Great Eastern Singapore has launched GREAT Family Care, a critical illness term plan that protects three generations in a family within a single policy. The solution comes at a time when it is important to prepare for fast-ageing population and to ease out the financial burden on the Sandwich Generation.

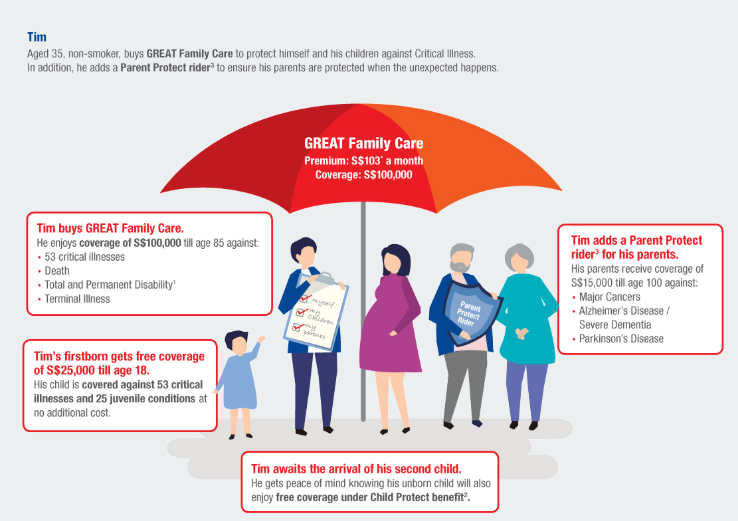

The features of GREAT Family Care include complimentary coverage for all current and future children of the life assured up till the age of 18, with each child enjoying comprehensive coverage of up to $100,000 against 53 critical illnesses and 25 juvenile conditions such as severe asthma and epilepsy without any medical underwriting required. Additionally, the ‘Parent Protect rider’ provides coverage against major cancers, Alzheimer’s disease or severe dementia and Parkinson’s disease for the parents of the life assured without any medical underwriting. Existing Great Eastern policyholders, including those who only hold Dependents Protection Scheme or ElderShield plans, will be able to purchase GREAT Family Care without any medical underwriting.

How Great Family Care works?

According to the data, one in every four to five Singaporeans is at risk of developing cancer in their lifetime, and 60% of new cancer cases diagnosed are those aged 60 and above. Furthermore, one in 10 aged 60 and above will suffer from dementia, while three in 1,000 aged 50 and above will suffer from Parkinson’s Disease. According to LIA 2017 Protection Gap study, Singaporeans and permanent residents are covered on average for only 20% of their critical illness protection needs.

Colin Chan, managing director of group marketing at Great Eastern, said, “In developing this, a key focus for us was to help the Sandwich Generation by providing coverage for their parents who are part of the Merdeka and Pioneer generations. This plan allows their children, as the primary insured, to cover them under the same policy with no medical underwriting. Insurance protection for this vulnerable segment will provide a much-needed financial cushion to the Sandwich Generation should the worst happen.”