How China is harnessing livestreaming in insurance: Alipay, Bihubao, and Manulife

As digital insurance platforms gain more traction among the Chinese population, insurers are looking for new ways to bring people through the door.

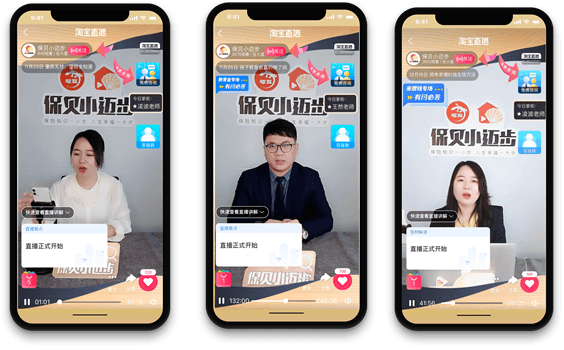

Livestreaming is becoming rapidly established as the new way to engage with a customer base.

Though a direct to consumer form of engagement, agents still have a role to play. However, increasingly, the first contact is digital, with agent sign up is embedded in WeChat.

Once the initial contact has been made, far greater use is being made of engagement and analytics to inform marketing strategies to close purchases and retain customers.

WeChat may be the common thread, but Taikang Life in particular is seeking to distance itself from the platform. It is developing native apps so it has more control than it does having to comply with Tencent’s rules governing third party traders.

Agents are introducing customers to these apps, such as Taikang’s Doctor, that can be accessed via telephony, smartphone or smart speaker.

These streams are largely educational and cover a range of life and health products.

Though relatively new, livestreaming has not gone unnoticed by the regulators. Scrutiny has led to a tightening of the rules governing financial services distribution.

Livestreamers may no longer promote a product from a specific company, but emphasise the type of product that may be available from a number of different insurers.

Here are three of the leaders making use of this new channel to engage with existing customers and to generate new business leads.

AliPay insurance

AliPay rose to prominence as an escrow account for buyers and sellers on its e-commerce service. Since then, it has expanded its features to present everything from bike rental, food delivery, and a range of financial services.

Alipay’s most successful insurance feature is a low price and low limit health insurance product, which has attracted 100 million users.

However, it has delegated its livestreaming efforts to a host of brokers who broadcast the virtues of financial planning and life insurance on a daily basis.

AliPay has partnered with a number of brokers that are using livestreaming as a marketing tool via the AliPay home page.

Tens of thousands of consumers watch AliPay’s insurance livestreams each day, many hundreds of which are converted into new policyholders.

Bihubao

Bihubao is a Chinese InsurTech with two business units. The first is a TPA operation that serves many of China’s biggest internet companies, including Alipay’s mutual insurance program – that counts 100 million members.

The second leg of Bihubao is a live streaming service that allows Alipay users to inform themselves of life and health insurance.

Bihubao’s daily live stream broadcast attracts around 500 people and has a conversion rate of anything up to 50.

The host of the stream is not a licensed agent. However, new regulations may make the use of a licensed agent mandatory for financial services live streams.

Bihubao is just one of many InsurTech businesses that have a channel on AliPay.

Watch Gavin Li the founder of Bihubao speaking on the ‘Digital Marketing in China – Compare, contrast, and learn?’ webinar available on-demand here

Manulife

It’s important to note that the live streaming era is not just the preserve of internet giants and creative InsurTechs. In fact, many of China’s leading live streaming actors belong to familiar multinationals.

One of these is Manulife, a company that now generates a third of its revenue from Asia and one that has been quick to embrace new trends such as WeChat lead generation and live streaming broadcasts.

Agents and existing customers gain access to the live stream via a WeChat newsfeed that shares a link.

New leads are able to join and listen to a financial planning topic. They are also encouraged to enter details for a ‘lucky draw’.

Once they have handed over their details, they will be contacted by Manulife agents.

There is no direct buying. Instead, it uses Manulife’s digital footprint combined with its existing offline representatives to spread the message about the live streamed content.

Finally, it is worth noting the rise of other live streaming formats on WeChat; Kuaishou, and Douyi.

This new breed of live streaming can be characterised by an increased emphasis on audience interaction, both in terms of one to one chat capability, on screen interactions, and user generated comments.

Several live streaming services are also directing users into tailored channels based on pre-selected customer segments.

In the case of the Manulife example, that is young professionals in major cities, new parents in second tier cities, and more general lead generation content.