TDI Point of View – ‘Omni’ is the future for insurance advisors in a digital world

Consumer adoption of technology is advancing rapidly, and the typical consumer is no longer tolerant of a sales process that only operates on a face-to-face basis. For insurance advisors and insurers there is a unique opportunity to be proactive and seize the opportunity to offer customers the best of both worlds – a blend.

In this short point of view article, we define and scope the omni opportunity and briefly explore the key practical steps incumbent life insurers and digital first ecosystem providers can take now to start moving to an omni model.

So what do we mean by ‘Omni’ and why is ‘digital presence’ so important?

‘Omni’ is a much-abused word but in the context of insurance, and certainly for this article, we use the word as shorthand for a philosophy where the customer is, with minimal constraints, able to seamlessly choose the timing and method of how they engage with an insurance company or an insurance advisor. This philosophy is simple and economically incontestable – allowing a customer choice will enable them to maximise ‘economic utility’, essentially they will get more value, and be a more satisfied consumer.

So, an Omni advisor model is one which hands control of the interaction process back to the customer. In this model the insurance advisor’s role is to help guide the customer.

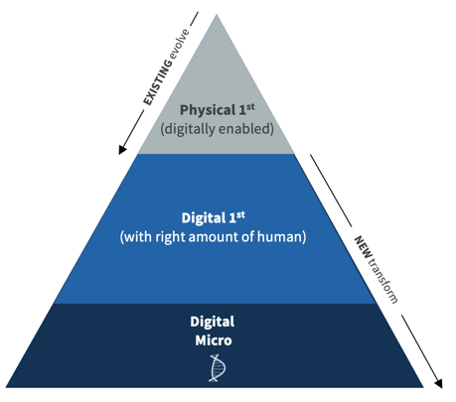

Figure 1 below provides our view on how insurance advisors can evolve into the ‘blue ocean’ by becoming digitally present omni advisors. The digitally present advisor has a deliberate digital presence and digital marketing strategy to be able to engage with, and develop relationships with existing and potential customers in a digital first manner – whilst at the same time being able to introduce face-to-face interactions, whether digital or physical . So for example, an advisor who builds their following on Facebook, shares content relevant to insurance and enables possible customers to engage when and how they want to is a digitally present Omni Advisor.

Figure 1: The blue ocean opportunity to move to an omni advisor model is to provide advisors with tools and skills to establish and maintain a digital presence

How big is the opportunity? And is now the right time?

At TDI, we did some research on the number of insurance advisors there are in the world and we estimate that there are at least 12-15 million insurance advisors around the world including independent financial advisors, tied agents and bancassurance advisors.

And rarely do we find advisors who either have more new business than they can manage or being satisfied with customer retention rates. Indeed, in some countries, the challenge is low productivity and low customer retention driven by a part-time salesforce that can have salesforce attrition rates approaching 50% per annum. So, the opportunity for digital to improve lead volume, increase sales closing and increase customer satisfaction is a huge one.

Beyond the size of the opportunity Insurers and digital only ecosystem players should be looking at the omni opportunity now for 2 more reasons:

- On the upside the technology has matured and is now available to cost-effectively execute the opportunity

- Ecosystem models are growing rapidly and the companies that can create a working digitally enabled omni advisor capability will find it much easier to attract and retain digital partners (who will have strengths in digital only but are much less likely to want to be involved in directly running omni advisor models)

So, let’s move onto the practical side of implementing a digitally present omni advisor model.

I am an incumbent life insurer with large face-to-face distribution channels. What should I do?

If your company has a large, tied agency sales force then a good approach to omni would cover these six steps:

- Identify the tools / technology and processes for creating a digitally present advisor – focusing on the ‘top of the marketing funnel’ and how advisors can be supported

- Investing in and planning on content production / content sourcing to allow advisors to be able to access

- Creating a working prototype and recruiting an initial group of advisors as pioneers

- Allocating resources to take the feedback from the first group and converting to an improved version

- Investing in, and deploying, the full range of tools and methods to help maximise adoption and creating excellent data driven feedback mechanisms to allow processes and approached to be approved. Playing the long game on adoption – and accepting that some established advisors will not want to adopt these techniques for good reasons

Figure 2 highlights the last point above, that omni advisor business models is not an either / or solution but does provide a new approach to doing business that will grow significantly over the next few years.

Figure 2: Moving to Omni is going to take time and not all advisors will need or want to make the move

I am a digital first ecosystem provider. What should I do?

Ecosystem owners who are distributing insurance in a digital only manner face a challenge that is almost a mirror image to the incumbents. The reality is that in order to move from micro to digital first a human element needs to be included in the sales and servicing process. The prize for those that success will be deeper and broader relationships with a larger number of customers and Figure 3 below provide an illustration of the different distribution models that TDI is seeing.

Some of the actions that ecosystem owners can consider are:

- Click to call processes: there is clear evidence that for more complex insurance purchases people like to talk to someone first

- Omni chat bots (that work): an AI assisted robot with very clear and professional handoff to a human advisor at the choice of the customer

- Virtual servicing: Dashboard built around video call technology to allow sales and servicing to be seamless

- Don’t commoditise: Insurance demand a deft human touch and this is not likely to be found in service / sales operating models that are driven to be the lowest cost. Bluntly the traditional call centre approach is a broken model for insurance sales

Figure 3: Digital First ecosystem providers are moving into mainstream advisory and reintroducing the essential human component to build long term relationships

In summary – omni is here for the long haul – and nearly all insurance business model need to embrace it

The TDI point of view is very clear – face to face advisory channels that fail to move to omni quickly will struggle and similarly digital only ecosystem providers who don’t incorporate human advisory elements will leave value and opportunities for others and perhaps not maximise their potential. The cost of inaction is clear but on the flip side whether you are an existing insurer or a new ecosystem insurance provider you can thrive with an omni mindset. Good luck on your omni journey – and forge your own path through genuine innovation!

Want more information? The TDI point of view on the Omni advisor is available here and you can contact me at [email protected]