The Promise of Blockchain

Ready to take advantage of blockchain?

Overwhelmed by constant disruption and facing what has been a prolonged low interest rate, low margin, and low underwriting return environment, insurance executives are worried. Everyone wants to know how to grow ahead of the market. Yet most are struggling to put together the ‘winning formula’ that will ensure profitable and sustainable long-term growth.

Added to that are the pressures of technological change. According to the KPMG CEO Outlook released in late 2016, almost three-quarters of insurance CEOs are concerned about their company keeping up with new technology, with Blockchain being close to the top of that list.

Getting comfortable with blockchain

Will blockchain be the ‘Big Transformer’? Blockchain has the potential to transform existing business models by eliminating the need for intermediaries. Even now, the impact of cat bonds on the reinsurance market is having unexpected consequences on direct insurers.

Many industry players have been investing to support their vision. For example, Lloyd’s London Market has included blockchain as part of their target operating model or TOM initiative[1], while AXA Strategic Ventures (along with other partners) invested around US$55 million into a blockchain startup in February 2016[2]. And in October 2016 Aegon, Allianz, Munich Re, Swiss Re and Zurich launched the Blockchain Insurance Industry Initiative B3i aiming to explore the potential of distributed ledger technologies to better serve clients through faster, more convenient and secure services[3].

We believe that blockchain will play a major and transformative role right across the insurance value chain. From customer onboarding and ‘Know Your Customer’ (KYC) requirements through to claims processing and adjudication, the potential use cases for blockchain in the insurance sector grow each day.

Claiming the benefits

In his article, Rick outlines some fantastic use cases for blockchain in the reinsurance market. Clearly, transparency and collaboration are key to efficient reinsurance transactions. But – when we take a hard look at the actual processes such as claims verification – they are often time consuming, highly manual and risky. Duplication and errors are not uncommon.

Using blockchain would allow insurers and reinsurers to create a distributed ledger of their transactions, using a real-time, efficient, automated and secure solution tailored to the reinsurance ecosystem. This will help all players not only reduce costs and improve efficiency, it also helps reduce overall exposure to losses.

Getting smart about risk

One of the more disruptive applications of blockchain is the development of ‘smart contract’ models. Smart contracts contain self-executing protocols that work with a blockchain to enforce the performance of a contract across all counter parties. Claims data is shared across all counter parties. Identities and contract provisions are immediately verified. Payments are automatically made. And, as a result, less adjudication and negotiation is required and costs are minimized.

An enabler, not a disruptor

We often remind insurance executives that these are still the early days of blockchain; things are just getting started. And more use cases are being developed each day.

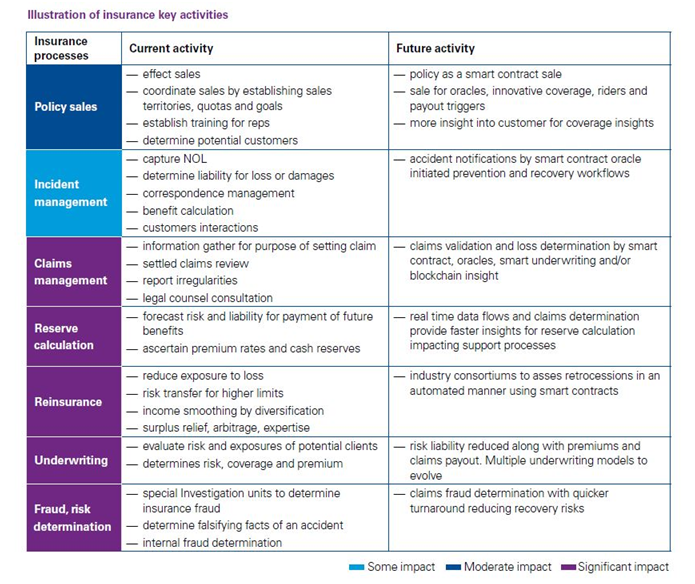

But we also point out that, rather than a disruptor, we see blockchain as a potential transformative response to many of the challenges now facing the industry. And it can deliver significant improvements in efficiency, trust and quality. We have spent time mapping the impact of blockchain across the insurance operational ecosystem and have identified key areas of change for activities throughout the enterprise, see table below.

Embrace the blockchain

We encourage insurance executives to embrace the blockchain, not fear it. There is clear evidence it will help enable greater efficiency, growth and competitive advantage – creating significant commercial and economic value for the industry. We are seeing some of the most proactive insurers looking to blockchain to help drive their wider transformation agenda within the context of the ‘data-driven fourth industrial revolution’. These first and second-movers see the value in participating in the broader financial services blockchain ecosystem. But they also see blockchain as an opportunity to improve efficiency, lower the costs of transaction processing, enhance the customer experience, improve data quality, increase trust between parties and support auditability, among other benefits. Understanding the value and impact of other enablers, such as big data, digital labor and analytics will also be key to maximizing the value of blockchain investments.

Maximize the ROI of your blockchain investment

We see five key stages in the life-cycle of blockchain investment, see the illustration below.

We recommend five key actions to get you started, which are focused on phase 1 (strategic prioritization) and phase 2 (prototype and use case development) of the investment life-cycle:

- Educate yourself, your executive team and your decision makers about the disruptive potential and threat posed by blockchain

- Develop a strategy and roadmap for implementing blockchain within the enterprise and with other third parties.

- Nurture, foster, incubate, partner,invest or acquire blockchain and digital ledger skills and capabilities.

- Get involved in industry blockchain and digital ledger partnerships, consortia,standard setting bodies and other collaborations as early as possible.

- Identify and qualify use cases that can provide short term benefits, to generate further organizational traction and investment along the industry maturity curve.

For more on blockchain applications for the insurance industry, please read our latest paper Blockchain accelerates insurance transformation.

[1]http://isupporttom.london/news/blockchain-technology-in-the-insurance-market/

[2]https://www.axa.com/en/newsroom/news/axa-strategic-ventures-blockchain

[3]http://www.coindesk.com/europe-insurance-blockchain-consortium/

Comments