Cap Gemini : Simplify your journey to the cloud

Article Synopsis :

In order to harness the business opportunities hidden in going digital, insurers across Asia need to build a digital transformation framework based on software, digital platforms and digital infrastructure.

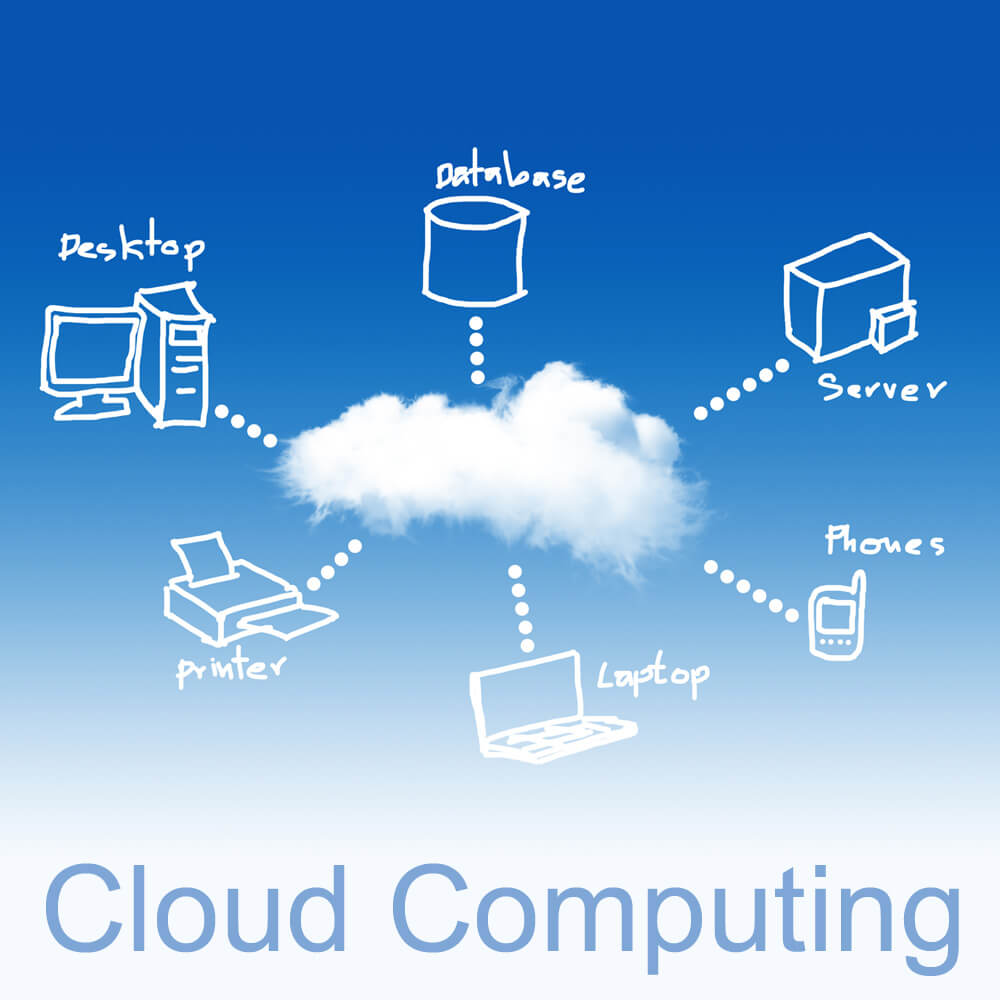

Cap Gemini in its report on cloud technology discusses the principles of Cloud, a rapidly growing technology which is supposed to become the backbone of responsive enterprises in the future. The report showcases technical and non-technical issues that organizations face, and highlights the strategies that organizations may adopt during their migration to Cloud Platform.

This report is recommended for organisations who are preparing to take a serious look at moving some business functionallity to the cloud and covers the following areas:

• Types of Cloud services (Saas, Paas and Iass)

• Cloud infrastructure – public, private and hybrid cloud

• The risks and pitfalls of cloud computing

Link to Full Article: click here

Digital Insurer's Comments

Cloud based operational model plus customer touch points will create win-win situations for both insurers and the customer. Insurer’s transition to the cloud will allow rapid and agile piloting and the avoidance of significant capital expenditure that is often a barrier to innovation. Security concerns are often cited as a reason not to adopt cloud based services, but in reality the best cloud based companies invest in security measures that are much more sophisticated than most companies have internally.Some of the key business functions that insurers can move to the cloud are:

• Advertising, Content management, Product sale

• Business/Data Analytics, including social media data mining, and data warehousing

• Lead Generation, Customer Relationship Management, Customer Loyalty Management

Link to Source:: click here

Comments