Why Customer Lifetime Value is the key metric every digital business needs to focus on, and how to effectively adopt it in insurance

KEY POINTS

- As digital adoption accelerates across industries, insurers need to shift their mindset to focus on customer lifetime value (CLV) in order to sustain profitable businesses

- Successful platform-based companies outside of insurance are already using CLV methodology to drive growth and boost the valuations of their businesses

- CLV can be applied in insurance to maximise the value that each customer delivers to a business and is a valuable model for insurers to study

- But refocusing a business on CLV is not a simple transformation – this article makes the case for CLV, and also outlines potential approaches for insurers through practical examples

The traditional insurance world is based on a mindset of VNB (value of new business) and EV (embedded value), but CLV (customer lifetime value) is the metric insurers need to focus more on in the future.

Already, the world’s digital adoption tipping point is approaching insurers faster than expected, according to a recent TDI strategic report from founder Simon Phipps. As a result, insurers need to accelerate their transformation efforts, and recognise that they are no longer playing in their traditional game. The world is rapidly moving on, and so are consumers expectations.

In with the old AND in with the new

CLV is the total value of a customer’s business throughout the time a relationship lasts between the individual and a company. It is important, as finding new customers is expensive – between five and 25 times more expensive than keeping existing ones. So retaining, rather than losing them, will increase value and drive growth.

And increasing the retention of existing customers will deliver increased profits. A report from as far back as 2000 by Bain & Co with Harvard Business School demonstrated how as little as a 5% increase in retained customers could deliver between 25% and 95% extra profit.

Focus on the prize

Amazon’s boss Jeff Bezos attributes the greatest portion of his company’s success to an “obsessive compulsive focus on the customer, as opposed to obsession over the competitor”. Yet insurance companies regularly score poorly in surveys on customer trust and experience, particularly in terms of the digital customer experience. It is apparent that most insurers do not fully focus on the value of their customers, but on product lifetime value instead, and this may often be as a result of the way they hold data on customers and how effectively they are able to use it for data analytics purposes (See benefits and implementation challenges video below).

Making money out of customers throughout the time they have a relationship with you – or even better retaining them from cradle to grave – remains the key reason why CLV is such an attractive model for insurers to pursue, allowing them to move away from a sprint towards quarterly profits, to a long term-view of the relationships they hold with their customers.

Shifting sands

The last 10 years have seen vast changes to the types of businesses that dominate the corporate landscape. In this time, the highest valued businesses have changed from those providing products to platform businesses. Tencent, Berkshire Hathaway and Alibaba are the only ones with insurance credentials to make it into the top 10 based on market capitalisation. And it comes down to how the businesses are valued.

Product-based businesses can expect to achieve valuations of around two times the business they write. However, this can be much, much higher for platform-based companies. In fact, in TDI’s recent Customers for Life webinar, Farooq Hanif, head of insurance equity research at Credit Suisse, offered an example of a platform-based insurer that has a valuation of 20 times business written. Insurers need to wake up to this, says Hanif. “Insurers have been able to rest on their laurels in recent years,” says Hanif, “but need to think quickly, because I don’t think it can persist going forward.”

Building blocks

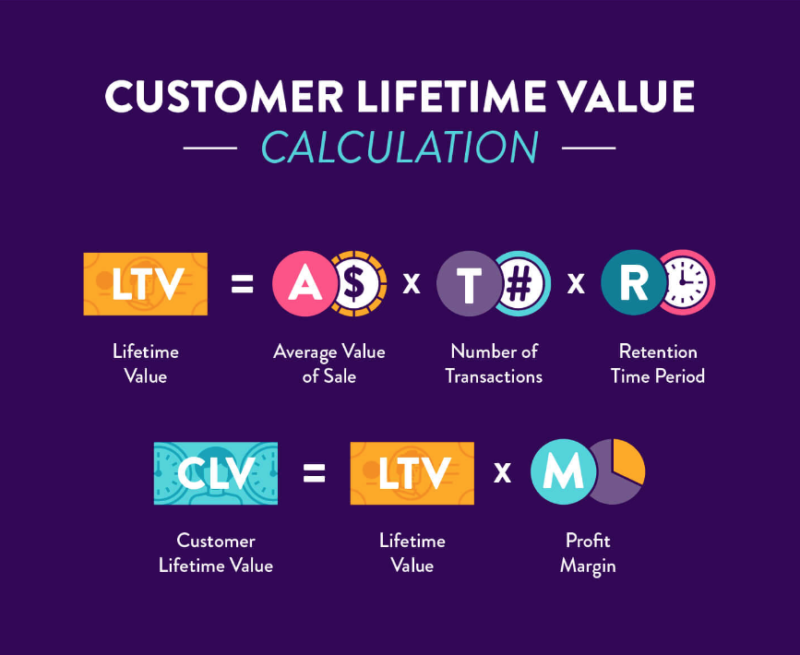

At its simplest, CLV is the net profit a business receives from a customer over the time they spend with you (see graphic above). Companies like Starbucks use a more sophisticated method utilising several different equations to calculate CLV. Firstly, there’s the original weekly total multiplied by 52 weeks in a year, and an assumed 20-year period – the simple CLV calculation.

