In-depth: How can Western insurers succeed in China?

Key points:

- Life for a foreign insurer in China has not been easy. Strong local competition, the need to localise business models, and a lack of training & development initiatives have constrained their growth.

- Until recently, there were also restrictions across ownership structures, geographic expansion, product approval, and investments which prevented foreign insurers from scaling up in China.

- Although this market has been historically dominated by joint ventures (JVs), it is important to note that many local Chinese companies that invested in JVs have been equally disappointed with their investment as their foreign counterparts.

In the past partnerships between foreign insurers and local InsurTechs in China were primarily based on lead generation. In fact, the first wave of startups focused almost exclusively on aggregators and sales orientated efforts.

One ongoing challenge is that obtaining traffic in China is very expensive if you have to rely purely on internet portals such as Aibaba, TikTok, Baidu, and WeChat.

Facing this, some foreign insurers have moved beyond distribution to tackle deeper challenges within product development, healthcare, and alternative distribution channels. They’ve done this to appeal to new market segments in urban areas.

To grasp these changes, and to visualise China’s life insurance market today, it’s worth considering the efforts underway at several foreign insurers in China.

Manulife: leveraging digital and offline relationships

Manulife operates in China through a joint venture with SinoChem Finance as Manulife-SinoChem Finance.

The JV, Zhonghong Life Insurance, was established in November 1996 and now has around 16,000 employees providing professional financial and insurance services to more than 1.6 million customers.

Another important ingredient of Manulife’s presence in China is its agent network – and it has several digital initiatives designed to optimize its agency force with consumer internet destinations such as WeChat. With 1 billion active users every day, WeChat is the obvious distribution channel for the agents to engage and expand their network. The Manulife model in China is largely based on online and offline. It has around 80,000 agents in the country and when the digital channel was launched on WeChat about six years ago, digital products were immediately offered to agents.

Each agent will have about 1,000 WeChat friends they use for their business. These tend to be the basic type of digital product (personal accident or critical illness). But all the products have expanded features and come with a value added service. For instance, a phone service, a telemedicine service, a medical chat service, and some coverage of emergency services. Insurance has a low frequency of usage, but these services can be – and are used actively.

There is also more comprehensive functionality for agents through a WeChat app. Home Master is an activity management tool that allows agents to forward content to customers. But embedded codes show the agent which customers have read the content allowing some customer activity analysis and build out of the customer persona for each agent’s customer. This can be very useful for follow up sales and in particular understanding who is more open to offline long-term product sales. These value added services are generally provided through third party partnerships in each market but often vary in scope and form.

Another example of Manulife localizing for an Asian audience is through the use of QR codes. Because each product generates a unique QR code, agents are able to forward the product to their WeChat friends in the confidence that a ‘digital fingerprint’ will link straight back to them.

Manulife has also launched a dedicated customer service chatbot that is housed entirely inside WeChat. The WeChat bot has been in place for three years and it now handles more than 90% of Manulife’s inbound customer queries.

Beyond agency…

WeChat is also home to the Manulife’s e-store. Launched three and a half years ago, the e-store now has almost 30 products that include short term travel, accident, term life and also some health cover products, such as medical and hospitalisation.

Manulife is also trialling the use of short TikTok style videos that use similar codes – and early results are encouraging.

Finally, Manulife has a longstanding fitness app called ‘Move’. Very similar in philosophy to Discovery’s Vitality programme, it is primarily used to engage customers.

For example, customers with an Apple Watch can receive rewards for achieving 10,000 steps a day that gives them an appointment with a hairstylist or offers for purchasing other Apple products.

