Is the insurance Actuary an endangered species, or simply facing an evolutionary makeover?

The role of the insurance actuary is built on a foundation of understanding data to better determine risk. With the massive explosion in data in the digital economy from just about every conceivable source, you’d think that this was the generation that the professional actuary would be king. Or would they? Automation and the emerging role of the data scientist have cast doubt on the importance of the actuary.

Are we at the beginning of the end for the professional actuary? Or at a pivotal moment when the actuary adapts to new skills, new technologies and new ways of understanding risk? To help me answer these questions, I turned to three friends for their insight on the role of the digital actuary.

- Geoff Keast, the CEO of Montoux in North America. Montoux is an actuarial technology company focussed on helping life insurers complete pricing transformation. Montoux provides life insurance carriers with the ability to understand the elasticity of their customers and use optimisation algorithms to price their products. They do this by combining existing actuarial data and assumptions, along with other publicly available and carrier-specific data.

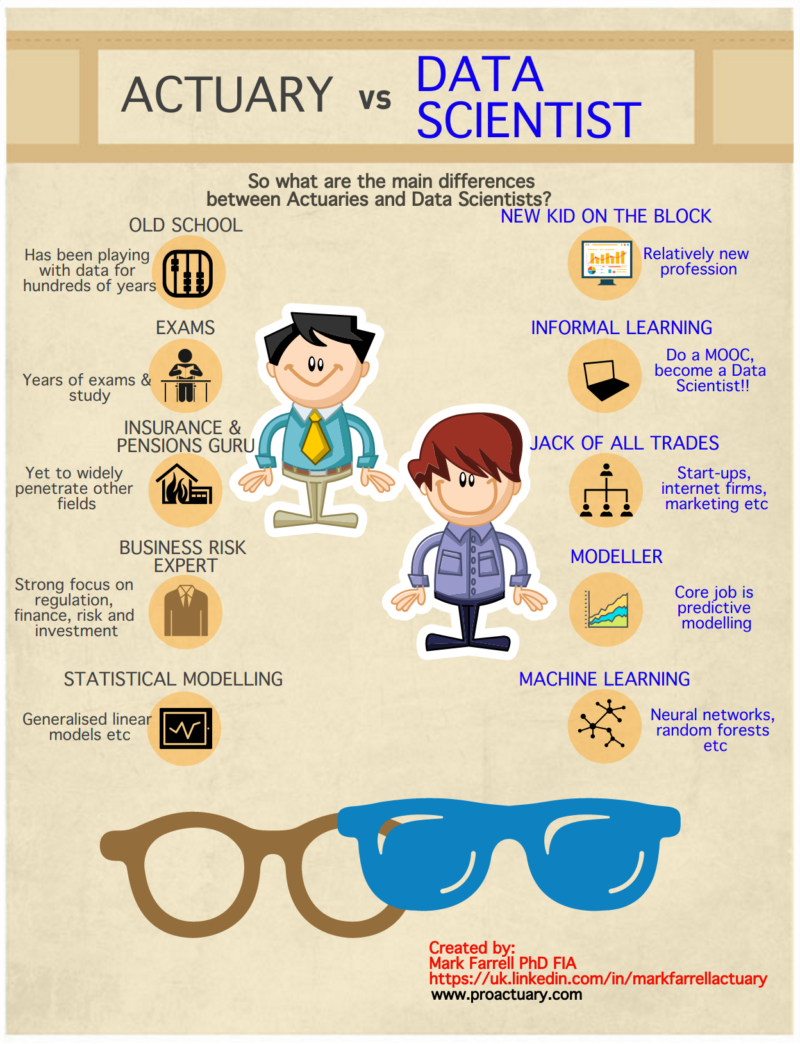

- Dr. Mark Farrell is a UK qualified actuary and a Senior Lecturer and Programme Director of Actuarial Science at Queen’s University Belfast. Mark is a Fulbright scholar and is currently researching the impact of wearable technology within insurance. Mark is active on social media in the #InsurTech space and blogs on actuarial topics at ProActuary.com.

- Steven Mendel, the co-founder and CEO of Bought By Many, who started his career as a professional actuary with Aon Consulting. Bought By Many is about six years old now and is at the forefront of technology innovation in insurance. Readers may be interested to know that Bought By Many featured in my very first InsurTech article back in the days before the #InsurTech hashtag was established.

I started by asking the experts what impact they saw new technologies such as AI and machine learning having on the role of the actuary?

