How blockchain is tackling insurance industry challenges

After years of excited predictions, at last we are seeing the emergence of solid blockchain use cases in banking, and other industries. Current trends show that greater blockchain use in insurance is on the horizon.

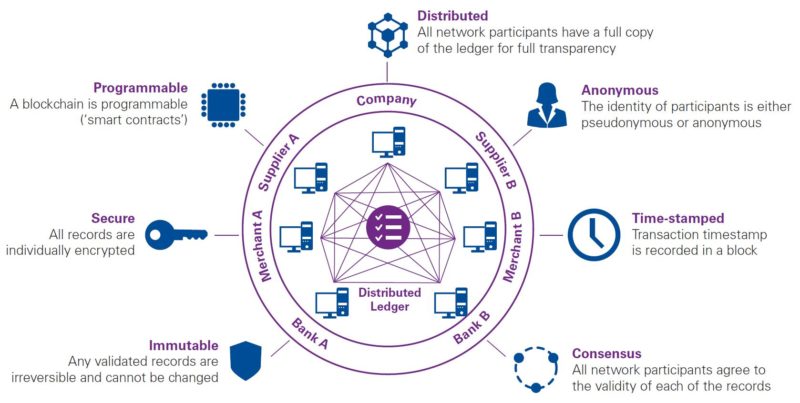

Blockchain, or distributed ledger technology, uses advanced cryptographic techniques to create a secure ledger of information that prevents the unauthorised modification, addition or removal of data. Use of blockchain offers significant advantages over other technologies, key among them is data security and the creation of a clear audit trail. As blockchain systems are immutable and do not require oversight by a central authority, use of a distributed ledger also opens up new options for secure collaboration between competitors by removing the need for trust between third party organisations. The key characteristics are set out below:

Though blockchain’s capabilities are well-established, insurers are still investigating blockchain’s potential applications within their unique organisations, as well as across the industry at large. Many are starting to recognise that blockchain has significant potential to transform the insurance value chain, creating a more secure, efficient, cost-effective, and customer-friendly experience.

Proof of concept projects and beyond

There are dozens of potential use cases for blockchain technology within any insurance firm. When investigating blockchain integration, the question quickly transforms from: “How can blockchain help?” to “Which specific use cases offer the greatest long-term value and return on investment?” To some insurers, blockchain also presents an opportunity to challenge long-standing assumptions and rethink existing insurance business models. While most blockchain activity is still in the proof of concept (POC) stage, we are already seeing some more viable applications being tested in the market.

Early adopters have started to explore use cases which leverage on the intrinsic properties of blockchain to lower operational costs related to transaction processing and improved data accuracy through increased trust between parties. One area already getting a lot of notice is the use of smart contracts, which execute automatically upon achievement of specific contractual criteria. For example, in 2017 AXA launched fizzy, an automated parametric insurance platform for delayed flights. Fizzy records information on customers’ purchased flight delay insurance using a smart contract, and connects to global air traffic databases to monitor flight statuses. If a policyholder experiences a flight delay of two or more hours as reported by airport information, the smart contract triggers the mechanism for payment upon receipt of flight confirmation by the policyholder and Fizzy automatically pays the customer. Not only does this mean that the customer is spared the hassle of filling out claim forms or speaking to a service assistant, but AXA also avoids the need to spend time processing the claim through independent verification of the claims data. At KPMG we have undertaken a similar POC with the following process flows:

Another use case already gaining traction is that of asset tracking. For insurers that cater to high net worth individuals, blockchain can provide secure and easy tracking of the proof of ownership and value of assets such as high-value collections of art, jewellery or wine.

Enabling industry collaboration

While the majority of blockchain-related activity in insurance to date has focused on internal POC projects, industry players are also coming together to investigate the viability of wider blockchain platforms. One such organisation is the EU-based Blockchain Insurance Industry Initiative (B3i). B3i was originally a collaborative effort between major insurers and reinsurers to investigate potential blockchain use cases across the industry, and was incorporated in March of 2018 as B3i Services AG with the goal of “[streamlining] the development, testing and commercialisation of blockchain solutions”[1] in insurance.

An excellent collaborative blockchain use case is that of fraud detection and prevention. Criminal activity often exploits insurers’ ‘blind spots’, where fraudulent patterns can only be detected across a wide data set, often across multiple insurers. Legal and competitive challenges have hampered insurers’ attempts to share intelligence on fraudulent activity to date. However, development of a blockchain network could provide a way for competitors to safely and securely share data, gain visibility into criminal patterns, and prevent future losses.

On the claims side, blockchain could also transform responses to catastrophic events. Where today insurers, reinsurers and brokers need to manage masses of paperwork and electronic forms created by parties such as claims assessors, lawyers, and salvage experts, a blockchain based claims system would make the process of sharing data faster and more efficient, creating significant operational savings for all parties.

The first steps on a long road

Though we can expect to see more POCs and use case development across the insurance industry in coming months, blockchain integration is clearly only one part of the larger move toward a digital first operating model. As experimentation continues, we should expect to see greater blockchain-related activity especially in areas strong in Fintech and RegTech such as Singapore, where the Monetary Authority of Singapore (MAS) actively encourages innovation though their regulatory sandbox and other initiatives.

For insurers looking to tackle challenges such as poor customer experience, costly manual administrative processes, and privacy and data security risks, blockchain may well be part of the solution.

For more insights and developments in insurance and InsurTech, please visit KPMG.

The information contained herein is of a general nature and is not intended to address the circumstances of any particular individual or entity. Although we endeavour to provide accurate and timely information, there can be no guarantee that such information is accurate as of the date it is received or that it will continue to be accurate in the future. No one should act on such information without appropriate professional advice after a thorough examination of the particular situation. © 2018 KPMG International Cooperative (“KPMG International”), a Swiss entity. Member firms of the KPMG network of independent firms are affiliated with KPMG International. KPMG International provides no client services. No member firm has any authority to obligate or bind KPMG International or any other member firm vis-à-vis third parties, nor does KPMG International have any such authority to obligate or bind any member firm. All rights reserved. The KPMG name and logo are registered trademarks or trademarks of KPMG International.

Comments