Move customers with critical lines cover also have access to video doctors and doctor appointments, hospital appointment arrangement

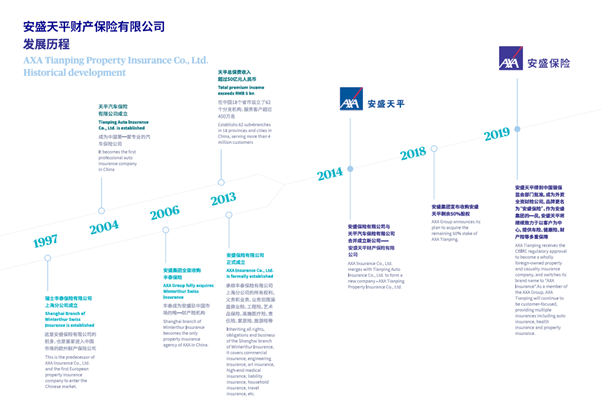

Axa: It’s getting better all the time

Axa’s Shanghai-based ‘Next Business Innovation Centre’ was originally envisaged by the insurance group as an incubator that would both foster and potentially invest in promising local InsurTechs. However, the lab has evolved to become more of an observatory whereby Axa can identify new trends and developments in China.

Health has been a major focus for Axa in recent years, but the private health market remains fairly small in China. Data from AXA suggests that in 2019, it accounted for only 16% of all insurance premiums in China, compared with life, which contributes around half of all premiums.

This lack of private sector contribution is not just a concern of multinationals such as AXA and Allianz, but also regional governments. One recent initiative involved the Shanghai metro issuing stripped down critical illness insurance products (without commission or general expenses) to millions of commuters, in an attempt to alleviate the public health burden carried by the government.

This trend is repeated elsewhere in Asia, but is changing. In the past five years, the health sector in China has seen double digit growth of around 30% annually, according to Axa.

One of Axa’s efforts has been the launch of Emma, a concierge service designed to provide AXA customers with whichever healthcare service they may need. This unmistakably western name stands in contract to its deployment in Asia – and Axa now has it available in Hong Kong, the Philippines and across mainland China. Axa has also partnered with numerous telehealth service providers. These include; Tencent Trusted Doctors in China, Halodoc in Indonesia, My Pocket Doctor in the Philippines and BDMS Network Hospitals and Praram 9 Hospital in Thailand.

This ecosystem partnership model is not a regional activity – instead it represents a long-term strategic play and is consistent with the global shift away from simply settling a claim to building relationships through value added services.

The market in China has become multi, using both online and offline, including super apps, ecommerce platforms, as well as being grounded in WeChat. And, of course, relationships with traditional agents. Content is increasingly being delivered in video, and often using the TikTok format, which has become highly successful across the globe.

AIG

Founded in China in 1919, AIG was until recently the only foreign insurer with a wholly owned licence, having entered the market in 1992.

AIG: It’s where it all started

It’s somewhat ironic that the quintessential American insurer, AIG, was actually founded in Shanghai in 1919. For this reason, China has always been an important market for AIG.

It is often credited with creating much of the tied agency force that helped foreign insurers become synonymous with financial strength and capabilities across product and service. Deregulation of car insurance in 2013 was a key moment in AIG’s establishment in China and both travel and commercial lines have become stable lines.

AIG has several initiatives in China, but they don’t necessarily follow the same model as other multinational insurance companies.

It has an analytics centre in Shanghai, that is responsible for its global data analysis. It continues to work on developing new products and propositions for the deregulated auto insurance market.

As the distinction between life and health insurance has become blurred, AIG is looking to establish partnerships with regional healthtech companies to develop new products for the Chinese market.

A new chapter is beginning

The past decade has witnessed two major shifts in the Chinese insurance market. Between 2010 and 2015, the digital insurance age began in China. Almost every insurer, broker, and agent developed an online presence and started to compete online. Despite a flurry of activity and a lot of investment, there was little concrete development.

Since 2015, a number of companies have emerged – WeSure, Water Drop, Zhong An – that look to have successfully constructed a digital presence and have a sustainable presence. Two of these companies have gone public.

The next phase is coming, but has been delayed by the necessary response to the COVID-19 pandemic. But it is coming, and it will be more focused on developing new products for specific sectors of the market.

To stay relevant, foreign insurers will first need to increase efforts to localise internal projects by attracting talent from technology incumbents. This approach has worked well for Ping An. The emergence of new market segments such as urban areas and an ageing population will require new product development. The agency channel also needs to be upgraded, but it will remain a pivotal part of the industry.