance policies that SURAMERICANA developed for the region, the product is available in countries like Chile and Argentina. Another great example is the acquisition of Relayr by Munich Re, to implement industrial IoT solutions and become preventive and predictive in the maintenance of machinery.

At this point, I want to insist that for these models to be successful, it is not only based on the implementation of a specific technology or analytical model but on the thinking process behind the development of the products. It should be a different process from the traditional underwriting models and should consider variables regarding the technology, customer expectation and design thinking strategies. In these products, software development and customer experience is more important than the insurance product itself.

6. What are the specific steps to guarantee success in the implementation of big data models in the insurance industry?

These projects are always a team effort. For example, at Bullfrog we use a framework that begins with an innovation workshop, where we give the opportunity to all the participants to call out the different pain points, challenges, and opportunities that are presented in their day-to-day work. With this starting point, we can identify the main priorities of each stakeholder and prioritize. Then, we create a plan and a work schedule focused on developing the opportunities and solve the problems to introduce the way to the digital transformation and use of Insurtech capabilities.

For the implementation of a digital transformation strategy, it is crucial to construct multidisciplinary teams that lead to the execution and selection of new technologies and processes. The teams not only need to have a balance between talent in digital technologies and analytics, but also expertise in the structure of the traditional insurance business.

In conclusion, I would say that the critical thing to note is that the implementation of big data is part of a broader strategy, called digital transformation. This process of digital transformation needs to be a collaborative effort among all the players across the insurance ecosystem, from the insurance companies through the brokers, the claims departments and assistance companies. All must play their part in the process and must be taken into account.

Finally, it is essential to think about products that work “on demand,” where users have the freedom to relate to insurance products at any time they need it. Always with the customer experience in the center of the process to create a service that is genuinely functional to the insured.

Comments