Beyond Insurance – the new strategy for incumbents?

About 3 years ago, we started to hear about beyond insurance. Large international groups are developing strategies to build beyond insurance ecosystems, managed through digital platforms. International consultants give indications of the positive impact of these strategies.

What is the concept of beyond insurance, how did it arise, what are the benefits and what are the requirements for implementing an beyond insurance strategy. These are the questions to which I sought an answer. Here I give you a summary of the studies I consulted as well as the conversations and testimonies of different actors in the sector.

At the origin of this new concept are problems related to customer loyalty and business profitability, and an incomplete response from the industry to the customer’s need of protection.

Until the changes induced by beyond Insurance, insurance products seemed, in the eyes of the consumer, very similar. They had become a commodity whose only differentiating factor was price. As no other element was valued by customers, the companies competed mainly on this vector, resulting in an erosion of the margin and a high turnover of customers.

An infrequent contact with the customer, limited to “less pleasant” moments – of collection and eventual claims – constituted an additional obstacle to customer loyalty.

Finally, traditional companies, delaying the innovation and adoption of new technologies, lost their attractiveness, customers, and business in favor of (new) more technological players. In addition to these intra-sectoral problems that market players faced, and which originated the new trend beyond insurance, there is still an incomplete response from insurance companies to consumer’s need of protections. Insurance repairs the harmful effects of an event. Now, what the customer wants in addition to this repair is to be protected against the possible appearance of the harmful event per se. This includes, inter alia, prevention and early detection of the event to minimize its consequences. In other words: beyond insurance services contribute to satisfying the desire for security against a certain risk. Bringing together all the entities that offer products and services to satisfy the need for consumer protection benefits everyone. This takes us towards the creation of an ecosystem.

As Roger Peverelli and Reggy of Feniks – Founders of The DIA Community indicate: “The most effective way to tap into the real needs of customers is to be part of relevant platforms and ecosystems. Platforms where people go to, to solve the challenges they have in life, and the financial and risk challenges that go with them.”

Meeting the needs underlying the insurance policy requires more than insurance. “Insurance beyond industry boundaries” refers to “products beyond cover”. That is, it is about developing new services to respond to the real need, and not creating new insurance products.[i]

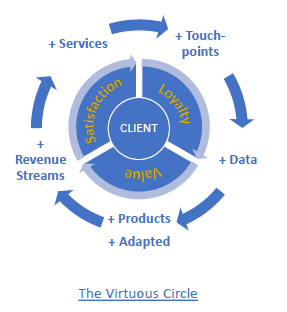

By adopting a strategy beyond Insurance, an actor differentiates his offer, reduces risk and multiplies customer touch points, making him more loyal and profitable. Prevention, early detection, and a finer measurement of risks reduce both the frequency and severity of claims, favorably impacting technical results. Offering more services to its customers, the insurer multiplies the opportunities of contact and the exchange of information. The data thus obtained can be used for the development of new offers, insurance or not.

An example of this is the start-up Mobly. This Belgian start-up has a mission: to facilitate mobility. It started in 2018 by proposing to the market a range of mobility services that include assistance on demand. It later offered guarantees for second-hand cars. Only in 2019 following the association with Bâloise, a mobility insurance was created that includes pay as you ride car insurance linked to the actual mileage, associated with a bodily damage insurance valid for any type of transport used by the household. To facilitate mobility, Mobly now offers other complementary services (Mobility as a Service Wallet, Car Subscription) that incorporate or not insurance. It also proposes the co-creation of other mobility solutions to interested entities.

Bain & Company identifies 4 privileged areas that insurance companies can orchestrate. These are interconnected services, with regard to home, car, health and life – see Figure 1 below[ii]. McKinsey mentions: travel, health and home.

Before going beyond insurance and reaping the benefits, studies indicate that some conditions must be met. A company needs to master the basics of customer relationships. Relationships must be fluid, effective, timely, empathetic, and trustworthy. The insurer should review its traditional role and its position vis-à-vis the customer. It should move from an actor focused on solving the problem of risk to an organization that proposes and orchestrates a broader offer of products and services. Based on the client’s basic need to be reassured in the face of the appearance of an unwanted and harmful event, the insurer will be able to set up offers of products and services that minimize the likelihood of that event happening (prevention) and alleviate the consequences of such an event (repairing).

Have the groups that adopted a strategy beyond Insurance to stand out in the market and breathe new life into their value proposition succeeded? McKinsey’s data tends to say so.

Autohome, an online car sales platform owned by Chinese insurance company Ping An (with more than 38 million daily unique visitors), generates one-third of the group’s non-life and financial services business leads. South African insurer Discovery has shown that users of its health and wellness platform have 28% fewer hospital stays and 10% fewer chronic illnesses, probably due to a combination of effects linked to selection and behavior change[iii].

Convinced of the results that this strategy can bring, more and more groups of global dimensions are betting on an activity beyond Insurance. Amongst others is the case of the AXA group which launched AXA Next in early 2019, whose sole objective is: “to build new services and business models, going beyond insurance coverage, to become a true partner for our customers[iv]”.

In Portugal, the concept is also gaining strength and being introduced by subsidiaries of multinational groups. This is the case of Ageas, which, in its multi-annual Connect21 plan, pledges to society to “actively contribute towards a better society beyond insurance: preparing for an ageing population, protecting against adverse events and building a healthier society[v]”.

Due to the possibility of differentiating from the competition and the potential economic gains, the beyond insurance strategy seduces. It has requirements and needs investment. It is not a panacea and is not suitable for any group. It is, rather, a strategy from which groups of a certain size can obtain a lot of benefits, if they reorganize themselves properly and in a timely manner.

[i] From https://www.digitalinsuranceagenda.com/thought-leadership/the-number-1-insurtech-trend-for-2019-ecosystems-beyond-insurance/

[ii] From https://www.bain.com/insights/customer-behavior-loyalty-in-insurance-global-2017/

[iii] From <https://www.mckinsey.com/industries/financial-services/our-insights/insurance-blog/ecosystems-in-insurance-the-next-frontier-for-enhancing-productivity>

[iv] From https://www.axa.com/en/magazine/bringing-innovation-to-the-next-level

[v] From https://connect21.ageas.com/en