Library: CapGemini – World Insurtech Report 2021

October 2021 featured report:

This report looks back at the impact of COVID-19, and how the insurance industry is going to adapt to a very different new normal environment.

Something to be aware of is a metric that the authors have introduced in this report. This is associated with an acronym – CARe – which covers convenience (C), advice (A), and the art of reach (Re).

Let’s explain that care equation. Convenience covers quick response times and multi channel access to information and account management, the A of is for advice (see figure one).

Personal customers want personalised advice with products that are catered for their needs, and the ability to manage their risk profile across the lifecycle of their policy, and the RV is for reach customers expect insurers to reach out to them and engage meaningfully, according to their preferences. These may be risk prevention offerings, or through some unintrusive support during moments of need.

These components are being examined, because the authors consider them to be essential in order to future proof the business in all parts of the value chain from distribution to engagement.

New approaches

COVID-19 has had a huge impact on the purchase of insurance. The report identifies a 7% increase (see figure one). But consumer behaviour has also changed. More than half of those surveyed would be happy to switch to big techs and new players in the digital space if incumbents fail to meet their requirements or expectations across the criteria of convenience advice and reach (see figure three).

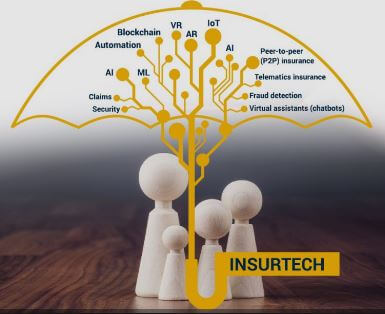

The report suggests that the crisis has increased the degree of collaboration, partnering and acquisition between insurers and insurtechs. More than half of incumbents have sought partnerships with insurtechs in order to expand their reach (see figure five).

Those at the front of the pack will probably focus on reach and engagement, increasingly using modular and specialised approaches to data and customer experience. These developments will blur the line between insurance and insurtechs.

It’s no longer appropriate to be talking about doing digital or going digital, says the report. The moment has now arrived for insurance industry to become digital. And it highlights “the evolutionary tech powered CARe path” that will assist insurers in closing gaps in engagement and reach, thereby unlocking growth.

Change is required

COVID-19 has certainly been a watershed moment in the history of insurance. Incumbents are focusing particularly on reach when acquiring and partnering with insurtechs to improve the care and insurtechs are focusing on investment into developing actionable insights to improve customer engagement by leveraging artificial intelligence, predictive modelling the internet of things connected devices APIs and open assurance. Through these, reach and convenience for the customer will both be improved. This in turn will improve the customer’s experience.

The elephant in the room is the amount of data that will be generated. It needs to be analysed, or else digital transformation is all for naught. Of course, this will trigger concerns about data protection and consumer protection, breaches of which will not be tolerated by regulatory authorities.

The data analysis will allow for hyper-personalisation across the value chain. Given there is a lack of personalisation today, hyper-personalisation sounds like hyperbole, but we’ll leave that aside for the time being. But the ones who succeed are those who dismantle their monolithic value chain.

As the lines between insurtechs blur, two types of player will emerge to dominate the market. The first is the risk carrier, such as insurance and insurtechs focusing on strategies by product line. The other is third party partners that enables product manufacturers, retailers and other players within the ecosystem – eg IKEA, Tesla and Walmart – who already deliver superior customer experience and journeys.

This will lead to considerable development of both value add, and added value offerings. Value add is something embedded in B to B to C models, ie, value provided through partners in related markets such as can manufacturers (see figure 12).

Added value requires considerable levels of engagement, but this is where the B2C relationship for more complex products such as protection, remain important providers will differentiate themselves based upon customer relationships, distribution, development of products, and of course, reach and engagement. How well they do that remains to be seen, but the report’s authors are convinced that if insurers aren’t doing it now, they’re going to get left behind.

The final analysis

The report focuses on the need for incumbents to not ‘do digital’ but ‘be digital’, through finding the right partners. This will require modularity and the key components that will achieve that are:

- open architecture;

- ecosystem mindset;

- agile governance;

- specialisation; and

- digitally native propositions.

This requires data players with deep pockets to redefine both customer expectations and experiences.

That customers have to be at the centre of everything now is no longer considered controversial. The most forward looking have already mastered convenience and are now looking at personalising advice and their reach capabilities.

The report’s authors suggest that ones to succeed will embrace:

- an ecosystem mindset;

- embed agile governance processes;

- develop a solid digital experience story;

- orchestrate effectively a rich ecosystem of partners; and

- deliver a digitally native proposition.

This requires collaboration between all stakeholders, insurers and insuretech, big techs, reinsurers and other third parties to drive innovation towards CARe and deliver seamless customer engagement.

For more, see the full report.

Link to Full Article:: click here

Link to Source:: click here