Customers love the choice with On-Demand insurance

Hey Dad, can I borrow your car?

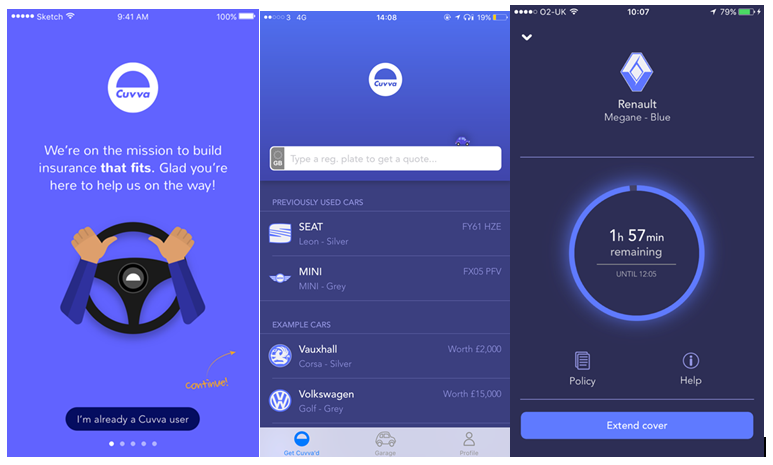

This is the title of an article I posted 18 months ago in December 2015. It was my first interview with Freddy Macnamara, the founder and CEO of Cuvva. We’d just met in a London coffee bar to talk about their newly launched on-demand insurance product.

Simply, Cuvva is a mobile app that is about as beautiful a user experience as you’re going to get. Within 10 mins, I’d created my account, been verified and vetted, and bought an hour’s fully comprehensive cover to drive my wife’s car.

Eighteen months on and Cuvva have over 150k downloads of their app and are on the cusp of selling their 1 millionth hour of cover.

Talking of beautiful apps

One month earlier, I had posted this article about Trov, in November 2015. The founder/CEO of Trov is Scott Walchek and we’d been speaking ahead of their inaugural launch in Australia with Suncorp.

Trov is a mobile app that is also a beautiful example of how to design and build if you want great customer engagement. Trov is a personal asset inventory that allows customers to turn protection insurance on and off as it suits them.

Eighteen months on and Trov have added the UK (with AXA) to Australia and announced plans to launch in the US later this year.

Pioneers of on-demand insurance

Now remember, that all the way back (sic!) in those heady days of 2015, InsurTech was just emerging from the shadows of Fintech. This new wave of technology-enabled insurance had not yet made its impact, although talk of market disruption had begun on social media.

It seems much longer than (only) eighteen months ago since Cuvva and Trov came to market. At the time, mobile insurance apps were largely clumsy front-ends to legacy policy admin systems. Some might say that was lipstick on a pig, but I couldn’t possibly comment!

For Trov and Cuvva, not only were they ahead of the game when it came to mobile experience, they were also pioneers of on-demand insurance. Eighteen months on, I caught up with both Freddy and Scott again to find out how they were doing.

Web to educate, mobile to execute

One of the common characteristics of their on-demand insurance product that interested me was that they both use a combination of website and mobile for customer engagement.

Scott explained why this is good for Trov. “When we first launched, we were going to be mobile only. We had good download numbers, but our conversion was low. It was because it was hard for consumers to understand on-demand insurance. So we switched to the web as our way of attracting and educating customers. Once they were informed and comfortable with how Trov worked, they moved easily to the app. Our conversion rate from downloads is over 60% now.”

For Cuvva, it is a similar story, using the web to attract customers, explain how it works and then switch them onto the app.

Instant and immediate

Another common characteristic between Trov and Cuvva is speed. When I spoke with Freddy about pricing for on-demand insurance, he explained that they, like Trov, had built the underwriting tables into the Cuvva platform.

“Using an API into the underwriter’s backend was too slow.” Freddy explained. “It is quicker if we have the tables and make the pricing calculations our self. We save about 10-20 seconds, which is a lifetime waiting for a response on a mobile app!”

For me this is interesting because the current trend is for a different approach. Today, the insurers and InsurTech start-ups are playing catch-up with the likes of Cuvva and Trov. They have to make up ground quickly for fear of being left behind. The way to fast track is for the InsurTech start-up to operate as an MGA with a (re)insurer providing the capacity, systems and paper behind them. This is the way that incumbents like Munich Re Digital Partners are enabling InsurTech startups to get to market quicker. Whether this short-term expediency proves to be a long term legacy is a question nobody can answer just yet. Time will tell!

