Aviva Ventures is the wholly owned venture arm of Aviva, investing in a range of early stage InsurTech startups. It provides investment, and access to Aviva’s global operation for entrepreneurs with startups that are of strategic relevance to Aviva.

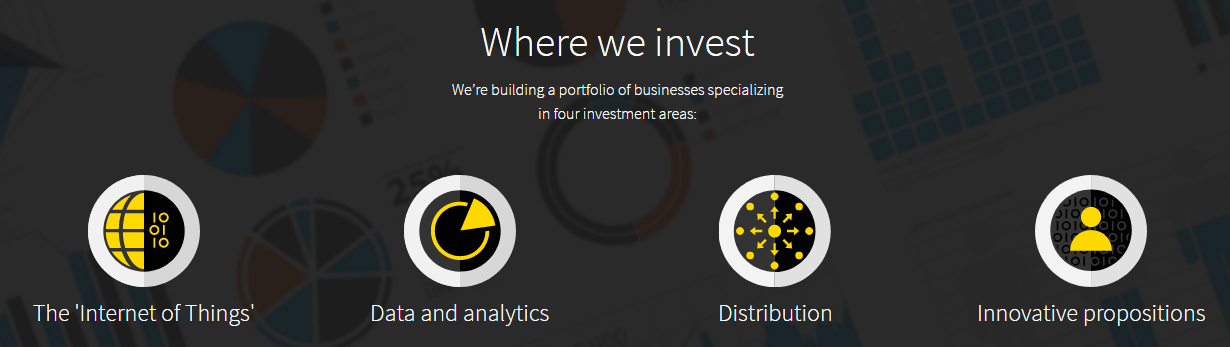

Based in London, Aviva Ventures plans to commit £20 million per year to startups operating in four key areas including:

- IoT, including connected homes and cars

- Data and analytics

- Innovative customer experiences

- Digital distribution, usage based insurance

One interesting example of an Aviva venture investment is Owlstone Medical which is leveraging proprietary and proven Field Asymmetric Ion Mobility Spectrometry (FAIMS) technology in its disease breathalyser product range. Other interesting members of Aviva Ventures portfolio include:

Being a strategic corporate venture fund, Aviva is endeavouring not only to invest in early stage InsurTechs but also to develop a strategic relationship with such companies that aligns with its broader goals. Ultimately, Aviva Ventures, like most legacy insurers, is on the lookout for new and disruptive ideas and technologies, talent and speed that will help accelerate Aviva’s internal innovation efforts including its ‘Digital Garage’ based in both London and Singapore.

Register for Venturing: Fuelling Digital Innovation in Insurance webinar

Comments