China In-Depth: Smart homes

Last month we examined the effects that advanced drones, sensors and meteorological data will have on natural catastrophe management in China here. This month, we assess how similar technologies will affect an equally important environment – the home. For insurers, the promise of the connected home is tied to prevention – moving insurers away from only paying claims, to taking on a more preventative role that can unlock additional revenue streams.

Although the notion of internet enabled domestic appliances is nothing new, the adoption of smart home technologies is currently being catalyzed by three forces:

- China is transitioning away from being an export orientated to a domestic-consumption oriented economy. The fact that less than 1% of residential property in China is covered by insurance will further drive demand for coverage far beyond its current levels.

- Although energy costs in China aren’t high enough for the public to be conscious of energy efficiency, the government is becoming more aware of the importance of energy and water consumption, and smart home technologies that optimize usage are increasingly being promoted by the government.

- Advancement in sensor technology has given rise to everything from sensor embedded insulation to ‘smart mirrors’ which can monitor people’s skin conditions. Notwithstanding the more outlandish use cases, the fact that new sensors allow data to be processed locally will further accelerate the mass adoption of smart home technologies.

Given these forces, and notwithstanding a degree of trial and error within smart home use cases, the impact of the connected home on insurers is currently being driven by two complimentary but distinct forces.

1) Home assistants:

The first wave of Chinese home assistants were nothing more than internet enabled digital clocks. Now, China’s internet giants have launched a range of home assistants that boast an increasing number of use cases, including:

Alibaba’s Tmall Genie X1 is in the same vein as the Amazon Echo and offers voice control of compatible domestic appliances, weather updates, news reports and music.

Baidu’s Xiaoyu is a home assistant created in partnership with Chinese smart home pioneer Ainemo. In addition to voice based services, Xiaoyu breaks the mould of home assistants with a screen and camera, allowing for a visual interface, video chat and a host of additional features.

Tencent’s Xiaowei is a pre-release home assistant that represents a powerful partner for WeChat inside the connected home. Interestingly, Tencent has chosen not to launch a stand alone home assistant but instead has positioned Xiaowei as an open source backend through which a range of hardware manufacturers can integrate. Midea, Xiaomi and Philips have all chosen to do so.

Ultimately, as home assistants transition from their current ‘plug and play’ state towards ‘integrated connectivity’, where smart home technology comes standardized for new homes, insurers will need to consider the role that home assistants are already providing in terms of quote generation and policy management services, in addition to what role they can play in a preventative and usage based capacity going forward.

2) Smart devices:

The second front in the connected home evolution is that of sensor infused home devices. Although Nest demonstrated the power of re-inventing traditional appliances such as the thermostat and smoke-detector, it also demonstrated the risks of device incompatibility with other smart home providers. In China, the smart home market is currently characterized by partnerships between domestic appliance manufacturers and consumer facing distribution platforms. Of these, several startups are particularly notable including:

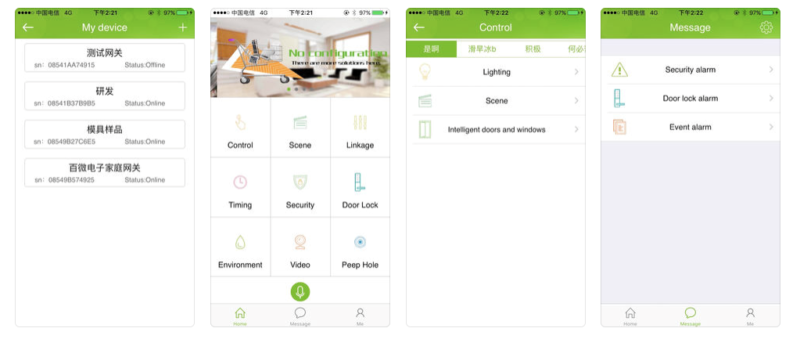

Baiwei

Baiwei is a Chendu-based smart home app that integrates with a range of smart home appliances in addition to allowing users to communicate with family members with the app. Available in both English and Chinese, Baiwei also includes a unique use case for smart home appliances in China – a real-time AQI app that integrates with air quality monitors.

Broadlink

Hangzhou-based Broadlink not only produces smart devices, it has its own third party PaaS (Platform as a Service) and is collaborating with 18 Chinese property developers including China Vanke, China Merchants Property and COFCO Property. This ensures Broadlink’s products come as standard with new homes from these developers in Beijing, Shanghai and Shenzhen. Broadlink recently raised a C round from Baidu through which it can grow its online distribution capabilities.

Rishun Electrics

Guangzhou-based Rishun Electrics is less smart home and more ‘smart hotel’ startup that provides intelligent lighting control systems for hotels including the Ritz Carlton, St. Regis, Park Hyatt, InterContinental, Wyndham and the Sheraton. Although many startups focus on the impact that the smart home will have on individual homes and consumers, the commercial applications for smart home technologies in hotels, office blocks and airports are even more impactful. For insurers, this represents an equally significant opportunity for those willing to start with simple use cases such as lighting and then expand across energy optimization, security and prevention-based insurance policies.

Shenzhen Yitoa Intelligent

Yitoa operates under the brand Aitbot and manufacturers ‘intelligent control products’ for the smart home including door and window sensors, refrigerators, steamers, oven controller, coffee pot controllers and lighting controllers. Although many of these use cases may seem simplistic, the provide the ability to automatically adjust lighting, close or open blinds or shutters, and regulate air conditioning.

Anjubao

Guangdong-based smart home manufacturer Anjubao specializes in IP based intercom systems for residential apartments and high rise complexes.

Yitoa Intelligent Control

Founded in 2011, Fantem Technologies is a joint venture between Aeon Labs and Yitoa Intelligent Control, which now boasts over 100 patents. Yitoa’s multi-sensor products can monitor motion, temperature and light, energy meters, door/window sensors, and water sensors that are capable of measuring as little as .25mm of water.

In addition to this vibrant startup scene, Chinese multi-nationals including Huawei, Tencent and Xiaomi Midea have all launched smart home initiatives, many of which can be controlled through WeChat and although shipments of smart home appliances to China are expected to double between now and 2020, significant challenges remain.

Installation costs, privacy concerns, and interoperability with third party hardware have all impeded the adoption rate. The message now is one of perseverance. However, the advent of smart home technology is also creating new insurable risks. The irony is that enabling prevention based home insurance also bears its own risk. Sensors, alarm systems and control/communications equipment can all be compromised or incur damage that insurance can cover. Cyber insurance can offer strong protections against malware and intrusions regardless of CPU type, regardless of functionality, regardless of operating system and without changing the performance and functionality of the device.

Conclusion:

Success in the smart home space is a marathon not a sprint. Although many insurers want to identify smart home startups to partner with – mastering offline distribution, device interoperability and data access will require ingenuity and perseverance in equal measure to succeed.

Comments