Digital transformation is the strategic imperative no insurer can ignore

Insurance innovation before the Internet

Once upon a time, in the days before the Internet (and well before InsurTech), when it came to IT, insurers bought policy admin systems. And according to Novarica, they still are with 70% of P&C and 74% of life insurers in the middle of implementing new policy admin systems. These are/were all-encompassing IT systems that sit at the centre of the insurer’s core operations. Core business functionality was built into and around these systems. Insurance innovation started here!

Buying a policy admin system has never been taken lightly either. They are usually massive purchases costing 10s or 100s of millions of whatever currency you choose. Often taking several years to procure and many more years to implement, these aircraft carrier systems come with a life expectancy of 20+ years.

Engagement with customers and the development of products are defined by the limits of the policy admin system. As a result, insurance innovation has been totally dependent on the (limitations) of the core policy admin system.

However, as Tom King from Pegasystems says in this article for Insurance Technology Association, “insurers are investing in the wrong systems.”

That was then, this is now

Today, when you look inside the IT department of incumbent insurers, many of the same pre-Internet systems are still being used today. This is the legacy IT landscape that dominates systems architecture maps. A problem that has been compounded by the acquisition of books of business and the consolidation of insurance firms. It is no surprise then that around 80% of IT spend is keeping the lights on.

It is expensive and demanding to maintain these IT systems that were written, quite literally, in the last century. Insurance innovation doesn’t really have much of a chance, does it!

Moving up a gear

Insurers, together with expertise from systems integrators, consultants and software vendors, have made many attempts to move off these legacy systems. The outsourcers tried too with many of the early insurance BPO deals built around a model of migration to the supplier’s own policy admin system. Generally, these IT led projects all failed.

The issue is that so much functionality has been hard coded into the core policy admin system that trying to unpick it is simply too hard. The complexity of these systems that had been built on and added too time and again, often without documentation, was always underestimated. In the end, migration off the legacy policy admin system became a ‘too risky, too expensive” option.

Enter the 2-speed model.

Simply, the logic is that, in the Slow Lane you’d keep the legacy policy admin as the system of record. And for the Fast Lane, where the insurer needs to be agile, responsive and digital, business functionality would be built into new front-end systems.

This way, or that way?

One way that insurers are approaching the Fast Lane is to partner with InsurTech platforms, which I covered a few months ago here. And of course, there is a new breed of InsurTech policy admin systems coming through.

However, for this article, I am going to look at the approach of insurance innovation from within. Where incumbent insurers use a 2-speed approach, building upon their massive investment in (legacy) IT to get fit for digital.

To do this, I caught up with Tony Tarquini, who leads the European insurance practice for Pegasystems. Tony comes from the vendor community and knows a thing or three about legacy systems. As do Pega. Formed in 1983, they are no strangers to the challenges of modernizing a legacy estate.

If you are not familiar with Pega, they provide cloud-based software that uses a mixture of contextually aware guidance, artificial intelligence (AI) and robotics to automate business processes. When layered across multiple admin and other legacy systems, it insulates internal users from the horrors of multiple windows with cut/paste/rekey. Pega also enable digital self-serve for a better customer experience with prompts for exactly the Next Best Action.

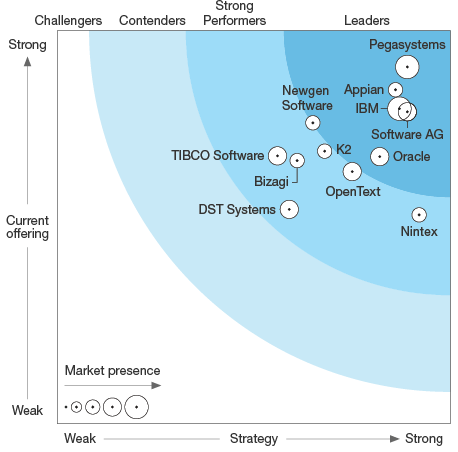

The Q3 ’17 report from Forrester cites Pega as a leader in digital process automation.They also received the highest possible score in 20 criteria in the Forrester Wave: Digital Process Automation Software.

Insurance innovation; the Pega way

Tony explained, “Our goal is to improve the combined operating ratio for our insurance clients. That’s it. There are many ways to do that, but when it all boils down, our purpose is to help our clients become better businesses.”

For a 30-odd year old tech firm, that’s a customer-first approach very much in tune with the defining characteristic today’s InsurTechs. But what does it really mean?

“What we’re seeing is that the days of large scale transformation programs are over. They are too expensive, take too long and are too risky. Insurers don’t have the appetite for them. The model has changed from taking one giant stride to taking many small steps, making incremental changes quickly and effectively.

“Insurance innovation achieves and sustains momentum this way because results come quicker. The financial benefits are realized in the near term and used to reinvest in the next “small project”.”

“One step at a time, the insurer gets fit for the digital economy without having to discard their long time investment in core IT systems.”

This is taking a very different route to the partnering approach with InsurTech digital platforms outside of the in-house IT. But it does get the insurers to the same place in a short time frame.

Digital speed to market has never been more important!

