Civic is a Blockchain-based identity management tool which aims to reduce identity theft and fraud online. Civic uses Blockchain technology to protect user identities through SSN tracking (Social Security Number).

At its core, the Civic service notifies users when their social security number is used by a Civic partner (Banks, Credit Bureau, Payment providers, background check companies etc) allowing people to be sure about the legitimacy of the transaction in real-time.

Civic has also collaborated with TransUnion and gives its customers real-time alerts by email or SMS when their credit report is being accessed.

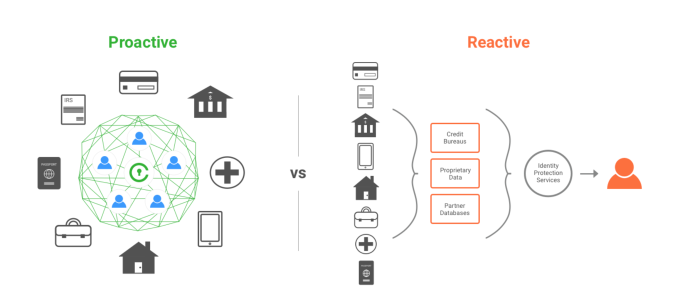

Civic uses Blockchain Technology to decentralise its network in order to make it hack proof

Civic also offers additional features to help protect users’ identity, such as credit report alerting, ID theft recovery insurance, and access to 24/7 fraud support. By offering these services, Civic ultimately aims to become the trusted third party source for securing and verifying users’ identity. To achieve these objectives, its already building partnerships with banks, credit card companies, online lenders, wireless and cable providers, employee verification services – in fact, any institution that uses your identity.

Civic plans to use Blockchain Technology to decentralise its network in order to make it hack proof – that’s the reason it’s collaborating with different players in the Blockchain space. It will then be using two-factor authentication between customers and financial institutions to prevent identity theft. In terms of its revenue model, Civic monetizes by partnering with companies to combat fraud and gets a share in the savings created.

Recently, the CEO of Civic ,Vinny Lingham, encapsulated one of the advantages of Blockchain for the insurance industry: “What Blockchain does really well is ensures you can’t have two copies of the same thing. With Civic, Blockchain technology means no one can use your Social Security number to set up a separate identity.”

Comments