Mark Farrell: AI and machine learning (ML) are changing many industries, but as insurance and the work of actuaries is largely data-driven the potential changes are even more profound. Machine learning is another tool that actuaries can add to their arsenal/toolkit as we deal with ever larger, more varied and increasingly complex data sets, often coming from real-time data. I think as ML is deployed across more functions, actuaries will be given the chance to potentially become more involved in non-traditional practice areas.

For example, whilst some actuaries currently work in say marketing or fraud analytics, this might become more the norm as we take a greater involvement in helping to build customer models and inform marketing spend as well as using big data approaches to detect fraudulent activity.

Insurance pricing is the obvious area where machine learning can, and is, having an impact on actuarial work. Machine learning is helping to price risk in a more granular and accurate fashion, utilizing data from new varied sources, but also helping to move pricing towards automation (e.g. rating factor selection). The challenge is to ensure that models are still somewhat transparent and can be explained.

Geoff Keast: These new technologies are going to have a massively positive impact. Forward-thinking insurance companies understand that actuaries are the lifeblood of their organisation, they understand deeply the financial performance and customer behaviour of their policy-holders. Combining this skill with the advancing analytics capabilities from the use of artificial intelligence capabilities, like machine learning techniques is giving insurers much deeper and granular insights into the financial performance of their companies and how best to serve their customers.

Putting this power in the hands of a skillful actuary will only increase their ability to win and retain profitable customers. Montoux believes we will see more blending of actuarial and data science in the next five years.

Steven Mendel: To add to what Mark and Geoff have said, I’ll answer this from the perspective of running an insurance startup. In our business, we use these new technology tools to better understand losses and loss ratios. The opportunities these tools give us at Bought By Many will be seen as we move into more dynamic pricing models.

Ok, so insurers are not going to be throwing the baby out with the bathwater anytime soon! What you’re saying is this is all about changing the way that data is handled, either through new technologies that derive better understanding or by using new sources of data that tells the actuary so much more about the risks being modelled. In that case, how do you see the traditional approach to modelling (based on a static, single point in time data points) evolving with the growth in real time, dynamic data?

Steven Mendel: The biggest difference that we experience now is the wealth of data and the ease with which we can tap into new data points. This will feed back into the first answer above and facilitate more accurate pricing models. Interestingly just because we have a better pricing model might not mean that we use it. We all operate in a highly competitive environment and just because we can do something doesn’t mean that is always in the consumers best interests – a good example of this is chatbots where most consumers tell us that a human, real, engagement is their preferred engagement route.

Mark Farrell: I think actuaries are living in very exciting times, given the constant new data sources that are coming to the fore. Telematics, wearables and the IoT all provide very exciting constant real-time data streams that will likely help insurers of the future to price in a more agile fashion. We are already seeing this with, for example, drone insurance assessing real-time risks.

As the number of sensors (phones, smart watches, cars, etc) increases and their accuracy improves and historic IT hurdles are reduced I think insurance will start to look very different across many product lines. Actuaries can play a major role in terms of understanding how to best deal with these new data sources as well as new emerging risks (e.g. liability from autonomous vehicles).

Geoff Keast: For us at Montoux, we see the world changing. In the future, models will have to be built on platforms that are natively cloud-based and use language and techniques that are able to ingest data from a variety of sources (i.e. API driven) and data agnostic (don’t care about where the data comes from). The use of AI and machine learning capabilities will need to be self-learning as the data and models change and evolve. We also expect to see a fundamental shift in focus toward growth outcomes (new business, customer retention, etc.) rather than the risk/compliance/ regulatory side of modelling.

Ok, as we build up the picture of the digital actuary, it’s all about new ways to handle data and processing new sources of data and taking a different approach to modelling and assessing this data. But it’s all about the data, right? Where does that leave the role of the actuary as a statistician and “keeper of accounts”?

| Let’s not forget that actuaries were the original data scientists and we have been using data to solve business problems for over 300 years!

Dr. Mark Farrell |

To what extent is the role of the professional actuary under threat from data scientists and automation?

Geoff Keast: I see it more as enhanced than extinction. Actuaries offer huge amounts of value to insurance companies and are often misunderstood. With the knowledge that an experienced actuary has on policy-holder behaviour and financial performance, combined with stronger dynamic analytics capabilities, they are able to offer much more granular insights on how to improve both sales and margin, ultimately what any company desires. The more automation of routine tasks, the more time can be applied using their “actuarial judgment” to improve financial performance. It’s a subject I discussed here with Prakash Shimpi, the Chief Actuary from American Family.