AI enabled self-service for better customer engagement

One of the major InsurTech trends in digital insurance right now is the automation of business processes. It used to be called straight through processing built on rules based workflow. Now, this is the tech of robotics, machine learning and AI combined with customer self-service.

The new breed of InsurTech carriers and intermediaries are building human-less digital interfaces that enable customers to self-serve. Real-life customers “talking” with real-life machines, 24×7. It has become the norm in a digital world with customers increasingly expectant that they can buy/ service/ complain/ compare/ review through their mobile phone or browser.

But the problem for the insurers is that their core policy admin systems were not developed with any of this tech in mind. The Pega answer is to “Wrap and Enhance” and use robotics and AI to automate and improve these manual, repetitive processes. Often taking quite small processes and automating them can have a significant impact. Leading to better customer service and lower operating costs.

“Let’s use the call-center as an example,” Tony explained, “a massive expense for insurers and a place of great inefficiency. We see call-centers where the insurance agent has several windows open at once and is having to manually flip between windows whilst the customer is on the line. Often the agent is cutting and pasting data into multiple windows because they’re not integrated.

“The issue is that the agent isn’t concentrating on the customer as much as they should be!”

Insurers can’t afford to put Digital Insurance Innovation on hold!

Tony talked me through an example of a US commercial lines insurer they worked with. The insurer had a combined ratio around 95 and all their attention and IT budget was going into a new policy admin replacement system. Insurance innovation was put on hold for several years as a result!

“The business was modeled on a projected volume of policy submissions a year,” Tony explained. “But they had no idea if this was the right volume of business, or if they could get more, or run on less, or even what their quality threshold should be.”

When Pega looked closer, they found the root cause to be at the front end. All data was being re-keyed by the field sales agents into multiple systems. Duplication of effort and inconsistency caused issues getting data to the underwriters. This in turn, led to a disconnect across the internal value chain.

The insurer was so focused on the policy admin replacement project that they’d not had the capacity to see a problem that would have a profound and more rewarding return when solved.

Turning IT from a constraint into an enabler

The Pega solution is about providing the insurer with the tools required to objectively run the business and prioritize their resources to improve their performance. If any insurers say they can do this today then they are in the minority (just saying!).

Pega is a multi-industry platform, not specific to insurance. It starts with Pega7 as the underlying platform that everything runs off. Insurance specific business applications sit on top of Pega7, which can be further refined for country, product, individual customer etc, in layers. This maximizes reuse and reduces maintenance effort and cost.

Pega call this the Situational Layer Cake and it offers a solution for insurers facing significant complexity, particularly when fronting a multitude of legacy applications from multiple heritages.

Another key feature is Pega’s Model Driven Environment, which enables the business unit (not IT) to define all aspects of an insurance process operating rules using pictures and diagrams. Where Pega is different to its competition is that the modeling directly drives the coding. Other vendors in this space use Visio type tools and then craft the modeled business process in Java. Pega don’t do that. Their solution does not involve IT programmers.

IT is not on the critical path!

Indeed the IT department becomes the provider and facilitator of a digital environment in which responsibility for business capabilities is put back in the hands of the business. Which is the same position achieved by the insurers taking the InsurTech partnering approach. In both cases, internal IT’s role is to ensure a secure and reliable IT infrastructure, not business process functionality.

Build for change – Start small, travel fast, arrive big

The necessity of taking any of the modern approaches to digital insurance innovation is that it must achieve agility. This is what makes InsurTech the wake-up call the insurance industry has needed in the last 20 years.

A major issue for insurers has always been the time and cost to deliver IT projects. With the increasing pressure from InsurTech, the ability to develop software faster and more accurately has never been higher.

Using the InsurTech partnering approach or working with software vendors like Pega, digital insurance innovation is now achievable. Insurer’s can change faster and compete in a digital world.

Agility is the watchword here and it’s not uncommon for Pega insurance customers to have weekly release cycles. The point is that with Pega, insurers don’t have to write code. Which means no maintenance and no repeat of the big issues that still dog legacy systems. And more of the IT budget is freed up for insurance innovation.

In Tony’s words, “Taking the Pega route provides insurers with a dynamic approach to making changes to business processes quickly and flexibly. This gives the insurer an agility to make real time changes, and for those changes to implemented immediately.“

Everything is joined up

When I looked deeper into Pega, the thing I liked about it was that it presents a unified, but flexible architecture. The way that Pega package up their software allows insurers to start with any part of the business.Whether that is sales or distribution, claims or underwriting, it matters not to Pega. The point is that the insurer can take a step-by-step approach to digitizing its legacy estate and business operations.

At a time when digital insurance innovation has become the new strategic imperative, insurers have clear choices about tactics and direction. Do they enter the world of the InsurTech startups through partnering with or acquiring them? But in doing so, what do they do with the current IT landscape? Or do they innovate from within, building upon the massive investment they’ve made in IT that is increasingly no longer fit for purpose?

Time will tell, but at least they have options and choices.

The author, Rick Huckstep, is the Chairman of The Digital Insurer, a keynote speaker on the world of InsurTech, and advisor and investor to technology start-ups.