Smart Ageing in China

As the world faces an ageing population time bomb, what could be the role of insurers?

By 2030, it is expected that Asia will be home to over 60% of the total population aged 65 years or older worldwide1. There is no doubt that our growing ageing population could represent a major market opportunity for financial services. However, of all the sources that help to fund a longer life, insurance only has a single-digit share. Based on our research, currently approximately 70% of the ageing wallet comes from the society (60% state; 10% family), 25% comes from savings, and only 5% comes from insurance. These numbers are consistent worldwide and not just applicable for Asia.

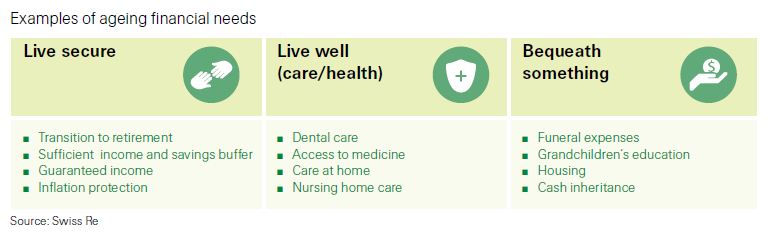

If insurers want to increase their ageing business, they will need to find new ways to provide relevant and attractive new paths to financial security for older people. In searching for breakthrough, we need to explore the needs of older people both financially and non-financially. Here are some examples of ageing financial needs:

Swiss Re also conducted a study on 9,000 people globally to get a better grasp of non-financial needs, aspirations, and fears about their later years. From the research, we discovered four basic need types that are consistent across countries, but each has specific nuances related to market characteristics and personal motivation that should be considered. Using consumer segments built specifically around needs and attitudes will help insurers to better drive successful proposition development, as this goes beyond typical demographics. Winning solutions will combine financial and service benefits with high levels of trust and simplicity.

Combining the four basic need types and our interviews with direct insurance distributors, we find out that most insurers want to incorporate technology and services like digital elderly care options or even leisure opportunities to differentiate themselves. This is a summary of the important factors when designing new products for the ageing population:

Smart Ageing in China

Like many other countries in the world, the population in China is ageing at an unprecedented rate. It is estimated that by 2020, there will be over 248 million people over the age of 60, and the number will reach 300 million by 2030.2

According to Swiss Re Institute’s research in 2017, it costs about USD 8tn annually to fund all the Chinese seniors over 65 years old, which is USD 15k on average per person per annum. These funding typically comes from the state (51%), savings (26%), families of the seniors (21%), and only 2% of the funding is coming from insurance.

Taking the four basic need types and product design considerations from the section above, the next logical step is to assess the technology currently available in the China market that could potentially add value to senior insurance products.

Take smartphones as example, most smartphone makers in China have launched “elderly smartphones” in recent years, such as TCL, Phillips, Huawei, Lenovo, etc. These phones target seniors above 65 years old, the prices are more affordable and functionalities are easier to use too. However, as the functionalities of these smartphones tend to be more basic, it is possible their design are not customised enough to address the real needs of the elderly yet, so a good balance of simplicity and tailor made are still in search.

In the home segment, even though there are more and more “smart” home electronics being launched in recent years, most basic home electronics such as air conditioners, televisions, still consist of a remote pad with multiple functions and buttons. It might look like that these are trivial problems to solve, however, this can be one of the key obstacles for elderly to lead an independent live. On the other hand, for the widely known smart home devices nowadays such as home motion sensors and smart medical devices, the challenge is how to bring positive impacts on elderly’s lives, and at the same time, can be non-invasive to their bodies?

The telehealth network in China amongst all are the most developed, with apps such as Ping An Good Doctor, Alihealth, Chunyu Yisheng are leading the market. These apps could be customised to the users based on their age, gender, user habits, and medical conditions etc. For the seniors, the apps are informative, personalised, and useful. However, we do see there are still rooms for them to be more user-friendly and simple for seniors to enjoy the full functionalities.

Lastly, the question is, how we can integrate technology into insurance? At Swiss Re, we constantly test new ways of innovating ageing products and more than ever, we are adding technology into our recipe to create value added solutions that will make senior lives easier. Get in touch with us, we would love to share our view and learn more about your needs.

Sources:

- Asia is expected to be home to more than half of the elderly population worldwide by 2030- Business Insider, Sept 2017

- 银发时代“适老化”智能家居或成未来行业蓝- Sohu News, Nov 2017

- Who Pays for Ageing?- Swiss Re Institute, Apr 2017

- The Ageing Wallet: By the Numbers- Swiss Re Institute, Apr 2017

- Who are the Ageing?- Swiss Re Institute, Jun 2017

Comments