McKinsey & Company – Moving to a user-first, omnichannel approach

Executive summary :

Today, about one in four motor insurance policies in Germany is sold online, and other property – and personal-insurance products are increasingly being purchased through digital channels. These trends have been further strengthened since the outset of the COVID-19 pandemic, which has increased customers’ comfort with digital- and remote-interaction models and tools. In an October 2019 survey of more than 3,000 individuals across Europe, 38% reported that their preferred sales channel for life insurance is digital. After the first few weeks of the lockdown, this share rose to 54%.

Established insurers are investing heavily in digitising their customer journeys and processes, and numerous new, purely digital insurers, or insurtechs, have entered the market. Traditional insurers are well aware of how their peers in the banking industry partially lost the customer interface to new entrants such as PayPal, TransferWise, or N26. Moreover, large technology groups also show clear interest in the insurance market, even if they refrain from taking risks onto their own balance sheets. All of these developments have raised the stakes across key dimensions of the business model.

To remain competitive, traditional insurers in Germany will need to quickly move to a user-first, omnichannel strategy. The most successful carriers in the post-coronavirus digital age are integrating this approach by prioritising three elements: availability of online purchasing capability, ease of navigating online customer journeys, and seamless integration of sales support and advice capabilities. To implement this strategy effectively, insurers must first lay a foundation focused on the customer journey and enabled by selected technologies and organisational capabilities.

Key elements for a user-first, omnichannel approach

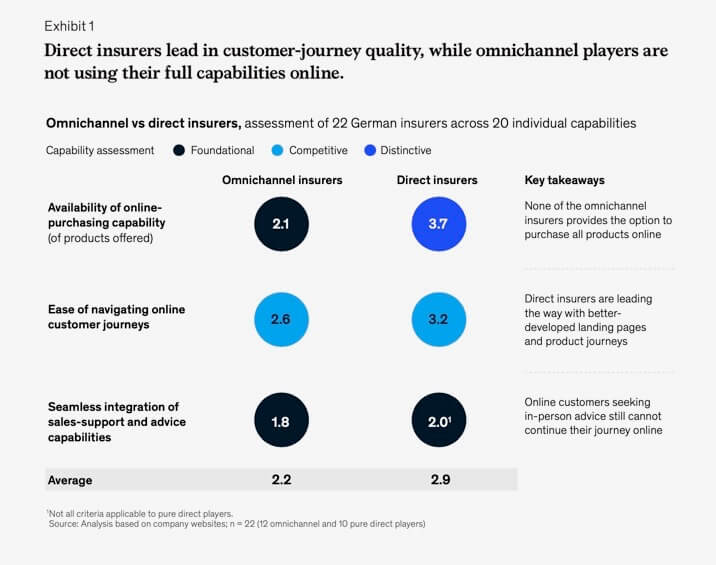

To gain a picture of the digital marketing capabilities of German insurers, we analysed 22 carriers across 20 individual capabilities along the conversion stage of the marketing funnel. Each player was scored from one (nascent) to four (distinctive).

An effective user-first, omnichannel approach includes three critical elements, listed here in order of importance: availability of online-purchasing capability, ease of navigating online customer journeys, and seamless integration of sales-support and advice capabilities (Exhibit 1). Product complexity that cannot be eliminated through rigorous redesign needs to be bridged with advice capabilities, which must be seamlessly integrated into relevant touchpoints across customers’ omnichannel journeys.

Our analysis reveals the large majority of carriers has at least foundational digital-marketing capabilities across the funnel, with 77% of players reaching an overall score between two and three. However, the industry as a whole still shows significant room for improvement: only two insurers with a traditional multichannel and intermediary- focused distribution model scored three or above. This is especially relevant when considering that customers are likely to draw comparisons not only between their experiences of online journeys with other insurance players but also from other industries (for example, shopping on Amazon or signing up for an account on Netflix).

Insurers focused on direct channels earned much more competitive scores, as their product offerings were typically fully digitised and their customer journeys easier to navigate. Interestingly, this difference in capabilities largely persisted even when traditional and direct players belonged to the same insurance group. However, most notable was that, on average, traditional players did not harness their in-person advice capabilities effectively within their omnichannel setup—a huge missed opportunity.

See the full report for more…

Link to Full Article:: click here

Link to Source:: click here