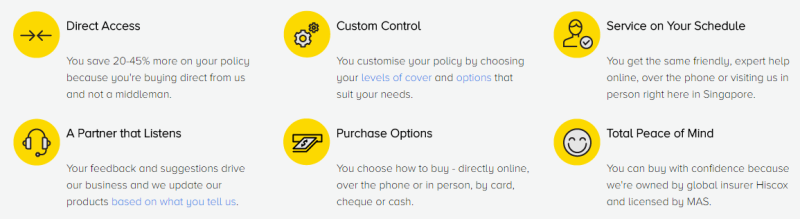

Adopting a direct business model enables DirectAsia to offer its customers lower insurance premiums by removing agents from the insurance chain.

DirectAsia is one of Singapore’s leading insurance providers, deploying innovative use of multi-channel direct distribution to cater to a customer segment interested in obtaining instant cover from insurers as opposed to sales agents.

DirectAsia was launched in 2010 in Singapore and expanded to Hong Kong in 2012 and Thailand in 2013. It deals in vehicle and travel insurance and has served more than 75,000 customers along with servicing 17,000 claims since inception.

DirectAsia offers a one-stop platform to obtain quotes, policies, and managing the coverage experience all the way to claims. It conducts its business primarily through a user-friendly website, supported by a fully staffed call-centre and offline offices. Adopting a direct business model enables DirectAsia to offer its customers lower insurance premiums by removing agents from the insurance chain.

“We have been listening to what consumers in Singapore have to say about the escalating costs of their insurance policies and poor claims service, and DirectAsia.com saw the perfect opportunity to empower customers to take control and to pay much more competitively and fairly-priced insurance premiums,” said the Chief Executive Officer of DirectAsia.com.

DirectAsia believes customers are tired of the old ways of buying car insurance with agents and dealers pushing unnecessary insurance products. Instead, DirectAsia says, it has created a customer segment and empowered customers with a need-based quotation process which it believes will provide its customers with better value car insurance.

DirectAsia’s technology platform and service model is expected to challenge the hitherto dominant distribution channel in Asia which is still heavily reliant on the agent model.

Comments