Library: Munich Re – Augmented automated underwriting brings a new generation of underwriting to the life insurance market

February 2021 featured report:

This month’s featured report is a new paper from Munich Re, looking at the evolution of digital underwriting in the life insurance space.

It focuses on what it refers to as augmented automated underwriting (AAU), also known as augmented underwriting with artificial intelligence (AI), accelerated underwriting, predictive underwriting, and so on.

Digital channels require new methods of underwriting

The premise is simple. The customer base is changing and the industry needs a new way of handling their business. Millennials are digital natives. In other words, it is second nature for them to research buy and review products via digital channels. But all generations are catching up with technology, but the industry hasn’t.

The industry is fixed on obsolete notions of the characteristics of various cohorts, says the paper. ‘Silver surfers’ are not as rare as proverbial hens’ teeth, nor are millennials spendthrifts who place experience above their financial wellbeing.

The oldest of this latter group is fast approaching middle age and faces the same challenges as previous generations.

This leaves the customer experience falling far short of expectations. AAU is meant to revolutionise the customer experience.

Old school’s out for ever

Millennials are the most open to using new technology for all aspects of their financial life, and are not willing to tolerate the time required, nor the searching nature of the questions associated with old fashioned life insurance products.

Data from aggregator sites shows that the speed to making a decision is key. Consumers are 50% more likely to buy if an option is presented quickly. Traditional life insurance comes with too many barriers to that decision making process, ie appointments, examination and blood tests.

The argument for AAU is clear. Millennials are not interested in buying from a broker or agent that doesn’t have a digital channel. This is the biggest shift from Generation X.

There is also a need to reduce the cost of acquiring customers, which is particularly acute in certain markets that lack underwriting resources.

With regulators also breathing down the necks of insurers to ensure insurers protect consumers from poor decision-making, and have a grip on risk management, the argument should be won.

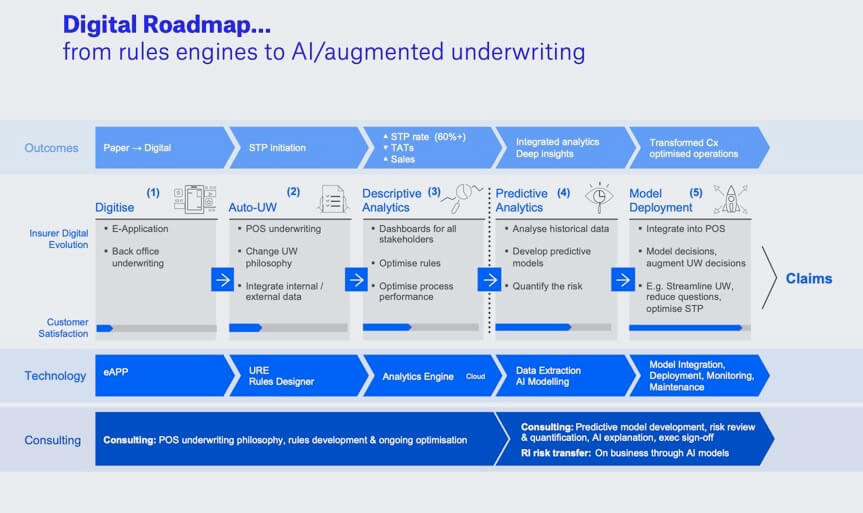

The evolution of digital underwriting

Digital underwriting has evolved through four generations of digital underwriting

1) black-box systems – often developed in house and intended to introduce some automated capabilities to the underwriting process. Typically They allowed speedier onboarding and improved times, but offered no insights.

2) electronic underwriting – these allowed underwriters to review and amend their own underwriting philosophy. Behavioural economics and external data could be introduced, but changes required IT resource, constraining development.

3) descriptive analytics – derived insights from dashboards and reports, providing descriptive analytic power, through better visualisation techniques and graphical user interfaces. This gave individual more flexibility and power enabling them to manage and implement new business processes themselves

4) advanced analytics – a huge step forward with all risk decisions based on connections between various data points. Not always immediately discernible to humans, advanced analytics exposes previously hidden connections and relationships, with very high accuracy. By using AI and machine learning techniques, insurers can, for example, identify which data-points in the application process are irrelevant.

Where to next?

Most life insurance businesses use second or third generation systems, but this latter stage now offers insurers deeper insights from data, through the use of advanced analytics techniques. They are able to develop predictive models that can increase sales and enhance business performance, but also improve the customer experience.

The report asserts that many insurers are using advanced analytics and integrating predictive models into existing underwriting and new-business processes. This, say the authors, is the real thing when we speak of AAU.

It does present a number of challenges, but the ability to accurately predict an applicant’s risk with will reduce the obstacles to onboarding customers and improve the consumer experience.

AAU may engage more and for longer than current processes do. It also means insurers do not have to replace their preferred models, or ditch existing rules-in order to define interactions

Models can be deployed to achieve one of a number of goals, including:

- streamlining the underwriting process;

- transforming the consumer experience;

- reducing manual underwriting and medical evidence costs;

- improving turn-around times;

- increasing STP rates;

- decreasing the number of questions asked;

- identifying fraudulent behaviour;

- implementing up- and cross-selling campaigns.

Each insurer’s decisions will be influenced in different ways by these different models and vary by insurer, use case, data availability, model confidence. geographic location and regulation.

A bright future

Ultimately, insurers must evolve and be confident in this technology. If harnessed correctly, it will allow them to deploy more “sophisticated, truly intelligent artificial intelligence that can unlock greater business value from an increased number of data sources”.

Sounds impressive.

The next paper in this series will cover the role of AI in underwriting and how it may evolve in time.

For more, see the full report.

Link to Full Article:: click here

Link to Source:: click here