The second, custom calculation, looks at the profit from each transaction, stripping out the costs, which might be 70% to 80% of the average spend, to give an average lifetime value in Starbuck’s case of around $5,000.

The 20-year figure of the simple calculation is arbitrary, and customers may fall away sooner than that. So, by taking account of real-life retention rates, a calculation adjusts this period to about 50% of the original figure. These three values are averaged to provide a more realistic CLV for a Starbucks’ customer of around $11,000 USD. (see graphic below).

The power of referrals

Another way to look at CLV involves what the client can do for you beyond spending their money. This looks at the value of referrals made to friends and family. One way to view this might be to multiply the percentage of new customers via referrals by the number of new customers, and then multiply that by the LTV of these new customers. Once divided by the number of referrals made, you arrive at the value of each referral.

What’s important here is not only looking at the value of customers today, but revenue potential in the future. Many customer-focused businesses, especially platform and ecosystem businesses, are increasingly looking at the future potential of their relationship with the client, because it offers up-selling and cross-selling opportunities.

Word of mouth

There’s also the potential for customers to become brand advocates. Not through providing doorstep endorsements, but by providing direct feedback. It uses customer advocacy as the central metric and again requires a culture shift in order to make proper use of it as a tool. The business must take a holistic view of the customer relationship and look at all the touch points it has, whether good, bad or plain ugly.

This would include companies recommending their competition when the competition has a product that is better – or more suitable – for the customer. This may not yield immediate returns, but it engenders a level of advocacy that pays off in the long term. A popular way of measuring this advocacy is through the net promoter score (NPS), widely used in insurance. Some argue that NPS is the one number in a business that needs to be measured and grown. It relies on one simple question, concerning how likely a customer is to recommend the company. Such a question is graded on a scale of zero to 10, across three groups of respondents. Detractors are those who score zero to six, the passives score seven and eight, while the promoters score nines and 10s. To determine the business’s NPS, the percentage of detractors must be deducted from the percentage of promoters. This will generally yield a negative score, so anything up to zero shows that improvements must be made. Anything above a zero up to 30 is considered good, and above that things are going very nicely indeed.

NPS identifies how satisfied customers are with how they have been treated, and increasingly this is not because the premium was cheap, or the settlement greater than anticipated, but because the insurer made it painless for them to interact with it, and they want to come back for more. Customer experience has become an integral part of managing relationships and directly contributes to CLV.

The application of technology

Every insurance business should be measuring CLV, but are they focusing in the right areas? It is often used to understand acquisition costs, but its power can be greatly magnified if coupled with relationship management. After all, we’ve determined it’s much cheaper to sell to existing customers and they’re more likely to engage. CLV helps create an environment that can exploit the ‘information potential’, where data concerning the choices and habits of the individual can be used to enhance products and services. Though this requires technology to be effective, this is as much about cultural shift as it is technology.

In TDI’s recent Customers for Life webinar, panellist Christopher Ong, chief actuary and head of product science, life capital Asia Pacific, at iptiQ by Swiss Re, says CLV needs to align with what the business is actually doing.

“Digital has changed the industry,” says Ong, with the ability to buy being quicker and easier, with increased competition, more choice and better choice of products. Direct customer relationships have already developed from digital engagement, but customers now also have higher expectations of their insurers.” And pricing in a digital world based on product valuation does not equate to CLV, Ong adds, as it only captures a small part of the lifetime of different decision making.

Keeping the customer satisfied

Research from Gartner shows that 75% of organisations can demonstrate that CLV hinges on satisfaction and this leads to increased revenues. As products become commoditised, customer experience (CX) is not only where insurers can make gains, but it may be the only way for them to differentiate themselves from their competitors. PWC’s Future of CX Report exposes an 18% gap between what customers expect, and what they actually get – their experience – in the insurance industry. What’s worse, is that the industry’s customer satisfaction scores are slipping according to a report by the Institute of Customer Service.

Technology, but with a human voice

Amazon, Netflix and Uber Eats have set a high bar for customer experience, but that’s what customers expect – and insurers are failing to keep up. Making use of data will improve many of the touchpoints customers experience, and increase the opportunity to interact with them. More opportunities present more chances to offer them an experience they value and improve their potential CLV.