Convenience replaces price as key buying criteria

Of course, price is important, that goes without saying. For the majority of personal lines purchases, insurance has been reduced to a commodity where lowest price wins. In ye olden days, before price comparison sites reduced the market to a bargain basement, brokers played a key role in providing a personalised service. Service was the differentiator and customers stayed loyal to the broker (not the carrier).

In the digital world, service has been automated and the broker disintermediated. In the on-demand insurance world, convenience is what matters.

Scott told me, “our customers like the ability to turn insurance off and on to suit themselves. What we’ve found though is that they don’t always turn it off, they just like to know that they can if they chose to do so. This shift in agency is fundamental to us, because we want to give our customers the means by which they can make their own decisions.”

And it’s clearly working for Trov with over $3.6bn worth of items added in their first year with the numbers of new items protected on Trov growing at an average of 55% per month.

Month over month, GWP is growing at a rate of 44% with the number of new customers growing at 39%. The interesting stat is the number of new policies being added to the platform, which is growing at 59%. This shows that customers are adding additional items to their Trov once they’ve signed up. Across the platform, customers protect an average of 1.7 items on Trov.

With a customer base that is 2/3rds under the age of 35 years old, Trov can also boast retention rates at over 80% – incumbents take note!

Evolution is a continuous process

The same goes for Cuvva, just look at their online reviews (4.8/5 ain’t shabby!).

Freddy explained their philosophy; “The Cuvva NPS is around 70. We take a sample every week and it’s a slick process that’s critical to how we maintain high levels of customer engagement. We have a tight build, measure, learn process that takes customer feedback and builds it back into our product.

“We’re releasing new updates about every 2 weeks based on this customer feedback. If we can keep improving our product 5-10% every time, in just a few years we can end up with a truly world class product.”

Awesome stuff! I can’t think of any incumbent insurance business that is capable of continuous improvement every 2 months, let alone every 2 weeks. And it is all customer driven based on listening to what customers have to say.

Like Trov, Cuvva is a great role model for wanna-be start-ups to see how it should be done. Hard graft, ingenuity, talent and tenacity are essential ingredients if you’re to have even half a chance of success.

When on-demand insurance meets usage-based insurance

It is this disciplined and considered approach that provides a solid foundation for the launch of Cuvva’s latest on-demand insurance product. Based on a subscription model akin to Metromile (more about them here), Cuvva have launched a product for low usage drivers.

The customer pays a basic monthly subscription to cover the legal requirement for car insurance when it is not in use. Then, when the driver wants to go somewhere, they can buy anything from an hour’s cover at a unit rate. A simple device plugged into the cigarette lighter and sync’ed with the mobile app ensures that cover is always turned on and off as the car is used.

Which brings us to the convergence of ODI (on-demand insurance) and UBI (usage-based insurance). As the tech evolves, the human action to turn insurance cover on and off will be replaced by automation.

It is not hard to imagine a world where machines make continuous assessments of where we are and what we are doing. Through machine learning and AI, these assessments lead to assumptions made on our behalf. In turn, these assumptions determine our insurance needs and turn cover on and off accordingly.

InsurTech has shown the insurance industry how to innovate

On-demand insurance is just one example of technology-enabled innovation in insurance. There are many others (go here for my back catalogue and 2 years of writing on InsurTech). Equally, both Trov and Cuvva are great exemplars of InsurTech and what it means for the insurance industry. They are technology businesses that have applied their skills to the problems in the insurance industry.

And just as we like to say that Amazon is the largest retailer without any stores or AirBnB without rooms, or Uber without cars, maybe it is going to be a Trov or a Cuvva that will be known as the “largest insurer without a balance sheet”.

Interesting times!

Meet Team Trov…

…and Team Cuvva

Two InsurTech start-ups worthy of note for on-demand insurance

Slice

Based out of New York, Slice Labs is a couple of years old and have raised around $4m so far. They just went live in May this year in 13 US states with their on demand insurance product for home sharers via AirBnB, Flipkey and HomeAway.

SURE

A year ago I hosted a webinar with the founders of Sure, GetSafe and Trov. Wayne Slavin, the CEO of Sure joined me on the panel to explain their approach to “episodic insurance”, as he calls it. Here’s the link to the post webinar article.

The Digital Insurer Webinar

Returning to the theme of last month’s InsurTech Insights on venture capital and the rise of the insurance corporate VC, please register for our free webinar on Venturing below:

Register here for our free webinar – Venturing: Fuelling Digital Innovation in Insurance

The author, Rick Huckstep, is the Chairman of The Digital Insurer, a public speaker on the world of InsurTech, and advisor and investor to technology start-ups.

Comments