Insurance brokerage in the digital age: Disruption is here

In recent years, we have seen the appearance of many websites that allow online insurance comparison (primarily for auto, travel, and life insurance). This has made the shopping experience more transparent and pricing models more competitive in terms of customer benefits. Also, we have seen how new digital platforms seek to enter the insurance market to disintermediate their commercialization and reach new audiences. Finally, many insurers are growing their digital direct-to-consumer sales channels. All these movements are threatening insurance intermediaries and their traditional intermediation model.

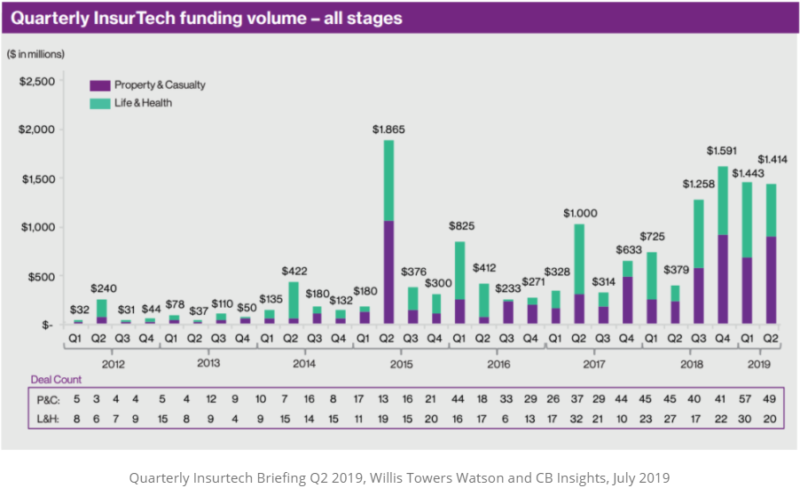

Investment in InsurTech has skyrocketed to levels never seen before. In 2019 alone, it reached more than US$ 5 billion in the world, and US$ 200 million in LatAm. . This investment has allowed the development and innovation of business models and products such as per-use policies, peer to peer models, social brokers, and 100% digital insurance companies. They are also innovating claims, underwriting, and customer service processes with big data and artificial intelligence.

In Latin America, most of these innovations and products have been concentrated on the distribution of personal lines businesses (web comparison sites, 100% digital insurers for auto and life, and on-demand insurance). However, the less complex corporate businesses, like SMEs, tend to follow the same behavior and are already Insurtechs in Latin America that seek this kind of business.

These disruptions are putting pressure on existing distribution models looking to get closer to customers and reduce costs. However, these insurer strategies are leaving intermediaries unsure of their role and creating inefficiencies in the value chain.

All of these factors create a difficult picture for traditional intermediaries. Therefore, they have to start planning for digital transformation. The first step is to understand the challenge and identify the new opportunities that come with innovation. The challenge is to recognize how the traditional agent can fit into this new landscape. How they can enhance the experience and take advantage of the new technological resources available in the industry. Doing nothing is not an option.

What options do traditional agents have? A relevant fact is that the majority of online sales are still closed by phone. This validates that people still need to receive advice to decide to buy insurance digitally. Online user experiences allow customers to create comparisons and quotes that help them get the information more efficiently, but to finalize the purchase many users still have the expectation of speaking with an agent.

So, it is important that intermediaries find their place in the new insurance ecosystem, an ecosystem that is much more collaborative. Therefore, it is key that they build new alliances with insurers and startups. They can benefit from the experience and knowledge of the intermediaries, and intermediaries will be better positioned for change. Digital technologies allow a multi-channel approach that generates new business opportunities that will benefit from the interaction with traditional agents.

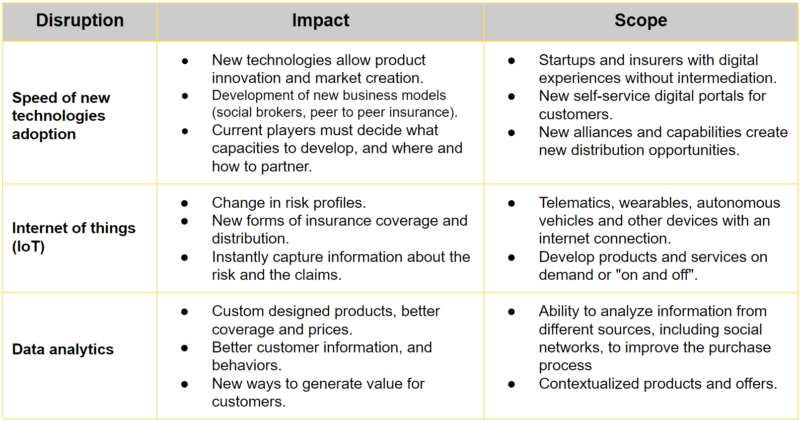

In order to understand how intermediaries in Latin America can adjust their services in this new scenario, it is necessary to be clear about the main disruptive issues that have been identified in the insurance industry. And above all, what can be its impact and scope on the insurance market.

Each of these disruptions changes the ecosystem, and it is important that agents can begin to identify new opportunities where they can generate value. For example, seeking alliances with digital portals that allow them to offer online services to their clients to improve communication, but at the same time reduce the cost to be more efficient.

Integrating automation and digital tools within the intermediaries’ front and back-office processes is a necessary step in order to evolve their services and continue to support the needs of their clients. For example, integrating CRM into the business operation helps the intermediary to be more effective in following up and closing new customers. Another example is to include a bot to solve simple doubts to its users 7/24. This improves its customer service and reduces time.

The following table shows four pillars that must be considered in order to position the insurance intermediary in a digital transformation process:

In conclusion, insurance brokers will continue to be relevant in the insurance industry, especially in a market like Latin America, where insurance has low penetration and an advised sale is needed, even to buy car insurance. But as user experiences improve and products become much simpler and transparent, the role of the intermediary will have to change and find a way to adapt to the digital ecosystem.