Friend or foe? Insurtechs and the global insurance industry

Article Synopsis :

This report from IBM, based on a survey of insurance and InsurTech executives and venture capitalists, outlines causes, consequences and a path forward for insurers to successfully embrace ‘an InsurTech-infused future.’

The growing impact of InsurTech on the global industry is beyond doubt, with InsurTech investments topping $5 billion between 2014 and 2016, and more than 30% of global insurance customers using InsurTech either exclusively or in combination with incumbent firms to fulfill their insurance needs. Furthermore:

- 81% of outperforming insurance businesses surveyed have either invested in or are already working with InsurTech businesses

- 26% of the 400 InsurTech businesses surveyed are creating online-only digital solutions

- 57% of the global insurance executives surveyed say InsurTech is already driving innovation across the insurance industry

Almost three in four insurance CxOs say they believe InsurTech is disrupting the insurance industry, yet only 43% see this same disruptive effect on their own business or operating models – a discrepancy that may point to overconfidence in their own innovative strength.

Just over a third of InsurTech businesses say their engagement with the insurance industry will be competitive, i.e., aimed at causing disruptive change. 44% of InsurTech businesses rate their involvement as cooperative, with 52% expecting evolutionary development. The breadth of a rapidly expanding insurance footprint underscores the opportunities for collaboration between insurance companies and InsurTech.

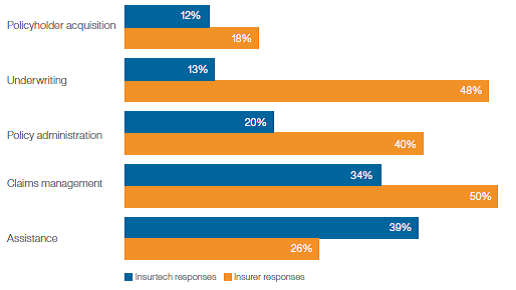

What specific links in the insurance value chain are being targeted by InsurTech?

Moving forward, the report issues three recommendations for insurers:

- Increase customer interaction value: Touchpoints with customers are opportunities to engender trust, loyalty and satisfaction. This means interacting more often, and providing value to the customer. Embrace insurtech philosophies around customer-centricity, experience and usability. Think about customers holistically – what they want, what they need, what they aspire to. Determine how you can contribute to a broader, more compelling experience, and by so doing, expand wallet share.

- Improve agility and flexibility in product development: Simply providing venture capital for an InsurTech is not an adequate strategy. Consider your value chain and how InsurTech strategies and activities can impact how, when and where you do business, including the products and services you sell. Mine social conversations to analyze customer trends and patterns. Learn from other industries and work to dramatically shorten product introduction cycles. Look beyond traditional risk coverage to introduce innovative packages of products and services.

- Give up to get back: Reevaluate the philosophy that you need to own the entire insurance value chain; insurers will not be able to develop everything on their own. Actively seek collaboration partners and opportunities not only with InsurTech businesses, but with other parties – perhaps in other industries. Develop or become part of one or more compelling insurance platforms as part of the new ecosystems. Keep or build the role of “life companion” for customers by aggregating brands, products and services of many startups and industry players, leveraging relevant capabilities and know-how.

Three specific recommendations for InsurTech:

- Identify scalable niches: Size matters in insurance, and not just for risk carriers. Differentiation and distribution scale create winners. Join digital hubs to expand reach to scale more quickly. Seek to work with reliable insurance platform providers, both on the technology and the business side, with international or global capabilities, if necessary.

- Look beyond insurance: Traditional insurers tend to focus solely on insurance, shunning “adjacent spaces,” whether within the industry – such as providing non-coverage products and services – or without. Look for opportunities to inhabit these spaces both for content and distribution.

- Create “InsurTech inside”: Form a building block that is easy to integrate into the insurance value chain. “Insurtech inside” can insert insurance into broader services, such as warranty coverage with a product sale that includes customer support or customization.

Link to Full Article:: click here

Digital Insurer's Comments

We agree with the authors that the data mined and presented in this report raises three essential questions, for carriers and InsurTech alike:- How is your company preparing to participate in an ecosystem-based insurance economy? How do you plan to leverage data, knowledge and new products and services?

- What’s your plan for interacting with open platforms? How will this enable you to scale and manage compliance in the eyes of all stakeholders (clients, partners, regulators and employees)?

- What new products and value-added insurance services do you plan to introduce (or use) to compete?

Link to Source:: click here

Comments