But technology alone cannot satisfy that just yet. Research from ResponseTap found that more than half (55%) of consumers had bought insurance over the phone in the previous 12 months. The same research showed that – currently at least – only 15% want to have zero human interaction when dealing with insurers, against 62% who want their experience to be tailored for them.

There are many things insurers can do to improve CX. Making things simple by not requiring them to jump through hoops. Digital referrals and simplified onboarding will help start the relationship on a strong footing.

Making CLV work in your business

There are myriad ways to implement CLV in a business, and insurers need to determine which ones work for them.

Targeted content – and products through the use of propensity models – will drive up engagement and increase the number of touchpoints the insurer has to build the relationship. Loyalty may be increased by offering the right kind of reward programme. These must speak to each individual, not look like a mass branding exercise – free pens don’t sell policies these days.

A holistic approach to CLV may also present cross-selling opportunities that didn’t exist before levels of interaction were increased.

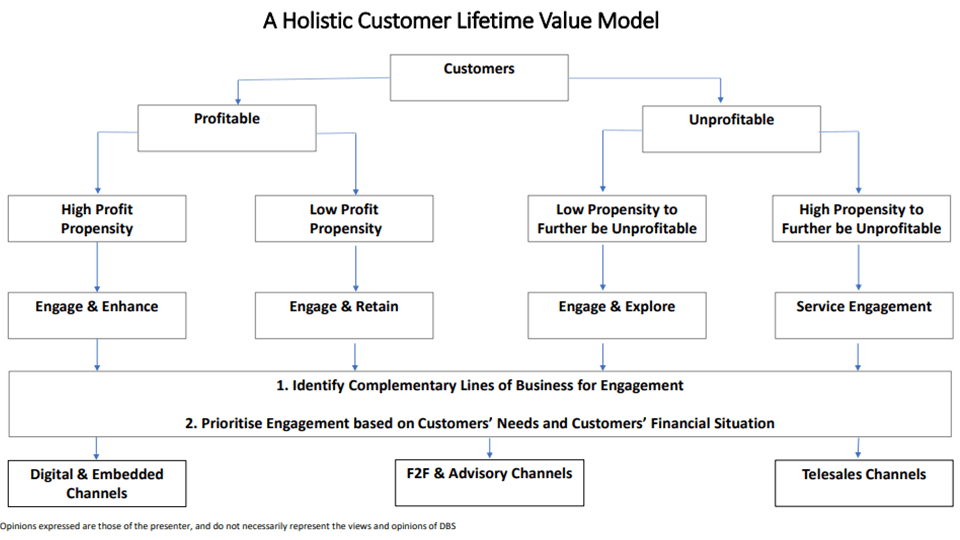

The DBS approach creates many touchpoints for customers. It enhances – or upsells – to not only the profitable customers, but also those who appear to be unprofitable, says Lin.

In TDI’s Customers for Life webinar, Clarence Lin, SVP regional bancassurance, consumer banking group, at DBS Bank shared the approach his business had taken to applying CLV (see image above).

For customers with a high propensity to be profitable, DBS will seek “to enhance the relationship”, while those that are less profitable will be “engaged and retained, as you don’t know when these loyal customers might transition into the higher profitability segment”, he says.

So, DBS seeks to engage even the ‘unprofitable’ segments, exploring what products might be of interest to them. And for those who do not engage immediately, for whatever reason, Lin says “there is still an opportunity for engagement and hope that they turn around at some point in time of the CLV model”.

It’s all about the numbers

CLV is important, says Ong, because it helps insurers to understand which customers are good for business and allows them to make profitable long-term decisions. It is forward looking and informs the business on how much to spend on acquiring new – or retaining existing – customers. Achieving these objectives will improve the business’s valuation.

To maximise the benefit of doing CLV, you must define who your customers are, then define the proposition,” says Ong. “Use data and analytics to know your customers better and then focus on increasing value for both you and your customer.” This doesn’t mean simply adding bells and whistles for customers if the focus remains on simply shifting more product. Instead of viewing those as a cost of acquiring customers, those additional services and products must add value to the overall proposition. In turn that will generate greater valuations for the business.

The industry is delivering more products that offer far greater flexibility than in the past. As policies adapt for changing lives, so will more services based on the customer lifecycle. This requires insurers to change the way they consider that lifecycle if they are to hold on to customers for longer.

“What gets measured gets done,” points out Phipps. “There is no doubt that hard wiring in new metrics to drive new behaviours is a great way to make things happen differently.”

By focusing more on loyal customers, insurers will add a disproportionate value to the business. “CLV as a key performance indicator assesses the effectiveness of your customer experience strategy,” adds Phipps. “And through increasing loyalty, you will increase profit – and perhaps even get a re-rating in time.”

As the insurance industry adopts to global mass digitalisation, CLV will increasingly be seen as the most important number for businesses to identify not only where they are now, but perhaps much more importantly, where they need to be in future.