Library: McKinsey – Capturing the climate opportunity in insurance

Executive summary:

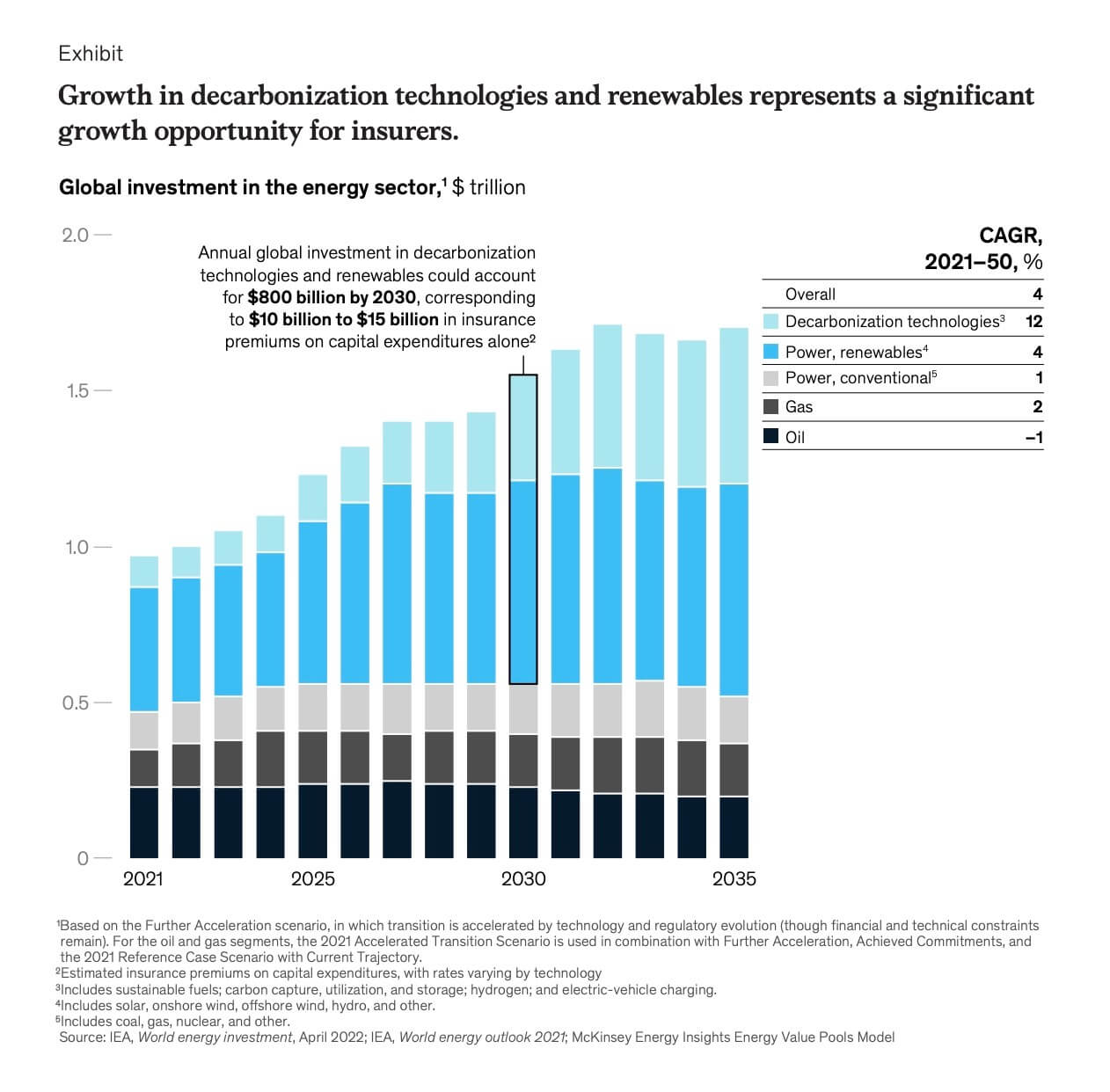

The world is at an inflection point in its climate transition efforts. As governments and companies worldwide pledge to achieve net-zero greenhouse gas emissions, the transition is poised to spark the greatest capital reallocation in a century, requiring an estimated annual investment of more than $9.2 trillion in energy and land-use systems.

It’s a transformational moment for insurers, with significant climate-related risks and opportunities on both sides of the balance sheet. Taking an offensive approach will be critical for insurance carriers to unlock growth and remain relevant in a net-zero future.

What the net-zero transition means for insurers

As the net-zero transition unfolds, new forms of volatility are emerging. Capital reallocation to low-carbon technologies is rapidly reshaping industries.

New technologies face business cases with uncertain economic viability and scalability. Companies face increasing demands for transparency on climate risk and emissions, driven by regulatory requirements and investor and consumer advocacy.

The risk of litigation for climate inaction is also growing. And against this backdrop, rising physical risk continues to affect communities and economies.

Insurers have a once-in-a-generation opportunity to address these new forms of volatility—and help catalyse an orderly transition to net-zero emissions—through product and solution innovation.

Yet in our experience, climate aspirations are often disconnected from commercial strategies, leading to a lack of a cohesive approach on two fronts: identifying and prioritising climate-focused commercial opportunities, and taking a go-to market approach to better source, underwrite, and share new types of risks.

See the full report for more…

Link to Full Article:: click here

Link to Source:: click here