Haven Life -making life insurance relevant to a digital generation

(Image courtesy of Pexels)

The insurance industry couldn’t make it any harder if it tried!

Buying life insurance in the U.S. is a painful process. It can take weeks, sometimes months. There’s form filling and almost always a medical exam involved. In fact, the process for buying life insurance in the U.S. hasn’t changed in decades.

And then there is regulation.

Everything in life insurance is subject to regulation. From the very outset, applying for life cover and then getting it is subject to intense reviews. And for good reason; the customer needs to be protected.

However, despite these good intentions, all they do is create barriers for customers. Especially younger generations who have a very different outlook on life (pun intended!)

And then, there is the insurance industry itself.

The incumbents, aka the carriers and the reinsurers are not known for their pace or ability to adopt new ways of working. They are hampered by legacy systems, legacy processes and legacy working practices. Some might say they are hampered by a legacy mindset, but I couldn’t possibly comment!

There is a better way!

Having just celebrated their first year in business, Haven Life is a new breed of life insurance agency. They represent all the characteristics of InsurTech – totally customer focused, mobile, digital, simple and transparent.

But they are different to most InsurTech start-ups. Haven Life is wholly owned by MassMutual, a U.S. insurer that started in 1851.

This is a great combination of the strength, balance sheet and experience of an incumbent, with the nimble, agile and entrepreneurial approach of a start-up.

This week, I Skyped with the CEO and co-founder of Haven Life, Yaron Ben-Zvi from their office in New York City. Yaron has a background in the media business and early stage financial services companies with all the traits of a successful entrepreneur.

I asked him, what made him get into the life insurance business?

““I was a customer and mistakenly thought it would be easy to buy insurance. We’re so used to everything being easy to buy, I just assumed life insurance would be the same. I was wrong!

“The entire process was confusing and frustrating. The marketing messages were all different with very little relevance to me. I wanted to buy a policy but couldn’t, despite many search queries turning up results for ‘life insurance online’. From a customer’s perspective, this was much harder than it needed to be. I wanted to fix it.”

In order to deliver the customer experience Yaron envisioned, it had to be technology based.

And it needed a whole new underwriting process that was real-time and digital. One that was not based on a mountain of irrelevant questions (irrelevant from the customer’s perspective.)

Online life insurance in 20 minutes

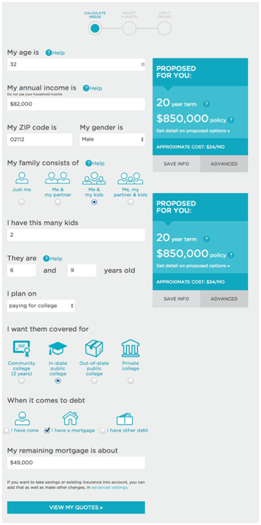

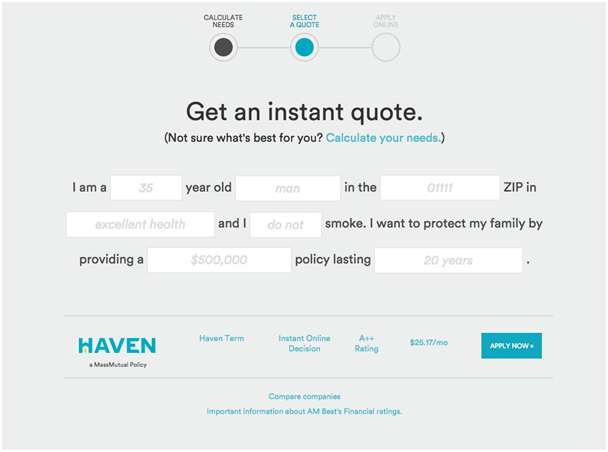

The result is Haven Term.

A fully underwritten, term life policy bought online with a decision in 20 minutes or less.

The key here is that Haven have made the process simple and easy for the customer. Putting the customer journey first means using the platform to take the heavy lifting out of the application process.

Yaron explained how they approached underwriting, “it had to be real-time so that we could render a decision immediately upon a customer submitting his or her application.

“Our product looks like a standard fixed term life insurance from the outside. But the underlying product was created and optimized for a personalized digital experience for the customer.

“We bring in data in real-time and run it through our own algorithms so that a real time decision can be offered at the point of query. This is where our relationship with MassMutual has been significant. We used their mortality data and expertise to build a completely new approach to underwriting.”

Engaging with digital customers

Engagement with a one-off product such as life insurance is a challenge for firms like Haven Life. In other lines of personal insurance, finding ways for continual engagement is a way to increase value to customers and reduce churn for insurers.

So, what about wearables and data aggregation players like Fitsense?

“Out of the gate, I wanted to address the customer engagement issue directly”, Yaron told me. “My intention was to launch with a health rewards program or some kind of unique value proposition that would set us apart.

“When we tried to get traction on some of the ideas early on, we were met with resistance and realized that the regulatory, legal, and operational risks were too great for us to be able to get this out in version one. We decided to put those customer engagement initiatives aside and instead to focus on creating a great digital process.”

Data privacy concerns was one of the issues that Yaron had to consider. Which is an industry issue I see all the time. There are mixed views on this that are certainly separated by generation and geography around the world. And it has some way to go before it fully plays out.

The other issue is one of influencing customer behavior.

It is one thing for an insurer to reward increased levels of activity or monitor behavior as a condition of a policy. But is it going too far when an insurer tracks the food bought in a supermarket and makes a judgment based on the brand of cereal the consumer buys at the checkout?

(These are both big subjects for another day.)

What next for Haven Life?

Haven Life is available in 42 states in the U.S. but is still missing some of the important, most populated states like New York and California.

And I know that Yaron wants to do even more to improve the customer experience. The application process is longer than he wanted and, in his words,“we still have a lot of work to do in order to completely transform the process and the way customers engage with life insurance”.

https://vimeo.com/114665952

Related articles

The Digital Insurer In View on Haven Life with Hugh Terry

Rick Huckstep article on InsurTech start-up Insquik (who provide non-medical life cover online in 10 minutes)

Rick Huckstep article “It’s all about the data! How wearables enables life and health insurers to better understand and engage with customers” (featuring wearables data aggregator Fitsense)

Replay of “Digital and Direct Life Insurance in Asia” webinar

The author, Rick Huckstep, is an InsurTech thought leader and editor of InsurTech Weekly for The Digital Insurer.

Comments