Mark Farrell: I see automation as both a threat and an opportunity. If you are an actuary that wants to sit back and simply churn the handle on processes that are potentially easy for a machine to do in the future, then yes automation is a big threat. But if you are an actuary with a ‘never stop learning’ mindset that thrives on new challenges and using creativity, then I believe automation will be a partial key to unlocking the actuary from certain aspects of the job which might be viewed as drudgery and allowing them to partake in much more creative and complex tasks that require high-level thinking and expert judgement. At the moment AI (and in particular the subset of AI known as machine learning) is generally being used as a tool and still requires human oversight and intervention. If we ever reach strong or general AI, however, then all bets are off!

There’s no doubt that data scientists (however you define one) are making inroads into some traditional actuarial fields. Areas such as pricing are attracting data scientists without actuarial qualifications and employers are often seeing benefits in terms of lower cost. But let’s not forget that actuaries were the original data scientists and we have been using data to solve business problems for over 200 years!

The advantage that the actuary generally has is that they are not just a modeller, but also a business risk expert that really understands insurance or business in great depth, especially in relation to regulation. In addition, our strong professional code of ethics provides an oversight which I think is particularly important for helping to ensure that we are using data ethically and responsibly.

Many actuaries are currently working in data science and I think one of the key benefits of becoming a data scientist via an actuarial path (at least if you work in insurance) is the recognised and valued credential. The problem though is the opportunity cost of learning irrelevant material (for much of data science) to get the actuarial credential.

Steven Mendel: Given my role as the founder of an InsurTech startup, I do not feel well qualified to opine on this, however that isn’t going to stop me! In fact, the need for the evolution of the profession is something that I have harped on about for over 15 years! We need to move, adapt and grow – no different from any other role, group or profession.

Ok, so in a nutshell, the role of the actuary and the data scientist is being blurred (in a good way). There’s lots of change coming down the road for the actuary in the way that they do their job and the tools they have available to them. Foremost though is the acknowledgement that the actuary is a highly valued member of the insurance team who has great insight and understanding of how the business actually works. New data and new technology doesn’t signal the end of the actuary, instead it’s going to give the profession a huge uplift.

The question we’re left with is where are actuaries applying new technology to improve and/or change the way they work?

Mark Farrell: There has been a lot of recent change with the material that actuaries are expected to learn to reach qualification. The Institute and Faculty of Actuaries in the UK are now placing a greater emphasis on practical problem-based assessment and machine learning and programming using packages such as R and Python. This is great to see as actuaries have probably relied on spreadsheets and VBA for too long!

As we are in a period of unprecedented change I think actuaries need to develop a flexible mindset being able to quickly learn new tools and techniques as and when required.

Steven Mendel: I agree with Mark, there are much better data analytics tools available now that make analysis and manipulation at speed for high volumes of data so much easier than it ever has been!

Montoux’s optimization capabilities include their ‘efficient frontier’, helping life insurance carriers find the trade-off between volume (sales) and profitability.

Geoff Keast: Montoux is doing this today with our pricing optimisation capabilities. By providing a platform that gives actuaries all the data they need to price products the most efficient way possible, we are changing the way they work and transforming their pricing process. Today actuaries have to speak to marketing, product, and competitive intelligence teams and gather the data they need, often in spreadsheets or unusable formats. It is not easily combined (it isn’t at all) with existing actuarial assumptions and therefore the ability to optimise pricing for a given cell is not done. Insurance carriers are losing billions of dollars globally with rates that are not optimised. Combining that data in one easy platform means actuaries are spending less time building models and processes, and more time evaluating the data to provide product people with the best possible rates. They are now able to see the elasticity of their customers and price new business to align the sales/margin trade-off with organisational goals.

Actuaries are now able to collaborate with other teams, complete pricing scenarios in real times with their peers and use their actuarial judgment to maximize financial performance. Less time building and maintaining models, more time on insights to improve sales and margin.

There you have, the views of a professional actuary, the founder of an InsurTech leader and a specialist InsurTech software provider for the actuarial profession. And it seems that far from predicting the end of the actuary, the importance of the role is only going to get bigger.

The author Rick Huckstep is Chairman of The Digital Insurer and a keynote speaker, strategic advisor and investor in technology startups.